Page 30 - 86395_CCB - 2024 Annual Report (web)

P. 30

30

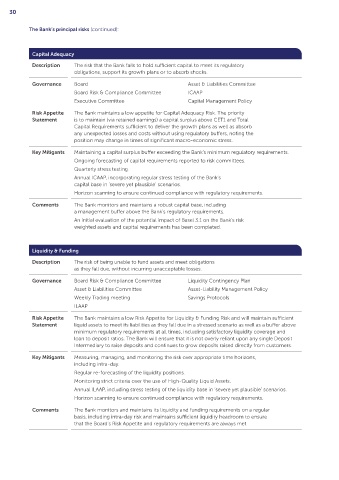

The Bank’s principal risks (continued):

Capital Adequacy

Description The risk that the Bank fails to hold sufficient capital to meet its regulatory

obligations, support its growth plans or to absorb shocks.

Governance Board Asset & Liabilities Committee

Board Risk & Compliance Committee ICAAP

Executive Committee Capital Management Policy

Risk Appetite The Bank maintains a low appetite for Capital Adequacy Risk. The priority

Statement is to maintain (via retained earnings) a capital surplus above CET1 and Total

Capital Requirements sufficient to deliver the growth plans as well as absorb

any unexpected losses and costs without using regulatory buffers, noting the

position may change in times of significant macro‑economic stress.

Key Mitigants Maintaining a capital surplus buffer exceeding the Bank’s minimum regulatory requirements.

Ongoing forecasting of capital requirements reported to risk committees.

Quarterly stress testing.

Annual ICAAP, incorporating regular stress testing of the Bank’s

capital base in ‘severe yet plausible’ scenarios.

Horizon scanning to ensure continued compliance with regulatory requirements.

Comments The Bank monitors and maintains a robust capital base, including

a management buffer above the Bank’s regulatory requirements.

An initial evaluation of the potential impact of Basel 3.1 on the Bank’s risk

weighted assets and capital requirements has been completed.

Liquidity & Funding

Description The risk of being unable to fund assets and meet obligations

as they fall due, without incurring unacceptable losses.

Governance Board Risk & Compliance Committee Liquidity Contingency Plan

Asset & Liabilities Committee Asset‑Liability Management Policy

Weekly Trading meeting Savings Protocols

ILAAP

Risk Appetite The Bank maintains a low Risk Appetite for Liquidity & Funding Risk and will maintain sufficient

Statement liquid assets to meet its liabilities as they fall due in a stressed scenario as well as a buffer above

minimum regulatory requirements at all times, including satisfactory liquidity coverage and

loan to deposit ratios. The Bank will ensure that it is not overly reliant upon any single Deposit

Intermediary to raise deposits and continues to grow deposits raised directly from customers.

Key Mitigants Measuring, managing, and monitoring the risk over appropriate time horizons,

including intra‑day.

Regular re‑forecasting of the liquidity positions.

Monitoring strict criteria over the use of High‑Quality Liquid Assets.

Annual ILAAP, including stress testing of the liquidity base in ‘severe yet plausible’ scenarios.

Horizon scanning to ensure continued compliance with regulatory requirements.

Comments The Bank monitors and maintains its liquidity and funding requirements on a regular

basis, including intra‑day risk and maintains sufficient liquidity headroom to ensure

that the Board’s Risk Appetite and regulatory requirements are always met.