Page 108 - CCB_Full-Annual-Report-2021

P. 108

108 Notes to the Financial Statements 109

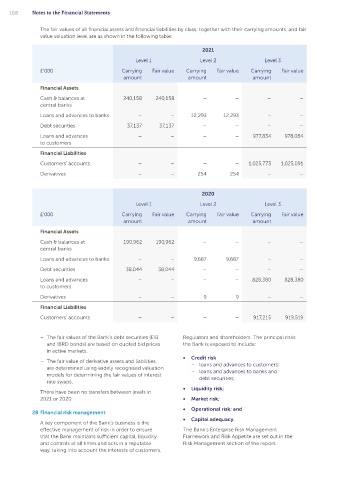

The fair values of all financial assets and financial liabilities by class, together with their carrying amounts, and fair • Credit risk and finance leases, and £1.3m (2020: £1.1m) is in

value valuation level are as shown in the following table: – loans and advances to customers the form of cash deposits. Contents

2021 Credit risk is the risk of financial loss to the Bank if a Credit risk management

Contents

customer with a financial instrument fails to meet its

Level 1 Level 2 Level 3 The Bank specialises in providing lending to Small

contractual obligations.

£’000 Carrying Fair value Carrying Fair value Carrying Fair value and Medium Enterprises (SMEs). Its lending is

secured on property. The Bank lends to owner

amount amount amount The credit risks associated with lending are managed occupied businesses to invest in their own

using detailed lending policies which outline the

Financial Assets commercial premises, as well as to experienced Strategic Report

Bank’s approach to lending, underwriting criteria,

Cash & balances at 240,158 240,158 – – – – credit mandates, concentration limits and product commercial and residential property investors. The

Bank also has a growing asset finance business

central banks terms. The Bank seeks to mitigate credit risk by providing finance to SMEs for business-critical

focusing on business sectors where it has specific

Loans and advances to banks – – 12,293 12,293 – – assets and Classic and Sports Vehicles through

expertise, and through limiting concentrated

hire purchase and finance lease facilities. At 31

Debt securities 37,137 37,137 – – – – exposures on larger loans, certain sectors and other December 2021, the Bank’s asset finance loan

factors that can represent higher risk. The Bank also

Loans and advances – – – – 977,834 978,084 seeks to obtain security cover and where appropriate, portfolio totalled £92m (2020: £69m).

to customers

personal guarantees from borrowers. Credit risk is

Credit risk is managed in accordance with

Financial Liabilities principally assessed through the manual underwriting lending policies, the Board’s risk appetite, and risk

of all transactions.

Customers’ accounts – – – – 1,025,773 1,025,091 management framework. Lending policies and Corporate Governance Statement

performance against risk appetite are reviewed

Derivatives – – 254 254 – – The Board Risk & Compliance Committee has regularly. All applications are reviewed and assessed

oversight responsibility for credit risk.

by a team of experienced underwriters.

2020 Credit exposure

All properties are individually valued at origination,

Level 1 Level 2 Level 3 The Bank’s maximum exposure to credit risk after and regular reports are produced to ensure the

provisions for impairment is as follows: property continues to represent suitable security

£’000 Carrying Fair value Carrying Fair value Carrying Fair value throughout the life of the loan. Affordability

amount amount amount

£’000 2021 2020 assessments are also performed on all loans, and

Financial Assets other forms of security are often obtained, such as

Cash and balances 240,158 190,962

personal guarantees.

Cash & balances at 190,962 190,962 – – – – at central banks

central banks Loans and advances 12,293 9,687 Real Estate Loans are secured on properties

Loans and advances to banks – – 9,687 9,687 – – to banks solely located in the UK, concentration risks are Independent Auditor’s Report

monitored, and credit exposures are diversified by

Debt securities 38,044 38,044 – – – – Debt securities 37,137 38,044

sector and geography.

Loans and advances – – – – 828,380 828,380 Loans and advances 992,601 840,831

to customers to customers* The Bank retains the ownership of all assets

financed by hire purchase and finance leases.

Derivatives – – 9 9 – – 1,282,189 1,079,524

Financial Liabilities Commitments 111,513 68,808 Concentration of credit risk

to lend**

Customers’ accounts – – – – 917,215 919,519 The Bank monitors concentration of credit risk by

product type, borrower type, geographic location

Gross credit 1,393,702 1,148,332

risk exposure and loan size.

– The fair values of the Bank’s debt securities (EIB Regulators and shareholders. The principal risks Financial Statements

and IBRD bonds) are based on quoted bid prices the Bank is exposed to include: Less allowance for (14,766) (12,451) Lending by product 2021 2020

in active markets. impairment losses

• Credit risk Net credit 1,378,936 1,135,881 and type %

– The fair value of derivative assets and liabilities – loans and advances to customers; Commercial Real

are determined using widely recognised valuation – loans and advances to banks and risk exposure Estate Lending

models for determining the fair values of interest debt securities; * Net of Effective Interest Rate liability of £4.1m (2020: £3.1m).

rate swaps. ** Commitments to lend represent agreements entered into but not Residential 33% 35%

• Liquidity risk; advanced as at 31 December.

There have been no transfers between levels in Commercial 55% 53%

2021 or 2020. • Market risk; The above table represents the maximum credit Other 3% 4%

risk exposure to the Bank at 31 December 2021,

• Operational risk; and

28 Financial risk management and 2020, without taking account of any underlying Asset Finance 5% 5%

• Capital adequacy. security. At 31 December 2021 the value of securities Notes to the Financial Statements

A key component of the Bank’s business is the held as collateral against drawn loans and advances Classic Vehicles and Sports 4% 3%

effective management of risk in order to ensure The Bank’s Enterprise Risk Management to customers is £1,792m (2020: £1,490m) of which Total 100% 100%

that the Bank maintains sufficient capital, liquidity Framework and Risk Appetite are set out in the £1,699m (2020: £1,420m) is in the form of property,

and controls at all times and acts in a reputable Risk Management section of the report. £92m (2020: £69m) in the form of assets owned by the

way, taking into account the interests of customers,

Bank and financed by customers using hire purchase