Page 103 - CCB_Full-Annual-Report-2021

P. 103

102 Notes to the Financial Statements 103

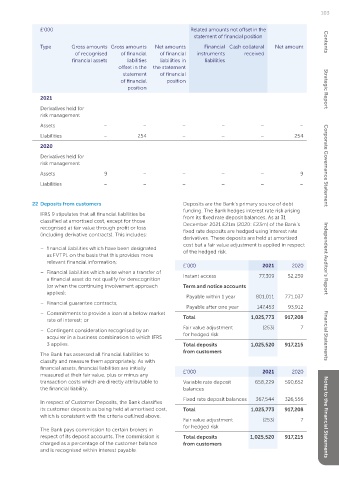

On the discontinuance of a hedge, any adjustment made to the carrying amount of the hedged item as a £’000 Related amounts not offset in the

consequence of the fair value hedge relationship, is recognised in the income statement over the remaining life of statement of financial position

the hedged item. Contents

Type Gross amounts Gross amounts Net amounts Financial Cash collateral Net amount

of recognised of financial of financial instruments received

Contents

The Bank uses interest rate swaps to minimise interest rate risk exposure in specific periods by hedging the interest financial assets liabilities liabilities in liabilities

rate risk associated with fixed rate deposit balances. The terms of the hedged items and hedging instrument are offset in the the statement

aligned to minimise hedge ineffectiveness arising. Hedge ineffectiveness, the difference between the hedging gains statement of financial

or losses of the hedging instrument and the hedged item recognised in the income statement was £2k (2020: £1k).

of financial position

position

Fair value hedges of interest rate risk 2021 2020 Strategic Report

£’000 2021

Instrument type: Assets Liabilities Assets Liabilities

Derivatives held for

Interest rate – 254 9 – risk management

Total – 254 9 – Assets – – – – – –

Liabilities – 254 – – – 254

The fair value of the Bank’s derivatives in place at the year-end was a liability of £254k, compared to an asset of 2020

£9k in 2020.

Derivatives held for

Credit risk derivative risk management risk management Corporate Governance Statement

Assets 9 – – – – 9

The Bank mitigates the credit risk of derivatives by entering into transactions under International Swaps

and Derivatives (ISDA) master netting agreements. The Bank has executed a Credit Support Annex (CSA) in Liabilities – – – – – –

conjunction with the ISDA agreement, which requires the Bank and its counterparty (NatWest Markets PLC) to

post collateral to mitigate counterparty credit risk in the event of specific triggers being met.

22 Deposits from customers Deposits are the Bank’s primary source of debt

Type of credit exposure % of exposure that is subject to Principal type Collateral IFRS 9 stipulates that all financial liabilities be funding. The Bank hedges interest rate risk arising

collateral requirements of collateral received/given from its fixed rate deposit balances. As at 31

classified at amortised cost, except for those

2021 2020 recognised at fair value through profit or loss December 2021 £21m (2020: £23m) of the Bank’s

fixed rate deposits are hedged using interest rate

(including derivative contracts). This includes:

Derivatives held for risk management 100% 100% Cash £280k derivatives. These deposits are held at amortised

cost but a fair value adjustment is applied in respect

– financial liabilities which have been designated

The following table sets out the Bank’s financial assets and financial liabilities that are subject to an enforceable as FVTPL on the basis that this provides more of the hedged risk.

master netting arrangement, irrespective of whether they are offset in the statement of financial position. relevant financial information; Independent Auditor’s Report

The values reflect the instruments fair value. The Bank’s ISDA does not meet the criteria for offsetting in the £’000 2021 2020

statement of financial position. This is because it creates a right of set-off of recognised amounts that is only – Financial liabilities which arise when a transfer of Instant access 77,309 52,259

enforceable following a predetermined event. a financial asset do not qualify for derecognition

(or when the continuing involvement approach Term and notice accounts

Cash is pledged and received as collateral against derivative contracts which are used by the Bank to manage its applies); Payable within 1 year 801,011 771,037

exposure to market risk. Collateral is pledged to derivative contract counterparties where there is a net amount

outstanding to the counterparty, and collateral is received from derivative contract counterparties where there – Financial guarantee contracts; Payable after one year 147,453 93,912

is a net amount due to the Bank. All derivatives are marked to market on a daily basis, with collateral pledged – Commitments to provide a loan at a below market

or received if the aggregate mark to market valuation exceeds the CSA variation margin threshold. The Bank’s rate of interest; or Total 1,025,773 917,208

derivative contracts have an outstanding contractual period of up to 5 years (2020:2 years). Fair value adjustment (253) 7

– Contingent consideration recognised by an

for hedged risk

acquirer in a business combination to which IFRS Financial Statements

At 31 December 2021 the Bank had pledged £280k (2020: nil) of collateral, which is included in the total loans

and advances to banks category on the balance sheet. 3 applies. Total deposits 1,025,520 917,215

The Bank has assessed all financial liabilities to from customers

classify and measure them appropriately. As with

financial assets, financial liabilities are initially £’000 2021 2020

measured at their fair value, plus or minus any

transaction costs which are directly attributable to Variable rate deposit 658,229 590,652

the financial liability. balances

Fixed rate deposit balances 367,544 326,556

In respect of Customer Deposits, the Bank classifies

its customer deposits as being held at amortised cost, Total 1,025,773 917,208

which is consistent with the criteria outlined above. Notes to the Financial Statements

Fair value adjustment (253) 7

for hedged risk

The Bank pays commission to certain brokers in

respect of its deposit accounts. The commission is Total deposits 1,025,520 917,215

charged as a percentage of the customer balance from customers

and is recognised within interest payable.