Page 95 - CCB_Full-Annual-Report-2021

P. 95

94 Notes to the Financial Statements 95

11. Directors’ remuneration differences when they reverse, using tax rates enacted Deferred tax

or substantively enacted at the reporting date. As

£’000 2021 2020 the Finance Bill 2021 was substantively enacted by Deferred tax assets are attributable as follows: Contents

the balance sheet date, deferred tax balances on

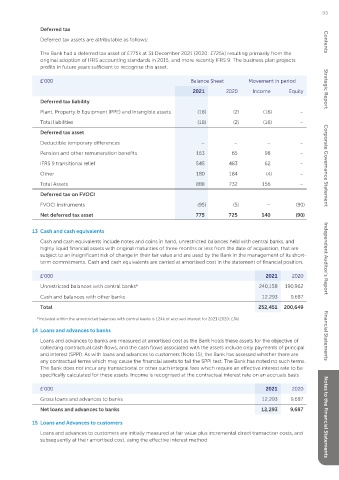

Directors’ remuneration 2,202 2,360 The Bank had a deferred tax asset of £775k at 31 December 2021 (2020: £725k) resulting primarily from the

Contents

timing differences as at 31 December 2021 have been

Amounts receivable under 50 – measured at 25% (2020: 19%). original adoption of IFRS accounting standards in 2015, and more recently IFRS 9. The business plan projects

profits in future years sufficient to recognise this asset.

long term incentive schemes

Deferred tax assets are reviewed at each reporting

Company contributions – 1 date and are reduced to the extent that is has become £’000 Balance Sheet Movement in period

to defined contribution probable that future taxable profits will be available 2021 2020 Income Equity Strategic Report

pension plans

against which they can be used. The measurement of

Provision for compensation – 109 deferred tax reflects the tax consequences that would Deferred tax liability

for loss of office follow the manner in which the Bank expects, at the Plant, Property & Equipment (PPE) and intangible assets (18) (2) (16) –

reporting date, to recover or settle the carrying amount

Amounts paid to third 53 52 of its assets and liabilities. Total liabilities (18) (2) (16) –

parties in respect of Deferred tax asset

Directors’ services

£’000 2021 2020

Total 2,305 2,522 Deductible temporary differences – – – –

Current tax expense

Pension and other remuneration benefits 163 65 98 –

The emoluments of the highest paid director were In respect of the current year 3,227 1,783

£596k (2020: £524k). There were no amounts In respect of prior years (62) (18) IFRS 9 transitional relief 545 483 62 – Corporate Governance Statement

receivable under long-term incentive schemes Other 180 184 (4) –

(2020: nil) and no contributions (2020: nil) to a 3,165 1,765

defined contribution pension plan within this total. Total Assets 888 732 156 –

Deferred tax expense

Deferred tax on FVOCI

No contributions were made into executive Origination and reversal of 70 75

directors’ personal defined contribution pension temporary differences FVOCI instruments (95) (5) – (90)

plans during the year (2020: £1k), with all directors Net deferred tax asset 775 725 140 (90)

receiving a cash allowance instead. There were no Adjustments in respect of 15 8

directors’ loans in 2021 (2020: nil). prior periods

13 Cash and cash equivalents

Effect of tax rate change on (226) (85)

12 Taxation opening balance Cash and cash equivalents include notes and coins in hand, unrestricted balances held with central banks, and

highly liquid financial assets with original maturities of three months or less from the date of acquisition, that are

Tax on the profit or loss for the year comprises current (141) (2) subject to an insignificant risk of change in their fair value and are used by the Bank in the management of its short-

and deferred tax. Tax is recognised in the income term commitments. Cash and cash equivalents are carried at amortised cost in the statement of financial position. Independent Auditor’s Report

statement except to the extent that it relates to Total income tax expense 3,024 1,763

items recognised directly in equity, in which case it is

The income tax expense for the year can be £’000 2021 2020

recognised in equity. Current tax is the expected tax

reconciled to the accounting profit as follows:

payable or receivable on the taxable income or loss Unrestricted balances with central banks* 240,158 190,962

for the year, using tax rates enacted, or substantively £’000 2021 2020

enacted at the balance sheet date, and any adjustment Cash and balances with other banks 12,293 9,687

to tax payable in respect of previous years. Profit before tax from 18,490 11,161 Total 252,451 200,649

continuing operations

The UK corporation tax rate of 19% (2020: 19%) has Income tax expense 3,513 2,120 *Included within the unrestricted balances with central banks is £24k of accrued interest for 2021 (2020: £8k)

been used in the preparation of these accounts. calculated at 19% (2020: 19%) 14 Loans and advances to banks

Deferred tax is provided on temporary differences Financial Statements

between the carrying amounts of assets and liabilities Effects of: Loans and advances to banks are measured at amortised cost as the Bank holds these assets for the objective of

for financial reporting purposes and the amounts Convertible loan note (244) (274) collecting contractual cash flows, and the cash flows associated with the assets include only payments of principal

used for taxation purposes. A deferred tax asset is interest payment and interest (SPPI). As with loans and advances to customers (Note 15), the Bank has assessed whether there are

recognised only to the extent that it is probable that any contractual terms which may cause the financial assets to fail the SPPI test. The Bank has noted no such terms.

future taxable profits will be available against which Expenses not deductible 3 5 The Bank does not incur any transactional or other such integral fees which require an effective interest rate to be

the temporary difference can be utilised. for tax purposes specifically calculated for these assets. Income is recognised at the contractual interest rate on an accruals basis.

Deferred tax charged (90) –

The Finance Act 2016 included a reduction in the £’000 2021 2020

directly to equity

main rate of UK corporation tax from 19% to 17% from Gross loans and advances to banks 12,293 9,687

1 April 2020. However, in the UK budget on 11 March Adjustments in respect (49) (9)

2020, it was announced that the cut in the tax rate to of previous periods Net loans and advances to banks 12,293 9,687

17% would not occur and the UK Corporation Tax Rate Notes to the Financial Statements

would instead remain at 19%. Subsequently, in the Timing differences 67 – 15 Loans and Advances to customers

March 2021 Budget it was announced that legislation Tax rate changes (186) (85)

will be introduced in Finance Bill 2021 to increase the Loans and advances to customers are initially measured at fair value plus incremental direct transaction costs, and

main rate of UK corporation tax from 19% to 25%, Non-Qualifying Depreciation 10 6 subsequently at their amortised cost, using the effective interest method.

effective 1 April 2023. Deferred tax is measured at the Total tax charge 19% 3,024 1,763

tax rates that are expected to be applied to temporary (2020: 19%)