Page 121 - 86395_CCB - 2024 Annual Report (web)

P. 121

121

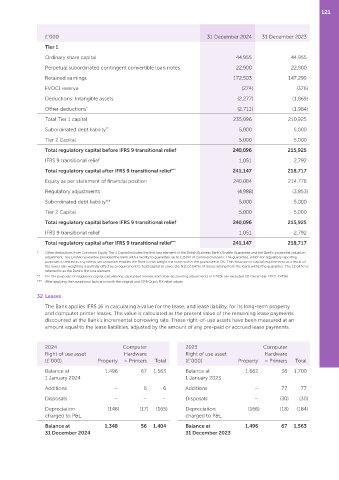

£’000 31 December 2024 31 December 2023

Tier 1

Ordinary share capital 44,955 44,955

Perpetual subordinated contingent convertible loan notes 22,900 22,900

Retained earnings 172,503 147,299

FVOCI reserve (274) (376)

Deductions: Intangible assets (2,277) (1,869)

Other deductions * (2,711) (1,984)

Total Tier 1 capital 235,096 210,925

Subordinated debt liability ** 5,000 5,000

Tier 2 Capital 5,000 5,000

Total regulatory capital before IFRS 9 transitional relief 240,096 215,925

IFRS 9 transitional relief 1,051 2,792

Total regulatory capital after IFRS 9 transitional relief *** 241,147 218,717

Equity as per statement of financial position 240,084 214,778

Regulatory adjustments (4,988) (3,853)

Subordinated debt liability** 5,000 5,000

Tier 2 Capital 5,000 5,000

Total regulatory capital before IFRS 9 transitional relief 240,096 215,925

IFRS 9 transitional relief 1,051 2,792

Total regulatory capital after IFRS 9 transitional relief *** 241,147 218,717

* Other deductions from Common Equity Tier 1 Capital includes the first loss element of the British Business Bank’s Enable Guarantee and the Bank’s prudential valuation

adjustment. The Enable Guarantee provided the Bank with a facility to guarantee up to £150m of commercial loans. The guarantee, which for regulatory reporting

purposes is treated as a synthetic securitisation enables the Bank to risk weight the loans within the guarantee at 0%. The reduction in capital requirements as a result of

the lower risk‑weighting is partially offset by a requirement to hold capital to cover the first £2.647m of losses arising from the loans within the guarantee. The £2.647m is

referred to as the Bank’s first loss element.

** For the purposes of regulatory capital calculations, capitalised interest and other accounting adjustments of £200k are excluded (31 December 2023: £249k)

*** After applying the transitional factors to both the original and CRR Quick FIX relief values

32 Leases

The Bank applies IFRS 16 in calculating a value for the lease, and lease liability, for its long‑term property

and computer printer leases. The value is calculated as the present value of the remaining lease payments

discounted at the Bank’s incremental borrowing rate. These right‑of‑use assets have been measured at an

amount equal to the lease liabilities, adjusted by the amount of any pre‑paid or accrued lease payments.

2024 Computer 2023 Computer

Right of use asset Hardware Right of use asset Hardware

(£’000) Property – Printers Total (£’000) Property – Printers Total

Balance at 1,496 67 1,563 Balance at 1,662 38 1,700

1 January 2024 1 January 2023

Additions – 6 6 Additions – 77 77

Disposals – – – Disposals – (30) (30)

Depreciation (148) (17) (165) Depreciation (166) (18) (184)

charged to P&L charged to P&L

Balance at 1,348 56 1,404 Balance at 1,496 67 1,563

31 December 2024 31 December 2023