Page 119 - 86395_CCB - 2024 Annual Report (web)

P. 119

119

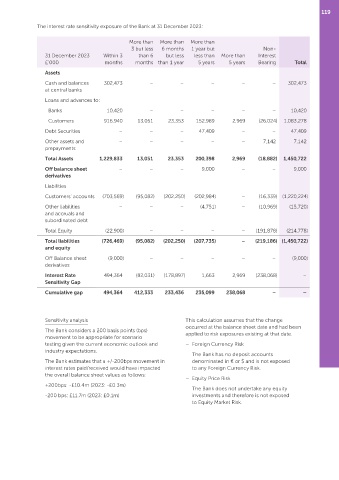

The interest rate sensitivity exposure of the Bank at 31 December 2023:

More than More than More than

3 but less 6 months 1 year but Non‑

31 December 2023 Within 3 than 6 but less less than More than Interest

£’000 months months than 1 year 5 years 5 years Bearing Total

Assets

Cash and balances 302,473 – – – – – 302,473

at central banks

Loans and advances to:

Banks 10,420 – – – – – 10,420

Customers 916,940 13,051 23,353 152,989 2,969 (26,024) 1,083,278

Debt Securities – – – 47,409 – – 47,409

Other assets and – – – – – 7,142 7,142

prepayments

Total Assets 1,229,833 13,051 23,353 200,398 2,969 (18,882) 1,450,722

Off balance sheet – – – 9,000 – – 9,000

derivatives

Liabilities

Customers’ accounts (703,569) (95,082) (202,250) (202,984) – (16,339) (1,220,224)

Other liabilities – – – (4,751) – (10,969) (15,720)

and accruals and

subordinated debt

Total Equity (22,900) – – – – (191,878) (214,778)

Total liabilities (726,469) (95,082) (202,250) (207,735) – (219,186) (1,450,722)

and equity

Off Balance sheet (9,000) – – – – – (9,000)

derivatives

Interest Rate 494,364 (82,031) (178,897) 1,663 2,969 (238,068) –

Sensitivity Gap

Cumulative gap 494,364 412,333 233,436 235,099 238,068 – –

Sensitivity analysis This calculation assumes that the change

occurred at the balance sheet date and had been

The Bank considers a 200 basis points (bps) applied to risk exposures existing at that date.

movement to be appropriate for scenario

testing given the current economic outlook and – Foreign Currency Risk

industry expectations.

The Bank has no deposit accounts

The Bank estimates that a +/‑200bps movement in denominated in € or $ and is not exposed

interest rates paid/received would have impacted to any Foreign Currency Risk.

the overall balance sheet values as follows:

– Equity Price Risk

+200bps: ‑£10.4m (2023: ‑£0.3m)

The Bank does not undertake any equity

‑200 bps: £11.7m (2023: £0.1m) investments and therefore is not exposed

to Equity Market Risk.