Page 118 - 86395_CCB - 2024 Annual Report (web)

P. 118

118

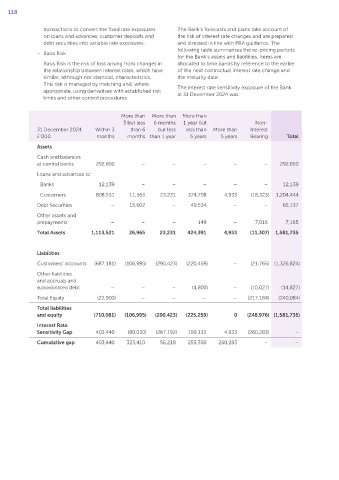

transactions to convert the fixed rate exposures The Bank’s forecasts and plans take account of

on loans and advances, customer deposits and the risk of interest rate changes and are prepared

debt securities into variable rate exposures. and stressed in line with PRA guidance. The

following table summarises the re‑pricing periods

– Basis Risk

for the Bank’s assets and liabilities. Items are

Basis Risk is the risk of loss arising from changes in allocated to time bands by reference to the earlier

the relationship between interest rates, which have of the next contractual interest rate change and

similar, although not identical, characteristics. the maturity date.

This risk is managed by matching and, where The interest rate sensitivity exposure of the Bank

appropriate, using derivatives with established risk at 31 December 2024 was:

limits and other control procedures.

More than More than More than

3 but less 6 months 1 year but Non‑

31 December 2024 Within 3 than 6 but less less than More than Interest

£’000 months months than 1 year 5 years 5 years Bearing Total

Assets

Cash and balances

at central banks 292,850 – – – – – 292,850

Loans and advances to:

Banks 12,139 – – – – – 12,139

Customers 808,531 11,363 23,231 374,708 4,933 (18,323) 1,204,444

Debt Securities – 15,602 – 49,534 – – 65,137

Other assets and

prepayments – – – 149 – 7,016 7,165

Total Assets 1,113,521 26,965 23,231 424,391 4,933 (11,307) 1,581,735

Liabilities

Customers’ accounts (687,181) (106,995) (290,423) (220,459) – (21,765) (1,326,824)

Other liabilities

and accruals and

subordinated debt – – – (4,800) – (10,027) (14,827)

Total Equity (22,900) – – – – (217,184) (240,084)

Total liabilities

and equity (710,081) (106,995) (290,423) (225,259) 0 (248,976) (1,581,735)

Interest Rate

Sensitivity Gap 403,440 (80,030) (267,192) 199,132 4,933 (260,283) –

Cumulative gap 403,440 323,410 56,218 255,350 260,283 – –