Page 88 - CCB_Full-Annual-Report-2021

P. 88

88 Financial Statements 89

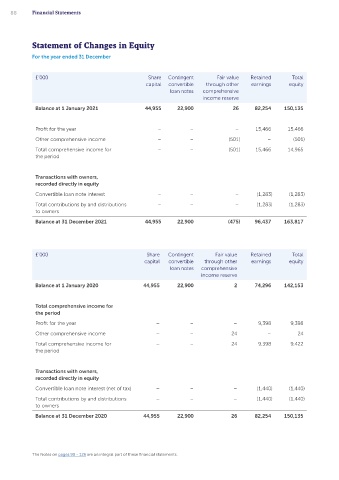

Statement of Changes in Equity Statement of Cash Flow Contents

Contents

For the year ended 31 December For the year ended 31 December

£’000 Share Contingent Fair value Retained Total £’000 Note 2021 2020

capital convertible through other earnings equity Cash flows from operating activities

loan notes comprehensive Strategic Report

income reserve Profit after tax 15,466 9,398

Balance at 1 January 2021 44,955 22,900 26 82,254 150,135 Adjustments for:

Depreciation, amortisation and loss on disposals 18,19 971 932

Profit for the year – – – 15,466 15,466 Non cash item on adoption of IFRS16 29 – (193)

Other comprehensive income – – (501) – (501) Taxation charge 12 3,024 1,763

Total comprehensive income for – – (501) 15,466 14,965 19,461 11,900

the period

Net increase in other assets/liabilities

Net (increase)/decrease in loans and advances to customers 15 (149,454) (66,877) Corporate Governance Statement

Transactions with owners,

recorded directly in equity Net increase/(decrease) in customers’ accounts 22 108,305 62,766

Net increase/(decrease) in central bank facilities 23 78,000 –

Convertible loan note interest – – – (1,283) (1,283)

Net (increase)/decrease in value of debt securities 17 591 518

Total contributions by and distributions – – – (1,283) (1,283)

to owners Net decrease in derivatives 21 262 (40)

Balance at 31 December 2021 44,955 22,900 (475) 96,437 163,817 Net increase in other liabilities and provisions 24 371 1,071

Net (increase) in other assets & prepayments 20 (661) (207)

Income tax paid (3,050) (3,881)

£’000 Share Contingent Fair value Retained Total 34,364 (6,650)

capital convertible through other earnings equity Net cash from operating activities 53,825 5,250 Independent Auditor’s Report

loan notes comprehensive

income reserve

Balance at 1 January 2020 44,955 22,900 2 74,296 142,153 Cash flows from investing activities

Proceeds from sales of debt securities 17 7,000 –

Total comprehensive income for Acquisition of debt securities 17 (7,094) (38,533)

the period Acquisition of property, plant & equipment and intangible assets 18,19 (646) (1,295)

Profit for the year – – – 9,398 9,398 Net cash from investing activities (740) (39,828)

Other comprehensive income – – 24 – 24 Financial Statements

Total comprehensive income for – – 24 9,398 9,422 Cash flows from financing activities

the period

Convertible loan note interest paid 25 (1,283) (1,440)

Net cash from financing activities (1,283) (1,440)

Transactions with owners,

recorded directly in equity

Convertible loan note interest (net of tax) – – – (1,440) (1,440) Net increase in cash and cash equivalents 13 51,802 (36,018)

Total contributions by and distributions – – – (1,440) (1,440) Cash and cash equivalents at 1 January 13 200,649 236,667

to owners Cash and cash equivalents at 31 December 252,451 200,649

Balance at 31 December 2020 44,955 22,900 26 82,254 150,135 Notes to the Financial Statements

Cash and cash equivalents comprise of:

• Cash and balances at central banks (including any accrued interest)

• Loans and advances to banks (including any accrued interest) all of which have a maturity of less than 3 months

The Notes on pages 90 - 126 are an integral part of these financial statements. The Notes on pages 90 - 126 are an integral part of these financial statements.