Page 26 - 86395_CCB - 2024 Annual Report (web)

P. 26

26

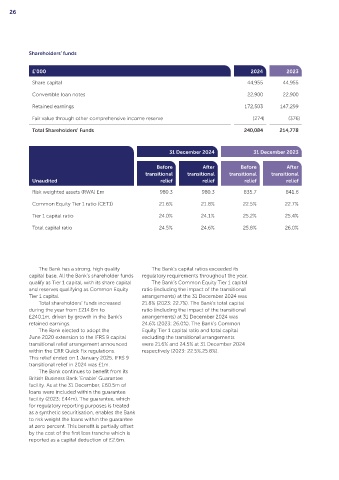

Shareholders’ funds

£’000 2024 2023

Share capital 44,955 44,955

Convertible loan notes 22,900 22,900

Retained earnings 172,503 147,299

Fair value through other comprehensive income reserve (274) (376)

Total Shareholders’ Funds 240,084 214,778

31 December 2024 31 December 2023

Before After Before After

transitional transitional transitional transitional

Unaudited relief relief relief relief

Risk weighted assets (RWA) £m 980.3 980.3 835.7 841.6

Common Equity Tier 1 ratio (CET1) 21.6% 21.8% 22.5% 22.7%

Tier 1 capital ratio 24.0% 24.1% 25.2% 25.4%

Total capital ratio 24.5% 24.6% 25.8% 26.0%

The Bank has a strong, high quality The Bank’s capital ratios exceeded its

capital base. All the Bank’s shareholder funds regulatory requirements throughout the year.

qualify as Tier 1 capital, with its share capital The Bank’s Common Equity Tier 1 capital

and reserves qualifying as Common Equity ratio (including the impact of the transitional

Tier 1 capital. arrangements) at the 31 December 2024 was

Total shareholders’ funds increased 21.8% (2023: 22.7%). The Bank’s total capital

during the year from £214.8m to ratio (including the impact of the transitional

£240.1m, driven by growth in the Bank’s arrangements) at 31 December 2024 was

retained earnings. 24.6% (2023: 26.0%). The Bank’s Common

The Bank elected to adopt the Equity Tier 1 capital ratio and total capital

June 2020 extension to the IFRS 9 capital excluding the transitional arrangements

transitional relief arrangement announced were 21.6% and 24.5% at 31 December 2024

within the CRR Quick Fix regulations. respectively (2023: 22.5%,25.8%).

This relief ended on 1 January 2025. IFRS 9

transitional relief in 2024 was £1m.

The Bank continues to benefit from its

British Business Bank ‘Enable’ Guarantee

facility. As at the 31 December, £60.5m of

loans were included within the guarantee

facility (2023: £44m). The guarantee, which

for regulatory reporting purposes is treated

as a synthetic securitisation, enables the Bank

to risk weight the loans within the guarantee

at zero percent. This benefit is partially offset

by the cost of the first loss tranche which is

reported as a capital deduction of £2.6m.