Page 98 - CCB_Annual Report_2022

P. 98

98 Notes to the Financial Statements 99

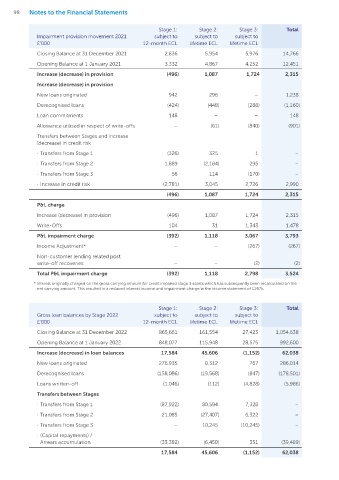

Stage 1: Stage 2: Stage 3: Total Stage 1: Stage 2: Stage 3: Total

Impairment provision movement 2021 subject to subject to subject to Gross loan balances by Stage 2021 subject to subject to subject to

£’000 12-month ECL lifetime ECL lifetime ECL £’000 12-month ECL lifetime ECL lifetime ECL

Closing Balance at 31 December 2021 2,836 5,954 5,976 14,766 Closing Balance at 31 December 2021 848,077 115,948 28,575 992,600

Opening Balance at 1 January 2021 3,332 4,867 4,252 12,451 Opening Balance at 1 January 2021 625,510 182,749 32,572 840,831

Increase (decrease) in provision (496) 1,087 1,724 2,315 Increase (decrease) in loan balances 222,567 (66,801) (3,997) 151,769

Increase (decrease) in provision Increase (decrease) in loan balances

New loans originated 942 296 – 1,238 New loans originated 299,081 8,002 – 307,083

Derecognised loans (424) (448) (288) (1,160) Derecognised loans (71,769) (30,778) (3,799) (106,346)

Loan commitments 148 – – 148 Loans written-off (141) (753) (3,334) (4,228)

Allowance utilised in respect of write-offs – (61) (840) (901) Transfers between Stages

Transfers between Stages and increase · Transfers from Stage 1 (61,057) 60,286 771 –

(decrease) in credit risk

· Transfers from Stage 2 94,704 (101,385) 6,681 –

· Transfers from Stage 1 (326) 325 1 –

· Transfers from Stage 3 772 494 (1,266) –

· Transfers from Stage 2 1,889 (2,184) 295 –

· (Capital repayments) /

· Transfers from Stage 3 56 114 (170) – Arrears accumulation (39,023) (2,667) (3,050) (44,740)

· Increase in credit risk (2,781) 3,045 2,726 2,990 222,567 (66,801) (3,997) 151,769

(496) 1,087 1,724 2,315

P&L charge Gross loan balance Expected Credit Loss (ECL) Net balance

Increase (decrease) in provision (496) 1,087 1,724 2,315 £’000 Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 Total

Write-Offs 104 31 1,343 1,478 Real Estate

P&L impairment charge (392) 1,118 3,067 3,793 Finance 758,879 113,270 28,334 2,277 5,793 5,766 756,602 107,477 22,568 886,647

Asset

Income Adjustment* – – (267) (267)

Finance 89,198 2,678 241 559 161 210 88,639 2,517 31 91,187

Non-customer lending related post

write-off recoveries – – (2) (2) At 31

December

Total P&L impairment charge (392) 1,118 2,798 3,524 2021 848,077 115,948 28,575 2,836 5,954 5,976 845,241 109,994 22,599 977,834

* Interest originally charged on the gross carrying amount for credit impaired stage 3 assets which has subsequently been recalculated on the Real Estate

net carrying amount. This resulted in a reduced interest income and impairment charge in the income statement of £267k.

Finance 761,269 156,789 23,832 1,964 8,013 4,753 759,305 148,776 19,079 927,160

Asset

Stage 1: Stage 2: Stage 3: Total Finance 104,392 4,765 3,591 1,118 270 810 103,274 4,495 2,781 110,550

Gross loan balances by Stage 2022 subject to subject to subject to At 31

£’000 12-month ECL lifetime ECL lifetime ECL

December

Closing Balance at 31 December 2022 865,661 161,554 27,423 1,054,638 2022 865,661 161,554 27,423 3,082 8,283 5,563 862,579 153,271 21,860 1,037,710

Opening Balance at 1 January 2022 848,077 115,948 28,575 992,600

Increase (decrease) in loan balances 17,584 45,606 (1,152) 62,038 2022 2021

New loans originated 276,935 8,312 767 286,014 £’000 Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Derecognised loans (158,086) (19,568) (847) (178,501) Loan loss coverage ratio % 0.4% 5.1% 20.3% 1.6% 0.3% 5.1% 20.9% 1.5%

Loans written-off (1,046) (112) (4,828) (5,986)

Transfers between Stages

· Transfers from Stage 1 (87,922) 80,594 7,328 –

· Transfers from Stage 2 21,085 (27,407) 6,322 –

· Transfers from Stage 3 – 10,245 (10,245) –

· (Capital repayments) /

Arrears accumulation (33,382) (6,458) 351 (39,489)

17,584 45,606 (1,152) 62,038