Page 78 - CCB_Full-Annual-Report-2021

P. 78

79

2. Key audit matters: our assessment of risks of material misstatement Contents

Key audit matters are those matters that, in our professional judgement, were of most significance in the audit of the financial

statements and include the most significant assessed risks of material misstatement (whether or not due to fraud) identified by

Contents

Independent us, including those which had the greatest effect on: the overall audit strategy; the allocation of resources in the audit; and

directing the efforts of the engagement team. We summarise below the key audit matters, in decreasing order of audit

significance, in arriving at our audit opinion above, together with our key audit procedures to address those matters and, as

required for public interest entities, our results from those procedures. These matters were addressed, and our results are

based on procedures undertaken, in the context of, and solely for the purpose of, our audit of the financial statements as a

auditor’s report whole, and in forming our opinion thereon, and consequently are incidental to that opinion, and we do not provide a separate Strategic Report

opinion on these matters.

Our response

The risk

Going Concern Disclosure quality: We considered whether these risks could

plausibly affect the capital, liquidity and

Refer to page 58 The financial statements explain how solvency in the going concern period by

(Directors Report), and the Board has formed a judgement that assessing the Directors’ sensitivities over the

page 90-91 it is appropriate to adopt the going level of available financial resources indicated

(accounting policy) concern basis of preparation for the by the Company’s financial forecasts taking

Company. account of severe, but plausible, adverse

The judgement is based on an effects that could arise from these risks

to the members of Cambridge & Counties Bank Limited evaluation of the inherent risks to the individually and collectively. Corporate Governance Statement

Company’s business model and how

those risks might affect the Company’s Our procedures also included:

financial resources or ability to continue — Sensitivity analysis: We assessed the

operations over a period of at least a stressed scenarios used by the Company in

year from the date of approval of the its forecasting of profitability, liquidity, and

financial statements in a range of capital and the viability of possible

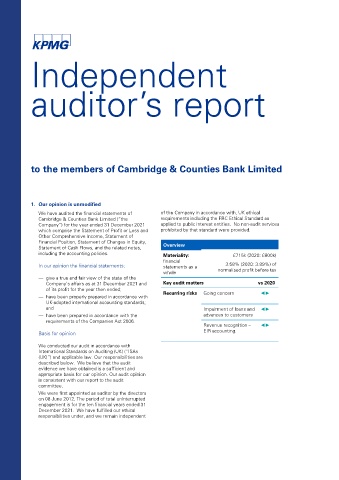

1. Our opinion is unmodified plausible stress scenarios. management actions.

We have audited the financial statements of of the Company in accordance with, UK ethical The risk most likely to affect the — Challenge of assumptions: We assessed

Cambridge & Counties Bank Limited (“the requirements including the FRC Ethical Standard as Company’s available financial resources the Company’s forecast profitability and

Company”) for the year ended 31 December 2021 applied to public interest entities. No non-audit services over this period was the heightened capital models to identify key assumptions.

which comprise the Statement of Profit or Loss and prohibited by that standard were provided. macroeconomic uncertainty. This could We challenged the reasonableness of

Other Comprehensive Income, Statement of result in reduced principal and interest assumptions underpinning the Company’s

Financial Position, Statement of Changes in Equity, collections from the Company’s loan forecasts.

Statement of Cash Flows, and the related notes, Overview assets.

including the accounting policies. Materiality: £715k (2020: £800k) The risk for our audit is whether or not a — Enquiry of Regulators: We engaged with

the Prudential Regulation Authority to

financial material uncertainty exists that may cast understand their assessment of the Independent Auditor’s Report

In our opinion the financial statements: statements as a 3.58% (2020: 3.89%) of significant doubt about the ability to Company’s capital and liquidity position.

whole normalised profit before tax continue as a going concern. Had this

— give a true and fair view of the state of the been such, then that fact would have — Assessing transparency: We critically

Company’s affairs as at 31 December 2021 and Key audit matters vs 2020 been required to have been disclosed. assessed the completeness and accuracy of

of its profit for the year then ended; ◄► the matters covered in the going concern

— have been properly prepared in accordance with Recurring risks Going concern disclosure within the financial statements

UK-adopted international accounting standards; using our knowledge of the relevant facts

and Impairment of loans and ◄► and circumstances developed during our

— have been prepared in accordance with the advances to customers audit work, considering economic outlook,

key areas of uncertainty and mitigating

requirements of the Companies Act 2006.

Revenue recognition – ◄► actions available to the Company to respond

Basis for opinion EIR accounting. to these risks.

Our results Financial Statements

We conducted our audit in accordance with We found the going concern disclosure without

International Standards on Auditing (UK) (“ISAs any material uncertainty to be acceptable (2020:

(UK)”) and applicable law. Our responsibilities are acceptable).

described below. We believe that the audit

evidence we have obtained is a sufficient and

appropriate basis for our opinion. Our audit opinion

is consistent with our report to the audit

committee.

We were first appointed as auditor by the directors

on 08 June 2012. The period of total uninterrupted

engagement is for the ten financial years ended 31

December 2021. We have fulfilled our ethical

responsibilities under, and we remain independent Notes to the Financial Statements

60 61