Page 42 - 86395_CCB - 2024 Annual Report (web)

P. 42

42

CORPORATE GOVERNANCE

STATEMENT

How the business is managed Director (ED) Board members – the Chief

Executive Officer, the Chief Financial Officer,

Design and operation of a robust corporate and Chief Risk Officer.

governance framework is critical to meeting The Board has its own terms of reference

the needs of all the Bank’s stakeholders. and has specific committees appointed

The Bank has a well‑established corporate by it for the purposes of Nominations &

governance structure, and the Board Governance, Audit, Risk & Compliance,

supports the principles of good corporate Performance & Remuneration, and Executive

governance as set out in the UK Corporate Management. Each committee has its own

Governance Code. Whilst the Bank is terms of reference.

exempt from several of the provisions due To ensure independence, and reduce

to it not being a listed entity, and its overall the potential for conflict of interest, the

size in terms of employee numbers, it has sub‑committees (excluding the Executive

reviewed the requirements and ensures that Committee) are each comprised entirely of

its governance processes continue to have Non‑Executive Directors (NEDs), although

regard to best practice. The Board believes individual Executive Directors and others

that its existing governance processes attend either as a matter of course or when

are appropriate for the current size and requested to provide advice and guidance.

structure of the Bank.

A NED chairs each of the Board Committees

except the Executive Committee which is

Structure of the Board and chaired by the CEO.

Board Committees

The Bank experienced changes to its

The Board has overall responsibility for the Chief Financial Officer during the year, with

operations of the Bank and is comprised Andrea Hodgson resigning on 30 September

of four independent Non‑Executive 2024 after 7 years as the Bank’s Chief Financial

Directors and two Non‑Executive Directors Officer and Richard Hanrahan was appointed as

representing the interests of the owners. her successor on 26 September 2024.

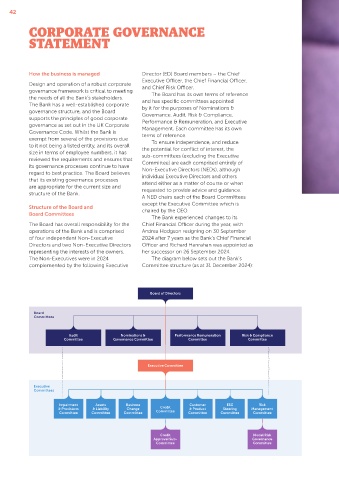

The Non‑Executives were in 2024 The diagram below sets out the Bank’s

complemented by the following Executive Committee structure (as at 31 December 2024):

Board of Directors

Board

Committees

Audit Nominations & Performance Remuneration Risk & Compliance

Committee Governance Committee Committee Committee

Executive Committee

Executive

Committees

Impairment Assets Business Customer ESG Risk

& Provisions & Liability Change Credit & Product Steering Management

Committee Committee Committee Committee Committee Committee Committee

Credit Model Risk

Approval Sub- Governance

Committee Committee