Page 11 - 86395_CCB - 2024 Annual Report (web)

P. 11

11

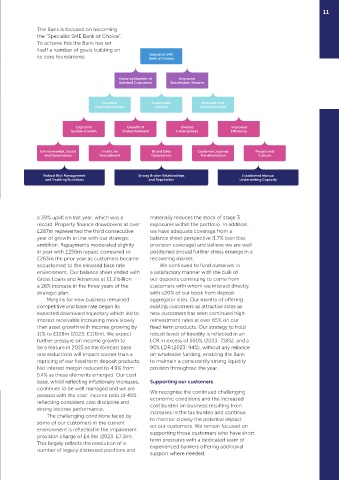

The Bank is focused on becoming

the “Specialist SME Bank of Choice”.

To achieve this the Bank has set

itself a number of goals building on

Specialist SME

its core foundations: Bank of Choice

Growing Number of Improved

Satisfied Customers Shareholder Returns

Excellent Sustainable Reduced Cost

Customer Service Growth to Income Ratio

Capital to Growth of Diverse Improved

Sustain Growth Broker Network Funding Base Efficiency

Environmental, Social Front Line BI and Data Customer Journey People and

and Governance Recruitment Governance Transformation Culture

Robust Risk Management Strong Broker Relationships Established Manual

and Enabling Functions and Reputation Underwriting Capacity

a 39% uplift on last year, which was a materially reduces the stock of stage 3

record. Property finance drawdowns at over exposures within the portfolio. In addition,

£287m represented the third consecutive we have adequate coverage from a

year of growth in line with our strategic balance sheet perspective (1.7% loan loss

ambition. Repayments moderated slightly provision coverage) and believe we are well

in year with £256m repaid, compared to positioned should further stress emerge in a

£283m the prior year as customers became recovering market.

accustomed to the elevated base rate We continued to fund ourselves in

environment. Our balance sheet ended with a satisfactory manner with the bulk of

Gross Loans and Advances at £1.2 billion our deposits continuing to come from

a 26% increase in the three years of the customers with whom we interact directly,

strategic plan. with c20% of our book from deposit

Margins for new business remained aggregator sites. Our mantra of offering

competitive and base rate began its existing customers as attractive rates as

expected downward trajectory which led to new customers has seen continued high

interest receivable increasing more slowly reinvestment rates at over 65% on our

than asset growth with income growing by fixed term products. Our strategy to hold

11% to £128m (2023: £116m). We expect robust levels of liquidity is reflected in an

further pressure on income growth to LCR in excess of 500% (2023: 718%), and a

be a feature in 2025 as the forecast base 95% LDR (2023: 94%), without any reliance

rate reductions will impact sooner than a on wholesale funding, enabling the Bank

repricing of our fixed term deposit products. to maintain a consistently strong liquidity

Net interest margin reduced to 4.9% from position throughout the year.

5.4% as these elements emerged. Our cost

base, whilst reflecting inflationary increases, Supporting our customers

continues to be well managed and we are We recognise the continued challenging

pleased with the cost: income ratio of 45% economic conditions and the increased

reflecting consistent cost discipline and cost burden on business resulting from

strong income performance. increases in the tax burden and continue

The challenging conditions faced by

some of our customers in the current to monitor closely the potential impact

on our customers. We remain focused on

environment is reflected in the impairment supporting those customers who have short

provision charge of £4.9m (2023: £7.3m). term pressures with a dedicated team of

This largely reflects the resolution of a experienced bankers offering additional

number of legacy distressed positions and

support where needed.