Page 122 - 86395_CCB - 2024 Annual Report (web)

P. 122

122

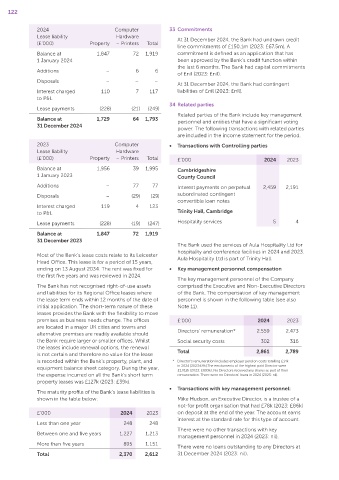

2024 Computer 33 Commitments

Lease liability Hardware At 31 December 2024, the Bank had undrawn credit

(£’000) Property – Printers Total

line commitments of £150.1m (2023: £67.5m). A

Balance at 1,847 72 1,919 commitment is defined as an application that has

1 January 2024 been approved by the Bank’s credit function within

the last 6 months. The Bank had capital commitments

Additions – 6 6

of £nil (2023: £nil).

Disposals – – –

At 31 December 2024, the Bank had contingent

Interest charged 110 7 117 liabilities of £nil (2023: £nil).

to P&L

34 Related parties

Lease payments (228) (21) (249)

Related parties of the Bank include key management

Balance at 1,729 64 1,793 personnel and entities that have a significant voting

31 December 2024

power. The following transactions with related parties

are included in the income statement for the period.

2023 Computer • Transactions with Controlling parties

Lease liability Hardware

(£’000) Property – Printers Total £’000 2024 2023

Balance at 1,956 39 1,995 Cambridgeshire

1 January 2023 County Council

Additions – 77 77 Interest payments on perpetual 2,459 2,191

Disposals – (29) (29) subordinated contingent

convertible loan notes

Interest charged 119 4 123

to P&L Trinity Hall, Cambridge

Lease payments (228) (19) (247) Hospitality services 5 4

Balance at 1,847 72 1,919

31 December 2023

The Bank used the services of Aula Hospitality Ltd for

hospitality and conference facilities in 2024 and 2023.

Most of the Bank’s lease costs relate to its Leicester Aula Hospitality Ltd is part of Trinity Hall.

Head Office. This lease is for a period of 15 years,

ending on 13 August 2034. The rent was fixed for • Key management personnel compensation

the first five years and was reviewed in 2024.

The key management personnel of the Company

The Bank has not recognised right‑of‑use assets comprised the Executive and Non‑Executive Directors

and liabilities for its Regional Office leases where of the Bank. The compensation of key management

the lease term ends within 12 months of the date of personnel is shown in the following table (see also

initial application. The short‑term nature of these Note 11).

leases provides the Bank with the flexibility to move

premises as business needs change. The offices £’000 2024 2023

are located in a major UK cities and towns and Directors’ remuneration* 2,559 2,473

alternative premises are readily available should

the Bank require larger or smaller offices. Whilst Social security costs 302 316

the leases include renewal options, the renewal Total 2,861 2,789

is not certain and therefore no value for the lease

is recorded within the Bank’s property, plant, and * Director’s remuneration includes employer pension costs totalling £14k

in 2024 (2023:£9k).The emoluments of the highest paid Director were

equipment balance sheet category. During the year,

£1,012k (2023: £693k). No Directors received any shares as part of their

the expense incurred on all the Bank’s short term remuneration. There were no Directors’ loans in 2024 (2023: nil).

property leases was £127k (2023: £39k).

• Transactions with key management personnel:

The maturity profile of the Bank’s lease liabilities is

shown in the table below: Mike Hudson, an Executive Director, is a trustee of a

not‑for profit organisation that had £78k (2023: £86k)

£’000 2024 2023 on deposit at the end of the year. The account earns

interest at the standard rate for this type of account.

Less than one year 248 248

There were no other transactions with key

Between one and five years 1,227 1,213

management personnel in 2024 (2023: nil).

More than five years 895 1,151

There were no loans outstanding to any Directors at

Total 2,370 2,612 31 December 2024 (2023: nil).