Page 97 - CCB_Annual Report_2022

P. 97

96 Notes to the Financial Statements 97

15 Loans and Advances to customers Gross loans and advances to customers includes 16 Allowance for impairment losses

Hire Purchase and Finance Lease agreements.

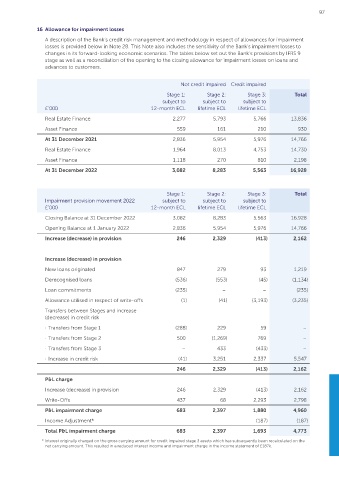

Loans and advances to customers are initially The table below shows the timing of the expected A description of the Bank’s credit risk management and methodology in respect of allowances for impairment

measured at fair value plus incremental direct cashflows on these agreements. losses is provided below in Note 28. This Note also includes the sensitivity of the Bank’s impairment losses to

transaction costs, and subsequently at their changes in its forward-looking economic scenarios. The tables below set out the Bank’s provisions by IFRS 9

amortised cost, using the effective interest method. stage as well as a reconciliation of the opening to the closing allowance for impairment losses on loans and

£’000 2022 2021 advances to customers.

The Bank has measured its loans and advances

to customers at amortised cost on the basis that Gross investment in finance

the Bank holds these assets for the objective of lease receivables*: Not credit impaired Credit impaired

collecting contractual cash flows, and the cash Less than one year 33,866 29,317 Stage 1: Stage 2: Stage 3: Total

flows associated with the assets include only subject to subject to subject to

payments of principal and interest (SPPI). For the 1 – 2 years 29,808 23,903 £’000 12-month ECL lifetime ECL lifetime ECL

purposes of this assessment, ‘principal’ is defined 2 – 3 years 25,829 17,906

as the fair value of the financial asset on initial Real Estate Finance 2,277 5,793 5,766 13,836

recognition. ‘Interest’ is defined as consideration 3 – 4 years 22,396 13,123 Asset Finance 559 161 210 930

for the time value of money for the credit risk

4 – 5 years 9,517 9,739

associated with the principal amount outstanding At 31 December 2021 2,836 5,954 5,976 14,766

during a particular period and for other basic More than five years 6,115 10,756 Real Estate Finance 1,964 8,013 4,753 14,730

lending risks and costs, as well as a profit margin.

Total 127,531 104,744

In making this assessment the Bank has considered Asset Finance 1,118 270 810 2,198

whether the financial asset contains a contractual Unearned future finance At 31 December 2022 3,082 8,283 5,563 16,928

term that could change the timing or amount income on finance charges (16,488) (13,900)

of contractual cashflows such that it would not Net investment in

meet this condition. All the Bank’s loans contain finance leases 111,043 90,844 Stage 1: Stage 2: Stage 3: Total

prepayment features. A prepayment feature is Impairment provision movement 2022 subject to subject to subject to

consistent with the SPPI criteria if the prepayment The net investment in £’000 12-month ECL lifetime ECL lifetime ECL

amount substantially represents unpaid amounts finance leases may be

of principal and interest on the principal amount analysed as follows: Closing Balance at 31 December 2022 3,082 8,283 5,563 16,928

outstanding, which may include reasonable Less than one year 27,752 24,500

compensation for early termination of the contract. Opening Balance at 1 January 2022 2,836 5,954 5,976 14,766

1 – 5 years 77,604 56,635

Gross loans and advances is net of an EIR liability of Increase (decrease) in provision 246 2,329 (413) 2,162

£4.1m (2021: £4.1m). More than five years 5,687 9,709

111,043 90,844

Increase (decrease) in provision

£’000 2022 2021 * Excludes effective interest rate

New loans originated 847 279 93 1,219

Gross loans

and advances 1,054,638 992,600 Derecognised loans (536) (553) (45) (1,134)

Loan commitments (235) – – (235)

Less: allowance for

impairment losses Allowance utilised in respect of write-offs (1) (41) (3,193) (3,235)

(see note 16) (16,928) (14,766)

Transfers between Stages and increase

Net loan receivables 1,037,710 977,834 (decrease) in credit risk

· Transfers from Stage 1 (288) 229 59 –

· Transfers from Stage 2 500 (1,269) 769 –

· Transfers from Stage 3 – 433 (433) –

· Increase in credit risk (41) 3,251 2,337 5,547

246 2,329 (413) 2,162

P&L charge

Increase (decrease) in provision 246 2,329 (413) 2,162

Write-Offs 437 68 2,293 2,798

P&L impairment charge 683 2,397 1,880 4,960

Income Adjustment* (187) (187)

Total P&L impairment charge 683 2,397 1,693 4,773

* Interest originally charged on the gross carrying amount for credit impaired stage 3 assets which has subsequently been recalculated on the

net carrying amount. This resulted in a reduced interest income and impairment charge in the income statement of £187k.