Page 100 - CCB_Full-Annual-Report-2021

P. 100

100 Notes to the Financial Statements 101

17 Debt securities 19 Intangible assets 21 Derivatives held for risk management

Under IFRS 9 the Bank’s debt securities are measured In December 2021 the Bank purchased a security Intangible assets that are acquired by the Bank Derivatives held for risk management purposes Contents

at fair value through other comprehensive income. with a nominal value of £7m to replace a similar are stated at cost less accumulated amortisation include all derivative assets and liabilities that are not

investment that had matured. The value of the and impairment losses. Expenditure on computer classified as trading assets or liabilities. Derivative

Contents

The Bank’s debt securities are initially recognised Bank’s debt securities includes a provision of £31k software development is capitalised if the product financial instruments are recognised at fair value.

at fair value and subsequently measured at fair (2020: £31k). or process is technically and commercially feasible, As at 31 December 2021, the Bank had £21m nominal

value through other comprehensive income. The future economic benefits are probable, and value of derivatives (2020: £23m), all related to the

instruments meet the SPPI criteria but as the assets £’000 2021 2020 the Bank can reliably measure the expenditure hedging of fixed rate deposit balances.

are in a Held To Collect and Sell Business Model they European Investment Bank 17,184 17,770 attributable to the intangible asset during its Strategic Report

are recorded at Fair Value with changes recorded bond (EIB) development. The capitalised expenditure includes Nominal value Fair value

through Other Comprehensive Income (OCI). the cost of direct labour and software licence costs. £’000 2021 2020 2021 2020

International Bank 19,953 20,274 Capitalised developments are stated at cost less

Changes in the fair value of debt securities are Reconstruction & accumulated amortisation. Instrument

recognised in other comprehensive income Development bond (IBRD) type

and presented in the fair value through other Total 37,137 38,044 Amortisation is charged to the income statement Interest rate 21,000 23,000 (254) 9

comprehensive income reserve. When the debt on a straight-line basis over the estimated useful

security is sold or matures, the gain or loss lives of intangible assets unless such lives are Designated – – – –

accumulated in equity, together with the tax thereon, indefinite. Intangible assets with an indefinite useful in fair value

is reclassified to the income statement. life are systematically tested for impairment at each hedges

balance sheet date. Other intangible assets are Total 21,000 23,000 (254) 9 Corporate Governance Statement

amortised from the date they are available for use. interest rate

The estimated useful life of capitalised software

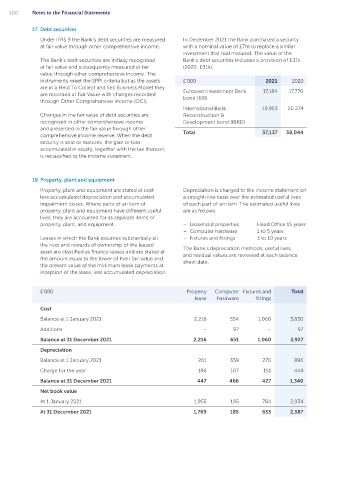

18 Property, plant and equipment derivatives

development costs is 3 to 5 years.

Property, plant and equipment are stated at cost Depreciation is charged to the income statement on Under IFRS 9 the Bank is not required to undertake

less accumulated depreciation and accumulated a straight-line basis over the estimated useful lives Intangible assets include assets totalling £52k a monthly retrospective test for hedge effectiveness

impairment losses. Where parts of an item of of each part of an item. The estimated useful lives which were in the course of construction at the 31 as it can demonstrate the critical terms of the hedge

property, plant and equipment have different useful are as follows: December 2021 (2020: £280k). instrument and the hedged item are matched.

lives, they are accounted for as separate items of

property, plant, and equipment. – Leasehold properties Head Office 15 years £’000 Computer software On initial designation of the hedge, the Bank formally

– Computer hardware 1 to 5 years

Leases in which the Bank assumes substantially all – Fixtures and fittings 3 to 10 years Cost documents the relationship between the hedging

instruments and the hedged items, including the risk

the risks and rewards of ownership of the leased The Bank’s depreciation methods, useful lives, Balance at 1 January 2021 3,618 management objective, together with the method

asset are classified as finance leases and are stated at

and residual values are reviewed at each balance Additions 549 that will be used to assess the effectiveness of the

the amount equal to the lower of their fair value and Independent Auditor’s Report

sheet date. hedging relationship. The Bank makes an assessment,

the present value of the minimum lease payments at Balance at 31 December 2021 4,167 at inception of whether the hedging instruments

inception of the lease, less accumulated depreciation.

Amortisation are expected to be highly effective in offsetting

the changes in the fair value or cash flows of the

Balance at 1 January 2021 2,051

£’000 Property Computer Fixtures and Total hedged items during the period in which the hedge

lease hardware fittings Amortisation for the year 527 is designated. On a monthly basis the Bank must

be able to continue to demonstrate that the critical

Cost Balance at 31 December 2021 2,578 terms of the derivative and the hedged item continue

Balance at 1 January 2021 2,216 554 1,060 3,830 Net book value to be closely aligned in order to conclude that the

relationship remains highly effective.

Additions – 97 – 97 At 1 January 2021 1,567

Balance at 31 December 2021 2,216 651 1,060 3,927 At 31 December 2021 1,589 All the Bank’s hedging relationships are currently fair Financial Statements

value hedges.

Depreciation

20 Other assets Fair value hedges

Balance at 1 January 2021 261 359 276 896

Where a derivative financial instrument is designated

Charge for the year 186 107 151 444 £’000 2021 2020

as a hedge of the variability in fair value of a recognised

Balance at 31 December 2021 447 466 427 1,340 Other debtors 132 105 asset or liability, or an unrecognised firm commitment,

all changes in the fair value of the derivative are

Net book value Cash Ratio Deposit 1,205 672

recognised immediately in the income statement.

At 1 January 2021 1,955 195 784 2,934 Prepayments 754 654 To the extent to which the hedge is effective, the

carrying value of the hedged item is adjusted by

At 31 December 2021 1,769 185 633 2,587 Total 2,091 1,431

the change in fair value that is attributable to the Notes to the Financial Statements

risk being hedged (even if it is normally carried at

The Bank is required to hold a Cash Ratio Deposit cost or amortised cost) and any gains or losses on

by the Bank of England. This is calculated twice measurement are recognised immediately in the

yearly at 0.18% of average eligible liabilities over the income statement (even if those gains would normally

previous six months in excess of £600m.

be recognised directly in reserves).