Page 122 - CCB_Full-Annual-Report-2021

P. 122

122 Notes to the Financial Statements 123

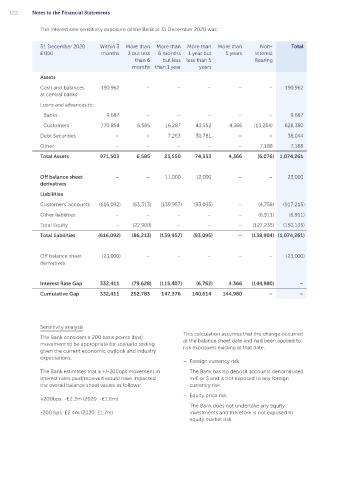

The interest rate sensitivity exposure of the Bank at 31 December 2020 was: • Operational risk the Bank against failure. The Bank submitted its last

ICAAP to the PRA in Q3 2021. The Bank presents

Operational risk is the risk of direct or indirect regular reports on the current and forecast level Contents

31 December 2020 Within 3 More than More than More than More than Non- Total loss arising from inadequate or failed internal of capital to the Executive Committee, ALCO, Risk

£’000 months 3 but less 6 months 1 year but 5 years Interest processes, people and systems or from external & Compliance Committee, and Board. The key

Contents

than 6 but less less than 5 Bearing assumptions and risk drivers used to create the

months than 1 year years events that cause regulatory censure, reputational

damage, financial loss, service disruption and/or ICAAP are regularly monitored and reported, and any

Assets customer detriment. material deviation from the forecast and risk profile

of the Bank would require the ICAAP to be reviewed.

Cash and balances 190,962 – – – – – 190,962 The Bank’s objective is to manage operational risk Strategic Report

at central banks

to balance the avoidance of financial losses or The Bank’s Total Capital Requirement (TCR) is set

Loans and advances to: damage to the Bank’s reputation with overall cost by its Regulator, the PRA. The Bank’s TCR was 11.1%

effectiveness and innovation. In all cases, Bank of Risk Weighted Assets (RWA) at 31 December

Banks 9,687 – – – – – 9,687

policy requires compliance with all applicable legal 2021. The Bank’s regulatory capital at 31 December

Customers 770,854 6,585 16,287 43,552 4,366 (13,264) 828,380 and regulatory requirements. 2021 totalled £167.5m (2020: £153.2m), (after IFRS 9

transitional relief). In addition to the TCR requirement

Debt Securities – – 7,263 30,781 – – 38,044

The Board of Directors has delegated responsibility the Bank is required to hold additional capital buffers,

Other – – – – – 7,188 7,188 for operational risk to the Risk & Compliance referred to as Pillar 2B, which includes the Counter

Committee, which is responsible for the oversight Cyclical Buffer and the Capital Conservation Buffer.

Total Assets 971,503 6,585 23,550 74,333 4,366 (6,076) 1,074,261

of the management of the full range of operational The Capital Conservation Buffer remained at 2.5%

risks the Bank faces, including: of RWA and the Counter Cyclical Buffer remained Corporate Governance Statement

at 0% of RWA during 2021. The FPC announced in

Off balance sheet – – 11,000 12,000 – – 23,000 – People December 2021, that the UK Counter Cyclical Buffer

derivatives

– Fraud (CCyB) would increase to 1%. This rate will come into

Liabilities – Execution, delivery and process management effect from 13 December 2022 in line with the usual

– Information security and management 12-month implementation period. The Committee

Customers’ accounts (616,092) (63,313) (139,957) (93,095) – (4,758) (917,215)

– Technology and cyber security also announced that if the UK economic recovery

Other liabilities – – – – – (6,911) (6,911) – Model risk proceeds broadly in line with the MPC’s central

– Supplier risk projections in the November Monetary Policy Report

Total Equity – (22,900) – – – (127,235) (150,135)

– Change management/execution and absent a material change in the outlook for UK

Total liabilities (616,092) (86,213) (139,957) (93,095) – (138,904) (1,074,261) – Employment practices and workplace safety financial stability, the FPC would expect to increase

– Conduct the rate further to 2% in 2022 Q2. This subsequent

– Operational resilience increase would be expected to take effect after the

Off balance sheet (23,000) – – – – – (23,000) – Environmental risk usual 12-month implementation period. Independent Auditor’s Report

derivatives The Bank uses various tools to monitor its exposure

to operational risk, including Risk and Control Self As at 31 December 2021, the Bank’s regulatory

capital consists entirely of Tier 1 capital which

Assessments, monitoring of operational risk events,

Interest Rate Gap 332,411 (79,628) (115,407) (6,762) 4,366 (144,980) – scenario analysis and the use of key risk indicators. includes ordinary share capital, convertible loan

notes, retained earnings, reserves, and deductions

Cumulative Gap 332,411 252,783 147,376 140,614 144,980 – – for intangible assets. The Bank’s intangible asset

• Capital Management

deduction as at 31 December 2021 reflects the

revised European Banking Authority regulatory

The Bank manages its capital under the Capital treatment that came into force in December 2020.

Requirements Regulation (CRR) and Capital Under these regulations the positive difference

Sensitivity analysis Requirements Directive (together referred to as CRD between the prudential and the accounting

This calculation assumes that the change occurred IV) framework. The framework is enforced in the UK

The Bank considers a 200 basis points (bps) at the balance sheet date and had been applied to by the Prudential Regulation Authority (PRA) who accumulated amortisation is fully deducted from Financial Statements

movement to be appropriate for scenario testing risk exposures existing at that date. sets and monitors capital requirements for the Bank. CET1 (Common Equity Tier 1) capital, while the

given the current economic outlook and industry residual portion of the carrying amount of software

expectations. is risk weighted. The majority of the Bank’s intangible

– Foreign currency risk The Bank’s policy is to maintain a strong capital assets are amortised over the prudential period of

base, to maintain investor and market confidence,

The Bank estimates that a +/-200bps movement in The Bank has no deposit accounts denominated and to sustain the future development of the 3 years and therefore the majority of the Bank’s

interest rates paid/received would have impacted in € or $ and is not exposed to any foreign business. The Board manages its capital levels for intangible assets are risk weighted.

the overall balance sheet values as follows: currency risk.

both current and future activities, and documents – Impact of IFRS 9 on capital planning

– Equity price risk its risk appetite, and capital requirements during

+200bps: -£2.3m (2020: -£1.6m) stress scenarios as part of the Bank’s Internal Capital The Bank elected to adopt the phased IFRS 9

The Bank does not undertake any equity Adequacy Assessment Process (ICAAP). transitional relief approach from 1 January 2018.

-200 bps: £2.4m (2020: £1.7m) investments and therefore is not exposed to Under the transition guidelines, the financial

equity market risk. Notes to the Financial Statements

The ICAAP represents the Board’s risk assessment impact of the increase in provision balances on

for the Bank, and it is used by the Board, CET 1 regulatory capital is phased in over 5 years,

management, and shareholders to understand the with 50% of the increase in requirements being

levels of capital required to be held over the short excluded in 2021 (70% in 2020) and 25% in 2022.

and medium term, and to assess the resilience of