Page 74 - 86395_CCB - 2024 Annual Report (web)

P. 74

74

The impact of climate risk on our audit

As part of our audit we made enquiries of management to understand the process management

adopted to assess the extent of the potential impact of climate risk on the Company's financial

statements and support the disclosures made in relation to climate change in the Annual report and

financial statements. In addition to enquiries with management, we also:

● Read the materials considered by the ESG Steering Committee during the year to consider the

impact on our audit risk assessment;

● Considered the exposure of the Company's secured property portfolio to physical and transition

risks by examining the output of assessments performed by management during the year; and

● Considered the consistency of the disclosures in relation to climate change within the Annual

Report with the financial statements and our knowledge obtained from our audit.

Our procedures did not identify any material impact in the context of our audit of the financial

statements as a whole, or our key audit matters for the year ended 31 December 2024.

Materiality

The scope of our audit was influenced by our application of materiality. We set certain quantitative

thresholds for materiality. These, together with qualitative considerations, helped us to determine the

scope of our audit and the nature, timing and extent of our audit procedures on the individual financial

statement line items and disclosures and in evaluating the effect of misstatements, both individually and

in aggregate on the financial statements as a whole.

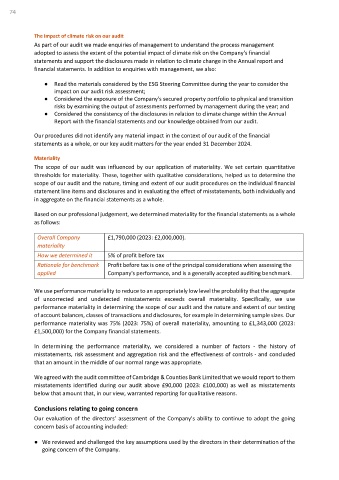

Based on our professional judgement, we determined materiality for the financial statements as a whole

as follows:

Overall Company £1,790,000 (2023: £2,000,000).

materiality

How we determined it 5% of profit before tax

Rationale for benchmark Profit before tax is one of the principal considerations when assessing the

applied Company's performance, and is a generally accepted auditing benchmark.

We use performance materiality to reduce to an appropriately low level the probability that the aggregate

of uncorrected and undetected misstatements exceeds overall materiality. Specifically, we use

performance materiality in determining the scope of our audit and the nature and extent of our testing

of account balances, classes of transactions and disclosures, for example in determining sample sizes. Our

performance materiality was 75% (2023: 75%) of overall materiality, amounting to £1,343,000 (2023:

£1,500,000) for the Company financial statements.

In determining the performance materiality, we considered a number of factors - the history of

misstatements, risk assessment and aggregation risk and the effectiveness of controls - and concluded

that an amount in the middle of our normal range was appropriate.

We agreed with the audit committee of Cambridge & Counties Bank Limited that we would report to them

misstatements identified during our audit above £90,000 (2023: £100,000) as well as misstatements

below that amount that, in our view, warranted reporting for qualitative reasons.

Conclusions relating to going concern

Our evaluation of the directors’ assessment of the Company’s ability to continue to adopt the going

concern basis of accounting included:

● We reviewed and challenged the key assumptions used by the directors in their determination of the

going concern of the Company.