Page 117 - 86395_CCB - 2024 Annual Report (web)

P. 117

117

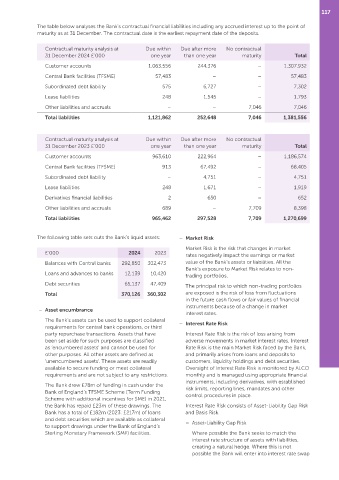

The table below analyses the Bank’s contractual financial liabilities including any accrued interest up to the point of

maturity as at 31 December. The contractual date is the earliest repayment date of the deposits.

Contractual maturity analysis at Due within Due after more No contractual

31 December 2024 £’000 one year than one year maturity Total

Customer accounts 1,063,556 244,376 – 1,307,932

Central Bank facilities (TFSME) 57,483 – – 57,483

Subordinated debt liability 575 6,727 – 7,302

Lease liabilities 248 1,545 – 1,793

Other liabilities and accruals – – 7,046 7,046

Total liabilities 1,121,862 252,648 7,046 1,381,556

Contractual maturity analysis at Due within Due after more No contractual

31 December 2023 £’000 one year than one year maturity Total

Customer accounts 963,610 222,964 – 1,186,574

Central Bank facilities (TFSME) 913 67,492 – 68,405

Subordinated debt liability – 4,751 – 4,751

Lease liabilities 248 1,671 – 1,919

Derivatives financial liabilities 2 650 – 652

Other liabilities and accruals 689 – 7,709 8,398

Total liabilities 965,462 297,528 7,709 1,270,699

The following table sets outs the Bank’s liquid assets: – Market Risk

Market Risk is the risk that changes in market

£’000 2024 2023

rates negatively impact the earnings or market

Balances with Central banks 292,850 302,473 value of the Bank’s assets or liabilities. All the

Bank’s exposure to Market Risk relates to non‑

Loans and advances to banks 12,139 10,420 trading portfolios.

Debt securities 65,137 47,409 The principal risk to which non‑trading portfolios

Total 370,126 360,302 are exposed is the risk of loss from fluctuations

in the future cash flows or fair values of financial

instruments because of a change in market

– Asset encumbrance

interest rates.

The Bank’s assets can be used to support collateral – Interest Rate Risk

requirements for central bank operations, or third

party repurchase transactions. Assets that have Interest Rate Risk is the risk of loss arising from

been set aside for such purposes are classified adverse movements in market interest rates. Interest

as ‘encumbered assets’ and cannot be used for Rate Risk is the main Market Risk faced by the Bank,

other purposes. All other assets are defined as and primarily arises from loans and deposits to

‘unencumbered assets’. These assets are readily customers, liquidity holdings and debt securities.

available to secure funding or meet collateral Oversight of Interest Rate Risk is monitored by ALCO

requirements and are not subject to any restrictions. monthly and is managed using appropriate financial

instruments, including derivatives, with established

The Bank drew £78m of funding in cash under the risk limits, reporting lines, mandates and other

Bank of England’s TFSME Scheme (Term Funding control procedures in place.

Scheme with additional incentives for SME) in 2021,

the Bank has repaid £23m of these drawings. The Interest Rate Risk consists of Asset‑Liability Gap Risk

Bank has a total of £182m (2023: £217m) of loans and Basis Risk.

and debt securities which are available as collateral

– Asset‑Liability Gap Risk

to support drawings under the Bank of England’s

Sterling Monetary Framework (SMF) facilities. Where possible the Bank seeks to match the

interest rate structure of assets with liabilities,

creating a natural hedge. Where this is not

possible the Bank will enter into interest rate swap