Page 125 - CCB_Annual Report_2022

P. 125

124 Notes to the Financial Statements 125

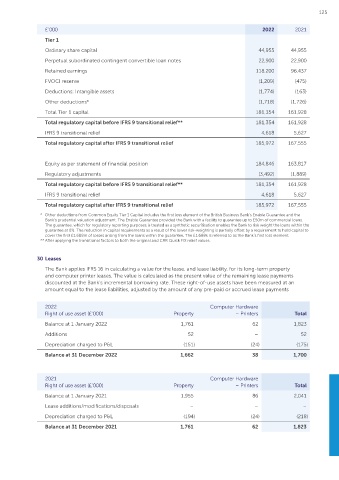

• Operational risk to the Executive Committee, ALCO, Risk & £’000 2022 2021

Compliance Committee, and Board. The key

Operational risk is the risk of direct or indirect loss assumptions and risk drivers used to create the Tier 1

arising from inadequate or failed internal processes, ICAAP are regularly monitored and reported, Ordinary share capital 44,955 44,955

people and systems or from external events that and any material deviation from the forecast and

cause regulatory censure, reputational damage, risk profile of the Bank would require the ICAAP Perpetual subordinated contingent convertible loan notes 22,900 22,900

financial loss, service disruption and/or customer to be reviewed. Retained earnings 118,200 96,437

detriment.

The Bank’s Total Capital Requirement (TCR) is FVOCI reserve (1,209) (475)

The Bank’s objective is to manage operational risk set by its Regulator, the PRA. The Bank’s TCR

to balance the avoidance of financial losses or was 13.19% of Risk Weighted Assets (RWA) Deductions: Intangible assets (1,774) (163)

damage to the Bank’s reputation with overall cost

at 31 December 2022. The Bank’s regulatory Other deductions* (1,718) (1,726)

effectiveness and innovation. In all cases, Bank

capital at 31 December 2022 totalled £185.1m

policy requires compliance with all applicable legal Total Tier 1 capital 181,354 161,928

(2021: £167.5m), (after IFRS 9 transitional

and regulatory requirements.

relief). In addition to the TCR requirement Total regulatory capital before IFRS 9 transitional relief** 181,354 161,928

The Board of Directors has delegated responsibility the Bank is required to hold additional capital

for operational risk to the Risk & Compliance buffers, referred to as Pillar 2B, which includes IFRS 9 transitional relief 4,618 5,627

Committee, which is responsible for the oversight the Counter Cyclical Buffer and the Capital Total regulatory capital after IFRS 9 transitional relief 185,972 167,555

of the management of the full range of operational Conservation Buffer. The Capital Conservation

risks the Bank faces, including: Buffer remained at 2.5% of RWA in 2022

whilst the Counter Cyclical Buffer increased Equity as per statement of financial position 184,846 163,817

– People

from 0% RWA at 31 December 2021 to 1% in

– Fraud Regulatory adjustments (3,492) (1,889)

December 2022.

– Execution, delivery and process management

– Information security and management As at 31 December 2022, the Bank’s regulatory Total regulatory capital before IFRS 9 transitional relief** 181,354 161,928

– Technology and cyber security capital consists entirely of Tier 1 capital which IFRS 9 transitional relief 4,618 5,627

– Model risk includes ordinary share capital, convertible

– Supplier risk loan notes, retained earnings, reserves, and Total regulatory capital after IFRS 9 transitional relief 185,972 167,555

– Change management/execution deductions for intangible assets. The Bank’s * Other deductions from Common Equity Tier 1 Capital includes the first loss element of the British Business Bank’s Enable Guarantee and the

– Employment practices and workplace safety intangible asset deduction as at 31 December Bank’s prudential valuation adjustment. The Enable Guarantee provided the Bank with a facility to guarantee up to £50m of commercial loans.

– Conduct 2022 are fully deducted from CET1 (Common The guarantee, which for regulatory reporting purposes is treated as a synthetic securitisation enables the Bank to risk weight the loans within the

guarantee at 0%. The reduction in capital requirements as a result of the lower risk-weighting is partially offset by a requirement to hold capital to

– Operational resilience Equity Tier 1) capital. cover the first £1.688m of losses arising from the loans within the guarantee. The £1,688k is referred to as the Bank’s first loss element.

– Environmental risk ** After applying the transitional factors to both the original and CRR Quick FIX relief values.

Impact of IFRS 9 on capital planning

The Bank uses various tools to monitor its exposure The Bank elected to adopt the phased IFRS 9

to operational risk, including Risk and Control Self transitional relief approach from 1 January 2018. 30 Leases

Assessments, monitoring of operational risk events, Under the transition guidelines, the financial

scenario analysis and the use of key risk indicators. The Bank applies IFRS 16 in calculating a value for the lease, and lease liability, for its long-term property

impact of the increase in provision balances and computer printer leases. The value is calculated as the present value of the remaining lease payments

on CET 1 regulatory capital is phased in over 5 discounted at the Bank’s incremental borrowing rate. These right-of-use assets have been measured at an

29 Capital management

years, with 25% of the increase in requirements amount equal to the lease liabilities, adjusted by the amount of any pre-paid or accrued lease payments

The Bank manages its capital under the Capital being excluded in 2022 (50% in 2021).

Requirements Regulation (CRR) and Capital In June 2020, as part of the economic

Requirements Directive (together referred to as CRD support initiatives implemented as a result of 2022 Computer Hardware

IV) framework. The framework is enforced in the UK the Covid-19 pandemic, the CRR ‘Quick Fix’ Right of use asset (£’000) Property – Printers Total

by the Prudential Regulation Authority (PRA) who package announced measures that enable Balance at 1 January 2022 1,761 62 1,823

sets and monitors capital requirements for the Bank.

banks to reduce the impact on Tier 1 capital Additions 52 – 52

The Bank’s policy is to maintain a strong capital from increased expected credit losses in 2020

base, to maintain investor and market confidence, and 2021. The Bank elected to adopt the new Depreciation charged to P&L (151) (24) (175)

and to sustain the future development of the transitional relief and informed its Regulator of Balance at 31 December 2022 1,662 38 1,700

business. The Board manages its capital levels for this decision. The additional relief allows the

both current and future activities, and documents impact of increased expected loss provision

its risk appetite, and capital requirements during balances in stage 1 and stage 2 cases in 2020,

stress scenarios as part of the Bank’s Internal Capital 2021 and 2022 on CET 1 regulatory capital, to 2021 Computer Hardware

Adequacy Assessment Process (ICAAP). The Bank’s be phased in over 5 years. 100% of the increase Right of use asset (£’000) Property – Printers Total

ICAAP was updated during the year and approved was added back to CET1 capital in 2020 and Balance at 1 January 2021 1,955 86 2,041

by the Board in October 2022. 2021, reducing to 75% in 2022, 50% in 2023,

and 25% in 2024. Lease additions/modifications/disposals – – –

The ICAAP represents the Board’s risk assessment

for the Bank, and it is used by the Board, The Bank’s capital requirement is calculated Depreciation charged to P&L (194) (24) (218)

management, and shareholders to understand the based on the gross exposures net of specific Balance at 31 December 2021 1,761 62 1,823

levels of capital required to be held over the short provisions. The tables below set out the Bank’s

and medium term, and to assess the resilience of capital resources at 31 December and reconciles

the Bank against failure. The Bank presents regular these resources to the Bank’s reported

reports on the current and forecast level of capital regulatory capital.