Page 40 - CCB_Annual Report_2022

P. 40

40 Strategic Report 41

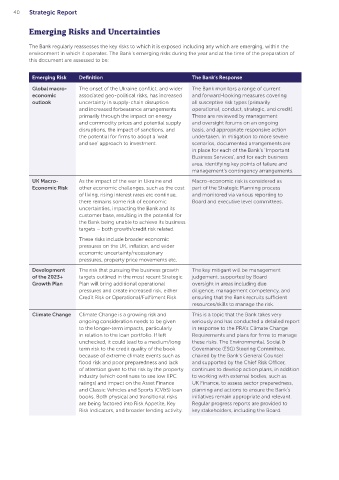

Emerging Risks and Uncertainties

The Bank regularly reassesses the key risks to which it is exposed including any which are emerging, within the

environment in which it operates. The Bank’s emerging risks during the year and at the time of the preparation of

this document are assessed to be:

Emerging Risk Definition The Bank’s Response Emerging Risk Definition The Bank’s Response

Global macro‑ The onset of the Ukraine conflict, and wider The Bank monitors a range of current Cyber Threat The nature of cyber-attacks across the The Bank’s technology infrastructure is

economic associated geo-political risks, has increased and forward-looking measures covering industry continues to change with the use UK based and has a very small externally

outlook uncertainty in supply-chain disruption all susceptive risk types (primarily of more sophisticated unseen malware or facing footprint, and the Bank’s websites

and increased forbearance arrangements operational, conduct, strategic, and credit). methods, as well as an increase in volume. are outside its perimeter, greatly reducing

primarily through the impact on energy These are reviewed by management the inherent exposure. Furthermore, the

and commodity prices and potential supply and oversight forums on an ongoing The Bank operations are inherently reliant Bank profile, suppliers, and customer-

disruptions, the impact of sanctions, and basis, and appropriate responsive action upon its technology infrastructure, and the base does not make it an obvious target

the potential for firms to adopt a ‘wait undertaken. In mitigation to more severe performance of third-party technology firms for state-sponsored or other hackers.

to maintain cyber security defences.

and see’ approach to investment. scenarios, documented arrangements are The Bank’s technology perimeter has

in place for each of the Bank’s ‘Important been reviewed without issue, and

Business Services’, and for each business patching timescales are as aggressive

area, identifying key points of failure and as possible. Technology arrangements

management’s contingency arrangements.

have been reviewed against the NCSC

UK Macro‑ As the impact of the war in Ukraine and Macro-economic risk is considered as guidance, and no deficiencies or areas

Economic Risk other economic challenges, such as the cost part of the Strategic Planning process for improvement were identified.

of living, rising interest rates etc continue, and monitored via various reporting to A Cyber Strategy and linked programme

there remains some risk of economic Board and executive level committees. of focused work, including obtaining a

uncertainties, impacting the Bank and its NIST Level 3 status, has begun and will

customer base, resulting in the potential for continue throughout 2023 which includes

the Bank being unable to achieve its business strengthening both Board and colleagues

targets – both growth/credit risk related.

understanding and ownership of Cyber

These risks include broader economic risk and the actions they need to take.

pressures on the UK, inflation, and wider Legal, Proposed regulation relating to a Strong We continue to monitor developments,

economic uncertainty/recessionary Compliance & and Simple Regime along with Basel 3.1, is as and when further clarity is provided,

pressures, property price movements etc.

Regulatory. expected to have an impact on the Bank, consideration is given to the impact for the

Development The risk that pursuing the business growth The key mitigant will be management including the capital holding requirements. Bank. We also engage with the relevant trade

of the 2023+ targets outlined in the most recent Strategic judgement, supported by Board bodies, as part of the wider industry response

Growth Plan Plan will bring additional operational oversight in areas including due to these proposed regulatory changes.

pressures and create increased risk, either diligence, management competency, and

Credit Risk or Operational/Fulfilment Risk. ensuring that the Bank recruits sufficient

resources/skills to manage the risk. The Strategic report on

Climate Change Climate Change is a growing risk and This is a topic that the Bank takes very pages 4 – 41 was approved,

ongoing consideration needs to be given seriously and has conducted a detailed report by order of the Board.

to the longer-term impacts, particularly in response to the PRA’s Climate Change

in relation to the loan portfolio. If left Requirements and plans for firms to manage

unchecked, it could lead to a medium/long these risks. The Environmental, Social &

term risk to the credit quality of the book Governance (ESG) Steering Committee,

because of extreme climate events such as chaired by the Bank’s General Counsel

flood risk and poor preparedness and lack and supported by the Chief Risk Officer, Richard Bryan

of attention given to this risk by the property continues to develop action plans, in addition Company Secretary

industry (which continues to see low EPC to working with external bodies, such as 30 March 2023

ratings) and impact on the Asset Finance UK Finance, to assess sector preparedness,

and Classic Vehicles and Sports (CV&S) loan planning and actions to ensure the Bank’s

books. Both physical and transitional risks initiatives remain appropriate and relevant.

are being factored into Risk Appetite, Key Regular progress reports are provided to

Risk Indicators, and broader lending activity. key stakeholders, including the Board.