Page 93 - CCB_Annual Report_2022

P. 93

92 Notes to the Financial Statements 93

The expected credit loss (ECL) on loans in stage 3 losses. The calculation includes all fees paid or fees to be recognised in future periods as well as All services undertaken by the Bank’s external

are estimated on an individual basis and all relevant received between parties to the contract that are an being a key driver of the value of fees expected auditor are subject to approval by the Bank’s Audit

considerations that have a bearing on the expected integral part of the EIR, transaction costs and all other to be generated in future years from subsequent Committee. The Bank has a non-audit services

future cash flows across a range of scenarios are premiums or discounts. In accordance with IFRS 9, early redemptions. policy, which states that non-audit related services

taken into account. These considerations can be the application of EIR has been applied to the gross The following sensitivities have been calculated to provided by the Bank’s external auditors should

particularly subjective and can include the business carrying amount of non-credit impaired financial show the sensitivity of the EIR income to changes not exceed 70% of the average of the fees paid

prospects for the customer, the realisable value of assets and to the amortised cost of credit impaired in these items: in the previous three consecutive financial years.

collateral, the reliability of customer information financial assets. Early Repayment Charges (ERC) In 2022 the Board approved the appointment of

and the likely cost and duration of the work-out are reported within the EIR expected cashflows and – If the value of Real Estate Loans that repay in the PricewaterhouseCoopers LLP to replace KPMG LLP

process. The level of the impairment allowance is reported within net interest income. next 12 months is 1% lower than forecast for each as the Bank’s auditor for the financial year starting

the difference between the value of the discounted Interest income and expense presented in the tranche of lending, the EIR income recognised in 1 January 2022. The Bank has complied with the

expected future cash flows (discounted at the loan’s Statement of Profit or Loss and Other Comprehensive the Bank’s profit or loss would be £0.3m lower non-audit services policy in 2022 (using either the

original effective interest rate), and the carrying Income includes (2021: £0.5m); 2022 fees paid to PricewaterhouseCoopers LLP or

amount. Furthermore, estimates change with time – If the Bank’s new lending in 2022 had been 25% the average of fees paid to both audit firms over

as new information becomes available or as work- – Interest on financial assets and liabilities measured lower, the effective interest rate (EIR) balance the past 3 years). Other Services undertaken by the

out strategies evolve, resulting in frequent revisions at amortised cost calculated on an EIR basis; current auditor relates to profit verification activities.

sheet liability would have been £0.4m lower

to the impairment allowance as individual decisions – Interest on fair value through other comprehensive (2021: £0.4m).

are taken. Changes in these estimates would result income investment securities 9 Administrative expenses

in a change in the allowances and have a direct 7 Other income

impact on the impairment charge. – Income from finance leases and instalment

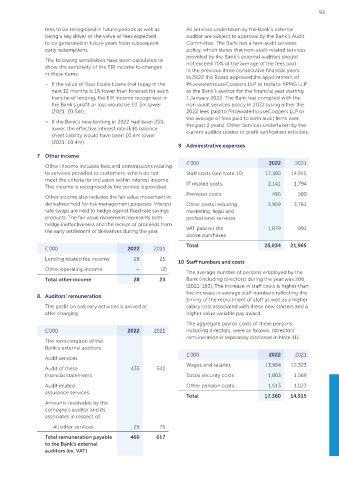

credit agreements. Other income includes fees and commissions relating £’000 2022 2021

The Bank assesses and discusses all individual

to services provided to customers, which do not Staff costs (see Note 10) 17,360 14,915

customer loans in arrears at the monthly Provisions

meet the criteria for inclusion within interest income.

Committee meeting chaired by the CFO. All cases £’000 2022 2021 The income is recognised as the service is provided. IT related costs 2,141 1,794

that are in arrears at month-end or are on the Interest income Premises costs 495 500

watch list are reviewed. The expected credit losses Other income also includes the fair value movement in

across all stages are adjusted for the impact of Loans and advances to banks 3,522 196 derivatives held for risk management purposes. Interest Other costs including 3,959 3,763

the forward-looking economic scenarios outlined rate swaps are held to hedge against fixed rate savings marketing, legal and

above. See Note 28 for the sensitivity analysis Loans and advances products. The fair value movement represents both professional services

regarding this. to customers 72,408 55,079 hedge ineffectiveness and the receipt of proceeds from

Investment securities 133 52 the early settlement of derivatives during the year. VAT paid on the 1,079 993

• Revenue recognition ‑ effective interest rate above purchases

Net income (expense) on (86) 8

The Bank has made a key estimate in relation to the other financial instruments £’000 2022 2021 Total 25,034 21,965

effective interest rate.

Total interest income 75,977 55,335 Lending related fee income 28 25 10 Staff numbers and costs

The key estimate relates to the expected life of each

type of instrument and hence the expected cash Interest expense Other operating income – (2) The average number of persons employed by the

flows relating to it. A critical estimate in determining Deposits from customers (15,607) (10,285) Total other income 28 23 Bank (including directors) during the year was 206

the effective interest rate is the expected life to (2021: 183). The increase in staff costs is higher than

maturity of the Bank’s commercial loans, as a Other (1,146) (123) 8. Auditors’ remuneration the increase in average staff numbers reflecting the

change in the expected life will have an impact Total interest expense (16,753) (10,408) timing of the recruitment of staff as well as a higher

on the period over which the directly attributable The profit on ordinary activities is arrived at salary cost associated with these new starters and a

costs and fees are recognised. See Note 6 for the Net interest income 59,224 44,927 after charging: higher value variable pay award.

sensitivity analysis regarding this. Interest income for the year ended 31 December 2022

excludes £187k (2021: £267k) relating to interest on impaired The aggregate payroll costs of these persons,

financial assets. £’000 2022 2021 including directors, were as follows, (directors’

6 Interest income and expense remuneration is separately disclosed in Note 11):

The remuneration of the

In accordance with IFRS 9 interest income and Management uses its judgement to estimate the

expense are recognised in the Statement of Profit expected life of each type of instrument and hence Bank’s external auditors:

or Loss and Other Comprehensive Income for all the expected cash flows relating to it. A critical Audit services £’000 2022 2021

instruments measured at amortised cost using the estimate in determining the effective interest Wages and salaries 13,984 12,323

Effective Interest Rate method (EIR). Audit of these 435 542

rate is the expected life to maturity of the Bank’s financial statements Social security costs 1,863 1,569

The EIR is a method of calculating the amortised commercial loans, as a change in the expected life

cost of a financial asset or financial liability and of will have an impact on the period over which the Audit related Other pension costs 1,513 1,023

allocating the interest income or interest expense directly attributable costs and fees are recognised. assurance services Total 17,360 14,915

over the relevant period. The EIR is the rate that The Bank’s effective interest rate is sensitive to Amounts receivable by the

exactly discounts estimated future cash flows changes in customer redemptions and the value company’s auditor and its

through the expected life of the instrument, or of new lending drawn in the year. If customer associates in respect of:

where appropriate a shorter period, to the net redemptions increase this is likely to result in

carrying amount of the financial asset or the increased fee income being received in the form of All other services 25 75

financial liability. When calculating the EIR, the early repayment charges and the acceleration of the Total remuneration payable 460 617

Bank considers all contractual terms of the financial recognition of arrangement fee income. New lending to the Bank’s external

instrument but does not consider future credit auditors (ex. VAT)

values will impact the value of loan arrangement