Page 116 - CCB_Full-Annual-Report-2021

P. 116

116 Notes to the Financial Statements 117

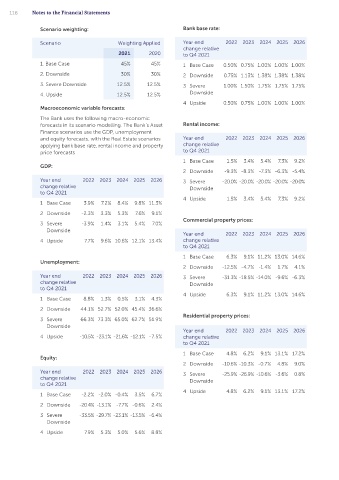

Scenario weighting: Bank base rate: Sensitivities The expected credit loss (ECL) on loans in stage

3 are estimated on an individual basis and all

Scenario Weighting Applied Year end 2022 2023 2024 2025 2026 The expected credit loss provision is sensitive relevant considerations that have a bearing on Contents

change relative to judgement and estimations made with the expected future cash flows across a range of

2021 2020 to Q4 2021 regard to the selection and weighting of economic scenarios are taken into account. These

Contents

multiple macroeconomic scenarios. As a result,

1. Base Case 45% 45% 1 Base Case 0.50% 0.75% 1.00% 1.00% 1.00% management has assessed and considered the considerations can be particularly subjective and

2. Downside 30% 30% 2 Downside 0.75% 1.13% 1.38% 1.38% 1.38% sensitivity of the provision as follows: can include the business prospects for the customer,

the realisable value of collateral, the reliability of

3. Severe Downside 12.5% 12.5% 3 Severe 1.00% 1.50% 1.75% 1.75% 1.75% 1. The tables below show the Real Estate and customer information and the likely cost and duration Strategic Report

4. Upside 12.5% 12.5% Downside Asset Finance ECL assuming each scenario has of the work-out process. The level of the impairment

allowance is the difference between the value of the

4 Upside 0.50% 0.75% 1.00% 1.00% 1.00% been 100% weighted to show the impact of discounted expected future cash flows (discounted

Macroeconomic variable forecasts: alternative scenarios.

at the loan’s original effective interest rate), and its

The Bank uses the following macro-economic • Real Estate carrying amount. Furthermore, judgements change

forecasts in its scenario modelling. The Bank’s Asset Rental income: with time as new information becomes available or

Finance scenarios use the GDP, unemployment Scenario Current 100% as work-out strategies evolve, resulting in frequent

and equity forecasts, with the Real Estate scenarios Year end 2022 2023 2024 2025 2026 weighted weighting revisions to the impairment allowance as individual

applying bank base rate, rental income and property change relative Scenario ECL £’000 decisions are taken. Changes in these estimates

price forecasts to Q4 2021 ECL £’000 would result in a change in the allowances and have a

1 Base Case 1.5% 3.4% 5.4% 7.3% 9.2% 1. Base Case 11,609 direct impact on the impairment charge

GDP: Corporate Governance Statement

2 Downside -9.3% -8.3% -7.3% -6.3% -5.4% 2. Downside 15,029 • Credit risk

Year end 2022 2023 2024 2025 2026 3 Severe -20.0% -20.0% -20.0% -20.0% -20.0% 13,836 – loans and advances to banks and debt securities

change relative Downside 3. Severe Downside 21,839

to Q4 2021 4. Upside 10,990 Credit risk exists in respect of Loans and Advances

4 Upside 1.5% 3.4% 5.4% 7.3% 9.2% to Banks and Debt securities where the Bank has

1 Base Case 3.9% 7.2% 8.4% 9.8% 11.3%

• Asset Finance acquired securities or placed cash deposits with

2 Downside -2.3% 3.3% 5.3% 7.6% 9.1% other financial institutions. No assets are held for

Commercial property prices: speculative purposes or actively traded. Certain liquid

3 Severe -3.9% 1.4% 3.1% 5.4% 7.0% Scenario Current 100%

Downside weighted weighting assets are held as part of the Bank’s liquidity buffer.

Year end 2022 2023 2024 2025 2026

4 Upside 7.7% 9.6% 10.6% 12.1% 13.4% change relative Scenario ECL £’000 The Bank holds balances in its Bank of England

to Q4 2021 ECL £’000 reserve account, along with a nostro accounts held

1 Base Case 6.3% 9.1% 11.2% 13.0% 14.6% 1. Base Case 820 with National Westminster Bank. The counterparties Independent Auditor’s Report

Unemployment: to which the Bank is exposed are domestically

2 Downside -12.5% -4.7% -1.4% 1.7% 4.1% 2. Downside 1,067 and globally systemic banks, and as such the Bank

930

Year end 2022 2023 2024 2025 2026 3 Severe -31.3% -18.5% -14.0% -9.6% -6.3% 3. Severe Downside 1,148 considers that the risk of default across these

change relative Downside balances is extremely low.

to Q4 2021 4. Upside 781

4 Upside 6.3% 9.1% 11.2% 13.0% 14.6% The Bank’s debt securities are currently issued by

1 Base Case 8.8% 1.3% 0.5% 3.1% 4.3%

2. The table below shows the impact of the European Investment Bank (£17m) and the

2 Downside 44.1% 52.7% 52.0% 45.4% 36.6% changes to the impairment assumptions in International Bank Reconstruction & Development

Residential property prices: the IFRS 9 models. (£20m). The Bank considers that the loans and

3 Severe 66.3% 73.3% 65.0% 62.7% 51.9%

Downside advances to Banks and the debt securities are of low

Year end 2022 2023 2024 2025 2026 credit risk and as such provide for a 12-month ECL,

4 Upside -10.5% -23.1% -21.6% -12.1% -7.5% change relative Scenario Provision consistent with the assets being classified in stage 1. Financial Statements

to Q4 2021 impact

1 Base Case 4.8% 6.2% 9.1% 13.1% 17.2% £’000 The Bank monitors its exposures to all counterparties

Equity: on an ongoing basis and whether there have been

2 Downside -10.6% -10.3% -0.7% 4.8% 9.0% Residential house price increases (107) any changes in the credit rating which may cause

by 20% more than the base case.

Year end 2022 2023 2024 2025 2026 3 Severe -25.9% -26.9% -10.6% -3.6% 0.8% an increase in the probability of said counterparty

change relative Downside Commercial property prices increase default. As at 31 December 2021 the Bank held no

to Q4 2021 by 20% more than the base case provisions against loans and advances to banks given

4 Upside 4.8% 6.2% 9.1% 13.1% 17.2% A reduction from 40% to 35% in the (1,503) the low credit risk of these financial instruments,

1 Base Case -2.2% -2.0% -0.4% 3.5% 6.7%

Bank’s forced sale discount their high propensity to meet contractual cash flow

2 Downside -20.4% -13.1% -7.7% -0.6% 2.4% obligations as they fall due, and the instant access

A reduction of from 35% to 30% in 559

3 Severe -33.5% -29.7% -23.1% -13.5% -6.4% the assumed Cure rate terms of these balances. Notes to the Financial Statements

Downside

A 12 months reduction in the assumed (946) The table below sets out the credit quality of the

4 Upside 7.9% 5.3% 5.0% 5.6% 8.8% time to sell defaulted properties Bank’s on-balance sheet loans and advances to

Bank’s, debt securities and derivative assets. Full

A 10% increase in the Bank’s Asset 35 details on the Bank’s derivative instruments can be

Finance LGD

found in Note 21.