Page 47 - CCB_Annual Report_2022

P. 47

46 Corporate Governance Statement 47

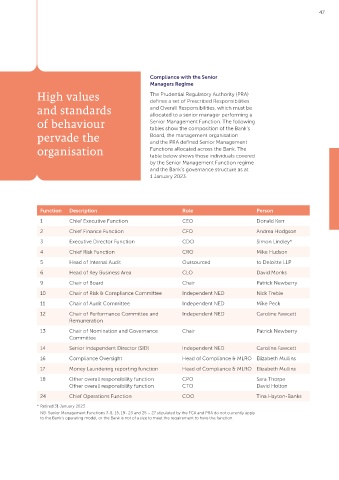

The Board is responsible for monitoring Compliance with the UK Corporate Compliance with the Senior

conflicts of interests, both in the Bank’s Governance Code Managers Regime

executives, and on the Board itself. If a The Bank seeks to comply with the UK The Prudential Regulatory Authority (PRA)

person in a position of leadership has Corporate Governance Code (Code) to the High values defines a set of Prescribed Responsibilities

compromised motives, the Board must step extent that it is applicable or considered and Overall Responsibilities, which must be

in and resolve the conflict. and standards

appropriate for its business. The following allocated to a senior manager performing a

areas are those where the Bank has Senior Management Function. The following

Chair and Chief Executive Officer of behaviour

considered the Code not applicable tables show the composition of the Bank’s

The offices of Chair and Chief Executive or appropriate: pervade the Board, the management organisation

Officer are distinct and held by different • As a non-listed, privately owned entity and the PRA defined Senior Management

people. The main role of the Chair is to lead the Bank has no requirement to re-elect organisation Functions allocated across the Bank. The

the Board and to ensure that it operates directors or hold formal general meetings. table below shows those individuals covered

effectively. The Chief Executive’s role is Consequently, the sections of the Code by the Senior Management Function regime

to put into effect the strategies agreed regarding re-election of directors and and the Bank’s governance structure as at

by the Board and the general operational general meetings have been considered 1 January 2023.

management of the Bank.

not applicable;

Responsibilities and requirements of • Whilst over half of the Board members are

Executive Directors NEDs (six out of 10), only four of them are

independent. The Board has considered Function Description Role Person

The Executive Directors are responsible this appropriate on the basis that the Bank

for the day-to-day operation of the Bank, is privately owned, and the remaining two 1 Chief Executive Function CEO Donald Kerr

supported by the senior management NEDs represent the Bank’s shareholders, 2 Chief Finance Function CFO Andrea Hodgson

team. This is in part effected via policies and are independent from the Executive.

and procedures developed with the 3 Executive Director Function CDO Simon Lindley*

approval of the Board (directly or indirectly • The remuneration of the NEDs is set by 4 Chief Risk Function CRO Mike Hudson

through committees and sub-committees), the Chair and the Shareholders, and not by

partly through the Executive Committee, the Board of the Bank. This is considered 5 Head of Internal Audit Outsourced to Deloitte LLP

and partly by the discharge of duties as appropriate on the basis that the Bank is 6 Head of Key Business Area CLO David Monks

specified within individual job descriptions. privately owned. No remuneration for the

NEDs includes share options or variable 9 Chair of Board Chair Patrick Newberry

Responsibilities and requirements of elements; and

Non‑Executive Directors 10 Chair of Risk & Compliance Committee Independent NED Nick Treble

• The Code introduced principles for

The essential role of the Non-Executive ensuring that the Board understood the 11 Chair of Audit Committee Independent NED Mike Peck

Directors (NEDs) is to provide independent views of its stakeholders, including its 12 Chair of Performance Committee and Independent NED Caroline Fawcett

assurance to the Bank’s shareholders workforce, suggesting one or a combination Remuneration

that the business is being conducted in of a director appointed from the workforce, 13 Chair of Nomination and Governance Chair Patrick Newberry

such a manner as to protect the interests a formal workforce advisory panel, or a

of the Bank’s depositors, and to comply designated NED. Whilst the Bank recognises Committee

with the Principles for Business of the the need for workforce engagement, 14 Senior Independent Director (SID) Independent NED Caroline Fawcett

Regulator. This responsibility is discharged the suggestions were considered

via oversight of, and appropriate challenge disproportionate for an organisation the 16 Compliance Oversight Head of Compliance & MLRO Elizabeth Mullins

to, the Bank’s senior management via the size of the Bank. In lieu of the suggestions, 17 Money Laundering reporting function Head of Compliance & MLRO Elizabeth Mullins

structure of the Bank’s sub-committees. the Bank elected to establish a Staff Forum

Part of the process for selection and that represents the workforce and meets 18 Other overall responsibility function CPO Sara Thorpe

training of the NEDs is to ensure they are with the Chief Executive Officer and Chief Other overall responsibility function CTO David Holton

familiar with the regulatory principles People Officer each month to discuss 24 Chief Operations Function COO Tina Hayton-Banks

and practices, and to maintain their matters impacting the workforce. The Staff

knowledge of them. Forum is also consulted with in advance * Retired 31 January 2023

of any material organisational change. NB: Senior Management Functions 7-8, 15, 19- 23 and 25 – 27 stipulated by the FCA and PRA do not currently apply

to the Bank’s operating model, or the Bank is not of a size to meet the requirement to have the function.

Further, the Bank undertakes an annual staff

engagement survey to understand the views

of its workforce. This is considered to be

a proportionate approach for the Bank in

adopting the principles of the Code.