Page 37 - CCB_Annual Report_2022

P. 37

36 Strategic Report 37

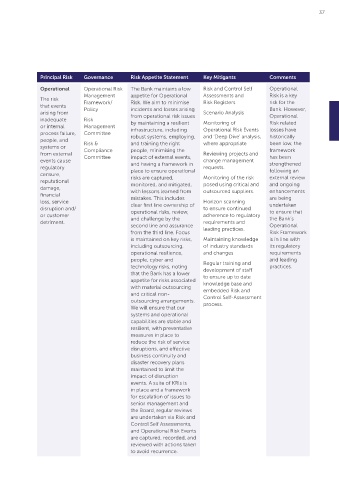

Principal Risk Governance Risk Appetite Statement Key Mitigants Comments Principal Risk Governance Risk Appetite Statement Key Mitigants Comments

Financial Financial Crime The Bank maintains a low Adherence to the Ensuring Operational Operational Risk The Bank maintains a low Risk and Control Self Operational

Crime Framework appetite for Financial Crime Financial Crime compliance The risk Management appetite for Operational Assessments and Risk is a key

risk, aiming to maintain a Framework with all Framework/ Risk. We aim to minimise Risk Registers risk for the

The risk that Risk low level of residual risk applicable that events Policy incidents and losses arising Bank. However,

inadequate Management and striving to ensure that Undertaking business regulatory arising from from operational risk issues Scenario Analysis Operational

controls Committee we always remain within wide risk assessments requirements in inadequate Risk by maintaining a resilient Monitoring of Risk related

relating to Risk & the law and regulation. Customer onboarding a fast-changing or internal Management infrastructure, including Operational Risk Events losses have

financial crime Compliance Whilst we recognise that incorporating standard landscape is process failure, Committee robust systems, employing, and ‘Deep Dive’ analysis, historically

could give Committee operational errors can and enhanced due a challenge people, and Risk & and training the right where appropriate been low, the

rise to fines, occur, we maintain zero diligence activities. to which the systems or Compliance people, minimising the framework

litigation, tolerance for breaches Bank devotes from external Committee impact of external events, Reviewing projects and has been

sanctions, of compliance with Risk based Source of considerable events cause and having a framework in change management strengthened

reputational applicable financial crime Funds and Source of resources. The regulatory place to ensure operational requests. following an

damage, or laws and regulations, Wealth checks. Financial Crime censure, risks are captured, Monitoring of the risk external review

financial loss. reputational

deliberate facilitation of Individual customer Framework damage, monitored, and mitigated, posed using critical and and ongoing

tax evasion, bribery and risk assessments which is continually financial with lessons learned from outsourced suppliers. enhancements

facilitation payments and determine a customer’s under review loss, service mistakes. This includes Horizon scanning are being

internal fraud. All material risk profile and maintained disruption and/ clear first line ownership of to ensure continued undertaken

breaches are investigated Third-party due in line with or customer operational risks, review, adherence to regulatory to ensure that

and reported to the Risk diligence. leading industry detriment. and challenge by the requirements and the Bank’s

Management Committee practices. second line and assurance leading practices. Operational

and Risk & Compliance Ongoing automated Annual from the third line. Focus Risk Framework

Committee in a timely transaction monitoring submission is maintained on key risks, Maintaining knowledge is in line with

manner, rule changes and screening of the MLRO including outsourcing, of industry standards its regulatory

are implemented within Receiving internal Report to operational resilience, and changes requirements

the applicable regulatory suspicious activity the Board people, cyber and Regular training and and leading

timelines and staff operate reports from any technology risks, noting development of staff practices.

within documented employee in the business that the Bank has a lower to ensure up to date

policies and controls appetite for risks associated knowledge base and

and, where applicable, High risk customers are with material outsourcing embedded Risk and

industry guidelines. approved by the MLRO and critical non- Control Self-Assessment

outsourcing arrangements.

Obtaining and using We will ensure that our process.

intelligence and national systems and operational

and international findings

capabilities are stable and

Receiving reports of resilient, with preventative

suspicious activity measures in place to

from any employee in reduce the risk of service

the business disruptions, and effective

business continuity and

Evaluating any suspicions disaster recovery plans

of money laundering/ maintained to limit the

terrorist financing

impact of disruption

Horizon scanning events. A suite of KRIs is

to ensure continued in place and a framework

adherence to regulatory for escalation of issues to

requirements. senior management and

the Board, regular reviews

Regular reviews of are undertaken via Risk and

training content and Control Self Assessments,

training and oversight and Operational Risk Events

of the development of are captured, recorded, and

staff to ensure up to date reviewed with actions taken

knowledge base

to avoid recurrence.