Page 121 - CCB_Full-Annual-Report-2021

P. 121

120 Notes to the Financial Statements 121

The table below analyses the Bank’s contractual financial liabilities including any accrued interest up to the point is the main market risk faced by the Bank, and primarily arises from loans and deposits to customers, liquidity

of maturity as at 31 December. The contractual date is the earliest repayment date of the deposits. holdings and debt securities. Oversight of interest rate risk is monitored by ALCO monthly and is managed

through the use of appropriate financial instruments, including derivatives, with established risk limits, reporting Contents

Contractual maturity analysis at Due within Due after more No contractual Total lines, mandates and other control procedures in place.

Contents

31 December 2021 one year than one year maturity

£’000 Interest rate risk consists of asset-liability gap risk and basis risk.

Customers’ accounts 880,586 153,039 – 1,033,625

– Asset-liability gap risk

Central Bank facilities (TFSME) – 79,371 – 79,371

Where possible the Bank seeks to match the interest rate structure of assets with liabilities, creating a natural Strategic Report

Lease liabilities 104 1,952 – 2,056 hedge. Where this is not possible the Bank will enter into interest rate swap transactions to convert the fixed

rate exposures on loans and advances, customer deposits and debt securities into variable rate exposures.

Derivative financial liabilities – 254 – 254

– Basis risk

Other liabilities – – 5,224 5,224

Basis risk is the risk of loss arising from changes in the relationship between interest rates, which have similar,

Total Liabilities 880,690 234,616 5,224 1,120,530

although not identical, characteristics. This risk is managed by matching and, where appropriate, through the

use of derivatives with established risk limits and other control procedures.

Contractual maturity analysis at Due within Due after more No contractual Total The Bank’s forecasts and plans take account of the risk of interest rate changes and are prepared and stressed

31 December 2021 one year than one year maturity in line with PRA guidance. The following table summarises the re-pricing periods for the Bank’s assets and

£’000 liabilities. Items are allocated to time bands by reference to the earlier of the next contractual interest rate

change and the maturity date. The interest rate sensitivity exposure of the Bank at 31 December 2021 was: Corporate Governance Statement

Deposits 826,252 98,397 – 924,649

Lease liabilities 147 2,055 – 2,202

Other liabilities – – 4,709 4,709

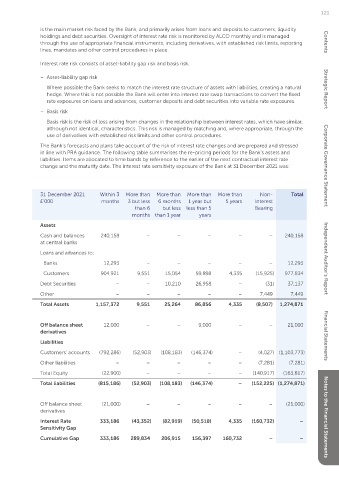

31 December 2021 Within 3 More than More than More than More than Non- Total

Total Liabilities 826,399 100,452 4,709 931,560 £’000 months 3 but less 6 months 1 year but 5 years Interest

than 6 but less less than 5 Bearing

months than 1 year years

Assets

Cash and balances 240,158 – – – – – 240,158

The following table sets outs the Bank’s liquid assets:

During 2021 the Bank repaid the £57m of Treasury at central banks

Bills drawn under the Funding for Lending Scheme

£’000 2021 2020 Loans and advances to:

(FLS). The Bank drew £78m of funding in cash under

Balances with Central banks 240,158 190,962 the Bank of England’s TFSME scheme (Term Funding Banks 12,293 – – – – – 12,293 Independent Auditor’s Report

Scheme with additional incentives for SME) in 2021.

Loans and advances to banks 12,293 9,687 Customers 904,921 9,551 15,054 59,898 4,335 (15,925) 977,834

The Bank has a total of £188m (2020: £122m) of loans

Debt securities 37,137 38,044 and debt securities which are available as collateral to Debt Securities – – 10,210 26,958 – (31) 37,137

support drawings under the Bank of England’s Sterling

Total 289,588 238,693 Other – – – – – 7,449 7,449

Monetary Framework (SMF) facilities.

Total Assets 1,157,372 9,551 25,264 86,856 4,335 (8,507) 1,274,871

The following table sets outs the Bank’s off-balance

sheet assets:

• Market risk Off balance sheet 12,000 – – 9,000 – – 21,000

-

£’000 Asset encumbrance 2021 2020 derivatives

Market risk is the risk that changes in market rates Financial Statements

Funding for Lending – 57,000 negatively impact the earnings or market value of the Liabilities

Scheme Treasury Bills Bank’s assets or liabilities. All the Bank’s exposure to Customers’ accounts (792,286) (52,903) (108,183) (146,374) – (4,027) (1,103,773)

market risk relates to non-trading portfolios.

Total – 57,000 Other liabilities – – – – – (7,281) (7,281)

As at 31 December 2021, the Bank does not have any Total Equity (22,900) – – – – (140,917) (163,817)

customer accounts or derivatives where the interest

– Asset encumbrance rate is set or linked to LIBOR. Total liabilities (815,186) (52,903) (108,183) (146,374) – (152,225) (1,274,871)

The Bank’s assets can be used to support collateral The principal risk to which non-trading portfolios are

requirements for central bank operations, or third party exposed is the risk of loss from fluctuations in the Off balance sheet (21,000) – – – – – (21,000)

repurchase transactions. Assets that have been set future cash flows or fair values of financial instruments derivatives

aside for such purposes are classified as ‘encumbered because of a change in market interest rates. Notes to the Financial Statements

assets’ and cannot be used for other purposes. All Interest Rate 333,186 (43,352) (82,919) (50,518) 4,335 (160,732) –

other assets are defined as ‘unencumbered assets’. Interest rate risk Sensitivity Gap

These assets are readily available to secure funding or Cumulative Gap 333,186 289,834 206,915 156,397 160,732 – –

meet collateral requirements and are not subject to Interest rate risk is the risk of loss arising from adverse

any restrictions. movements in market interest rates. Interest rate risk