Page 125 - CCB_Full-Annual-Report-2021

P. 125

124 Notes to the Financial Statements 125

In June 2020, as part of the economic support initiatives implemented as a result of the COVID-19 pandemic, 29 Leases The Bank has considered whether any of its leases

the CRR ‘Quick Fix’ package announced measures that enable banks to reduce the impact on Tier 1 capital The Bank applies IFRS 16 in calculating a value for the contain any onerous clauses. Management have

from increased expected credit losses in 2020 and 2021. The Bank elected to adopt the new transitional relief lease, and lease liability, for its long-term property concluded that they do not, and that the whilst the Contents

and informed its Regulator of this decision. The additional relief allows the impact of increased expected loss and computer printer leases. The value is calculated Head Office had limited use during the onset of

Contents

provision balances in stage 1 and stage 2 cases in 2020 and 2021 on CET 1 regulatory capital, to be phased in as the present value of the remaining lease payments the Pandemic, the Bank has started to return to the

over 5 years. 100% of the increase can be added back to CET1 capital in 2020 and 2021, reducing to 75% in 2022, discounted at the Bank’s incremental borrowing rate. office during 2021 as working from home guidance

50% in 2023, and 25% in 2024. and social distancing restrictions were relaxed.

These right-of-use assets have been measured at an

amount equal to the lease liabilities, adjusted by the

The Bank’s capital requirement is calculated based on the gross exposures net of specific provisions. The tables amount of any pre-paid or accrued lease payments. The maturity profile of the Bank’s lease liabilities is

below set out the Bank’s capital resources at 31 December and reconciles these resources to the Bank’s reported shown in the table below: Strategic Report

regulatory capital.

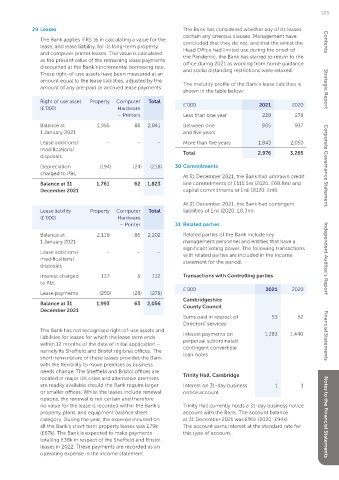

Right of use asset Property Computer Total £’000 2021 2020

(£’000) Hardware

£’000 31 December 2021 31 December 2020

– Printers Less than one year 228 278

Tier 1

Balance at 1,955 86 2,041 Between one 905 937

Ordinary share capital 44,955 44,955 1 January 2021 and five years

Perpetual subordinated contingent convertible loan notes 22,900 22,900 Lease additions/ – – – More than five years 1,843 2,050

modifications/

Retained earnings 96,437 82,254 Total 2,976 3,265

disposals

FVOCI reserve (475) 26

Depreciation (194) (24) (218) 30 Commitments Corporate Governance Statement

Deductions: Intangible assets (163) (83) charged to P&L

At 31 December 2021, the Bank had undrawn credit

Other deductions* (1,726) (1,688) Balance at 31 1,761 62 1,823 line commitments of £111.5m (2020: £68.8m) and

December 2021 capital commitments of £nil (2020: £nil).

Total Tier 1 capital 161,928 148,364

Total regulatory capital before IFRS9 transitional relief** 161,928 148,364 At 31 December 2021, the Bank had contingent

Lease liability Property Computer Total liabilities of £nil (2020: £0.3m).

IFRS9 transitional relief 5,627 4,799

(£’000) Hardware

Total regulatory capital after IFRS9 transitional relief 167,555 153,163 – Printer 31 Related parties

Balance at 2,116 86 2,202 Related parties of the Bank include key

1 January 2021 management personnel and entities that have a

Equity as per statement of financial position 163,817 150,135 significant voting power. The following transactions

Lease additions/ – – –

Regulatory adjustments: with related parties are included in the income

modifications/ statement for the period. Independent Auditor’s Report

Less intangible assets (201) (83) disposals

First loss tranche on BBB Enable Guarantee (1,688) (1,688) Interest charged 127 5 132 Transactions with Controlling parties

to P&L

Total regulatory capital before IFRS9 transitional relief** 161,928 148,364 £’000 2021 2020

Lease payments (250) (28) (278)

IFRS9 transitional relief 5,627 4,799 Cambridgeshire

Balance at 31 1,993 63 2,056

Total regulatory capital after IFRS9 transitional relief 167,555 153,163 December 2021 County Council

Sums paid in respect of 53 52

Directors’ services

31 December 2021 31 December 2020 The Bank has not recognised right-of-use assets and Interest payments on 1,283 1,440

liabilities for leases for which the lease term ends Financial Statements

Before After Before After perpetual subordinated

transitional relief transitional relief transitional relief transitional relief within 12 months of the date of initial application – contingent convertible

namely its Sheffield and Bristol regional offices. The

Risk weighted assets (RWA) 723,352 728,379 625,673 629,727 short-term nature of these leases provides the Bank loan notes

with the flexibility to move premises as business

Common Equity Tier 1 ratio (CET1) 19.2% 19.9% 20.1% 20.7%

needs change. The Sheffield and Bristol offices are

Tier 1 capital ratio 22.4% 23.0% 23.7% 24.3% located in major UK cities and alternative premises Trinity Hall, Cambridge

are readily available should the Bank require larger Interest on 31-day business 1 1

Total capital ratio 22.4% 23.0% 23.7% 24.3%

or smaller offices. Whilst the leases include renewal notice account

options, the renewal is not certain and therefore

* Other deductions from Common Equity Tier 1 Capital includes the first loss element of the British Business Bank’s Enable Guarantee that no value for the lease is recorded within the Bank’s Trinity Hall currently holds a 31-day business notice

became effective in 2019 and the Bank’s prudential valuation adjustment. The Enable Guarantee provided the Bank with a facility to guarantee

up to £50m of commercial loans. The guarantee, which for regulatory reporting purposes is treated as a synthetic securitisation enables the property, plant, and equipment balance sheet account with the Bank. The account balance Notes to the Financial Statements

Bank to risk weight the loans within the guarantee at 0%. The reduction in capital requirements as a result of the lower risk-weighting is partially category. During the year, the expense incurred on at 31 December 2021 was £95k (2020: £94k).

offset by a requirement to hold capital to cover the first £1.688m of losses arising from the loans within the guarantee. The £1,688k is referred all the Bank’s short term property leases was £79k The account earns interest at the standard rate for

to as the Bank’s first loss element.

** After applying the transitional factors to both the original and CRR Quick FIX relief values (£67k). The Bank is expected to make payments this type of account..

totalling £38k in respect of the Sheffield and Bristol

leases in 2022. These payments are recorded as an

operating expense in the income statement.