Page 116 - 86395_CCB - 2024 Annual Report (web)

P. 116

116

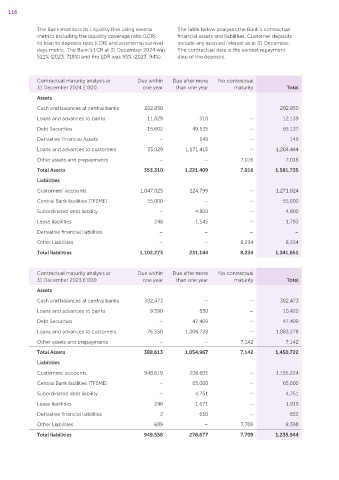

The Bank monitors its Liquidity Risk using several The table below analyses the Bank’s contractual

metrics including the liquidity coverage ratio (LCR), financial assets and liabilities. Customer deposits

its loan to deposits ratio (LDR) and an internal survival include any accrued interest as at 31 December.

days metric. The Bank’s LCR at 31 December 2024 was The contractual date is the earliest repayment

521% (2023: 718%) and the LDR was 95% (2023: 94%). date of the deposits.

Contractual maturity analysis at Due within Due after more No contractual

31 December 2024 £’000 one year than one year maturity Total

Assets

Cash and balances at central banks 292,850 292,850

Loans and advances to banks 11,829 310 – 12,139

Debt Securities 15,602 49,535 – 65,137

Derivative Financial Assets – 149 – 149

Loans and advances to customers 33,029 1,171,415 – 1,204,444

Other assets and prepayments – – 7,016 7,016

Total Assets 353,310 1,221,409 7,016 1,581,735

Liabilities

Customers’ accounts 1,047,025 224,799 – 1,271,824

Central Bank facilities (TFSME) 55,000 – – 55,000

Subordinated debt liability – 4,800 – 4,800

Lease liabilities 248 1,545 – 1,793

Derivative financial liabilities – – – –

Other Liabilities – – 8,234 8,234

Total liabilities 1,102,273 231,144 8,234 1,341,651

Contractual maturity analysis at Due within Due after more No contractual

31 December 2023 £’000 one year than one year maturity Total

Assets

Cash and balances at central banks 302,473 – – 302,473

Loans and advances to banks 9,590 830 – 10,420

Debt Securities – 47,409 – 47,409

Loans and advances to customers 76,550 1,006,728 – 1,083,278

Other assets and prepayments – – 7,142 7,142

Total Assets 388,613 1,054,967 7,142 1,450,722

Liabilities

Customers’ accounts 948,619 206,605 – 1,155,224

Central Bank facilities (TFSME) – 65,000 – 65,000

Subordinated debt liability – 4,751 – 4,751

Lease liabilities 248 1,671 – 1,919

Derivative financial liabilities 2 650 – 652

Other Liabilities 689 – 7,709 8,398

Total liabilities 949,558 278,677 7,709 1,235,944