Page 24 - 86395_CCB - 2024 Annual Report (web)

P. 24

24

Sources of funding Expenditure

The Bank’s lending continues to be Total operating expenses (including

primarily funded by the acquisition of depreciation) increased from £28.2m in

UK savings balances through a range 2023 to £32.8m in 2024.

of deposit products available direct to A key driver of the increase in costs was

business customers and available to the increase in the Bank’s employees. The

retail customers through a network average number of people employed during

of Deposit Intermediaries. Business the year increased from 225 in 2023 to 243

customers include organisations in 2024 increasing payroll costs by £2.3m.

such as charities, clubs, societies, and The Bank also continued to invest in

associations. developing its IT systems and processes to

The Bank’s customer deposit deliver both an efficient service proposition

balances totalled £1.3bn (2023: £1.2bn) to both new and existing customers.

at the end of 2024. These balances are The increase in operating costs is higher

held across a mix of fixed term bonds than the growth in income resulting in the

and a range of notice accounts, with only Bank’s cost : income ratio increasing from

a very small proportion of balances held 37% in 2023 to 45% in 2024.

in easy (next day) access accounts.

The Bank continued to grow the Impairment

proportion of balances acquired through

its direct channels in 2024 reducing its

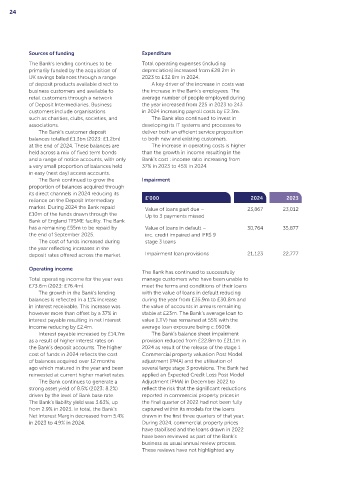

reliance on the Deposit Intermediary £’000 2024 2023

market. During 2024 the Bank repaid Value of loans past due – 23,867 23,012

£10m of the funds drawn through the Up to 3 payments missed

Bank of England TFSME facility. The Bank

has a remaining £55m to be repaid by Value of loans in default – 30,764 35,877

the end of September 2025. inc. credit impaired and IFRS 9

The cost of funds increased during stage 3 loans

the year reflecting increases in the

deposit rates offered across the market. Impairment loan provisions 21,123 22,777

Operating income

The Bank has continued to successfully

Total operating income for the year was manage customers who have been unable to

£73.6m (2023: £76.4m). meet the terms and conditions of their loans

The growth in the Bank’s lending with the value of loans in default reducing

balances is reflected in a 11% increase during the year from £35.9m to £30.8m and

in interest receivable. This increase was the value of accounts in arrears remaining

however more than offset by a 37% in stable at £23m. The Bank’s average loan to

interest payable resulting in net Interest value (LTV) has remained at 55% with the

income reducing by £2.4m. average loan exposure being c.£600k.

Interest payable increased by £14.7m The Bank’s balance sheet impairment

as a result of higher interest rates on provision reduced from £22.8m to £21.1m in

the Bank’s deposit accounts. The higher 2024 as result of the release of the stage 1

cost of funds in 2024 reflects the cost Commercial property valuation Post Model

of balances acquired over 12 months adjustment (PMA) and the utilisation of

ago which matured in the year and been several large stage 3 provisions. The Bank had

reinvested at current higher market rates. applied an Expected Credit Loss Post Model

The Bank continues to generate a Adjustment (PMA) in December 2022 to

strong asset yield of 8.5% (2023: 8.2%) reflect the risk that the significant reductions

driven by the level of Bank base rate. reported in commercial property prices in

The Bank’s liability yield was 3.63%, up the final quarter of 2022 had not been fully

from 2.9% in 2023. In total, the Bank’s captured within its models for the loans

Net Interest Margin decreased from 5.4% drawn in the first three quarters of that year.

in 2023 to 4.9% in 2024. During 2024, commercial property prices

have stabilised and the loans drawn in 2022

have been reviewed as part of the Bank’s

business as usual annual review process.

These reviews have not highlighted any