Page 122 - CCB_Annual Report_2022

P. 122

122 Notes to the Financial Statements 123

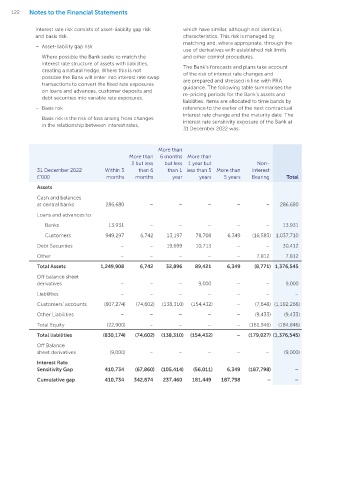

Interest rate risk consists of asset-liability gap risk which have similar, although not identical, The interest rate sensitivity exposure of the Bank at 31 December 2021:

and basis risk. characteristics. This risk is managed by

matching and, where appropriate, through the More than

– Asset-liability gap risk

use of derivatives with established risk limits More than 6 months More than

Where possible the Bank seeks to match the and other control procedures. 3 but less but less 1 year but Non-

interest rate structure of assets with liabilities, The Bank’s forecasts and plans take account 31 December 2021 Within 3 than 6 than 1 less than 5 More than Interest

creating a natural hedge. Where this is not of the risk of interest rate changes and £’000 months months year years 5 years Bearing Total

possible the Bank will enter into interest rate swap are prepared and stressed in line with PRA Assets

transactions to convert the fixed rate exposures guidance. The following table summarises the

on loans and advances, customer deposits and re-pricing periods for the Bank’s assets and Cash and balances

debt securities into variable rate exposures. at central banks 240,158 – – – – – 240,158

liabilities. Items are allocated to time bands by

– Basis risk reference to the earlier of the next contractual Loans and advances to:

interest rate change and the maturity date. The

Basis risk is the risk of loss arising from changes Banks 12,293 – – – – – 12,293

interest rate sensitivity exposure of the Bank at

in the relationship between interest rates,

31 December 2022 was: Customers 904,921 9,551 15,054 59,898 4,335 (15,925) 977,834

Debt Securities – – 10,210 26,958 – (31) 37,137

More than Other – – – – – 7,449 7,449

More than 6 months More than Total Assets 1,157,372 9,551 25,264 86,856 4,335 (8,507) 1,274,871

3 but less but less 1 year but Non-

31 December 2022 Within 3 than 6 than 1 less than 5 More than Interest Off balance sheet

£’000 months months year years 5 years Bearing Total derivatives 12,000 – – 9,000 – – 21,000

Assets Liabilities – – – – – – –

Cash and balances Customers’ accounts (792,286) (52,903) (108,183) (146,374) – (4,027) (1,103,773)

at central banks 286,680 – – – – – 286,680

Other Liabilities – – – – – (7,281) (7,281)

Loans and advances to:

Total Equity (22,900) – – – – (140,917) (163,817)

Banks 13,931 – – – – – 13,931

Total liabilities (815,186) (52,903) (108,183) (146,374) – (152,225) (1,274,871)

Customers 949,297 6,742 13,197 78,708 6,349 (16,583) 1,037,710

Off Balance

Debt Securities – – 19,699 10,713 – – 30,412 sheet derivatives (21,000) – – – – – (21,000)

Other – – – – – 7,812 7,812 Interest Rate

Sensitivity Gap 333,186 (43,352) (82,919) (50,518) 4,335 (160,732) –

Total Assets 1,249,908 6,742 32,896 89,421 6,349 (8,771) 1,376,545

Cumulative gap 333,186 289,834 206,915 156,397 160,732 – –

Off balance sheet

derivatives – – – 9,000 – – 9,000

Liabilities – – – – – – – Sensitivity analysis

– Foreign currency risk

Customers’ accounts (807,274) (74,602) (138,310) (154,432) – (7,648) (1,182,266) The Bank considers a 200 basis points (bps) The Bank has no deposit accounts

movement to be appropriate for scenario testing

Other Liabilities – – – – – (9,433) (9,433) given the current economic outlook and industry denominated in € or $ and is not exposed

Total Equity (22,900) – – – – (161,946) (184,846) expectations. to any foreign currency risk.

– Equity price risk

Total liabilities (830,174) (74,602) (138,310) (154,432) – (179,027) (1,376,545) The Bank estimates that a +/-200bps movement in

interest rates paid/received would have impacted The Bank does not undertake any equity

Off Balance the overall balance sheet values as follows: investments and therefore is not exposed

sheet derivatives (9,000) – – – – – (9,000) to equity market risk.

+200bps: -£1.8m (2021: -£2.3m)

Interest Rate

Sensitivity Gap 410,734 (67,860) (105,414) (56,011) 6,349 (187,798) – -200 bps: £1.8m (2021: £2.4m)

Cumulative gap 410,734 342,874 237,460 181,449 187,798 – – This calculation assumes that the change occurred

at the balance sheet date and had been applied to

risk exposures existing at that date.