Page 23 - 86395_CCB - 2024 Annual Report (web)

P. 23

23

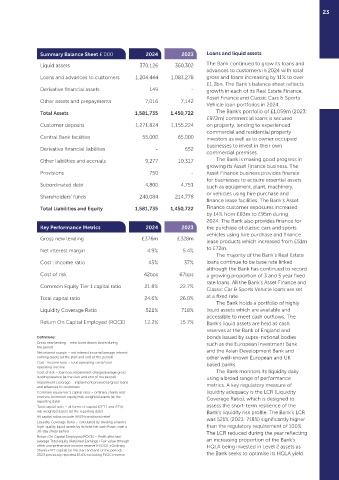

Summary Balance Sheet £’000 2024 2023 Loans and liquid assets

Liquid assets 370,126 360,302 The Bank continued to grow its loans and

advances to customers in 2024 with total

Loans and advances to customers 1,204,444 1,083,278 gross and loans increasing by 11% to over

£1.2bn. The Bank’s balance sheet reflects

Derivative financial assets 149 ‑ growth in each of its Real Estate Finance,

Asset Finance and Classic Cars & Sports

Other assets and prepayments 7,016 7,142

Vehicle loan portfolios in 2024.

Total Assets 1,581,735 1,450,722 The Bank’s portfolio of £1,059m (2023:

£972m) commercial loans is secured

Customer deposits 1,271,824 1,155,224 on property, lending to experienced

commercial and residential property

Central Bank facilities 55,000 65,000 investors as well as to owner occupied

businesses to invest in their own

Derivative financial liabilities ‑ 652

commercial premises.

Other liabilities and accruals 9,277 10,317 The Bank is making good progress in

growing its Asset Finance business. The

Provisions 750 ‑ Asset Finance business provides finance

for businesses to acquire essential assets

Subordinated debt 4,800 4,751 such as equipment, plant, machinery,

or vehicles using hire purchase and

Shareholders’ funds 240,084 214,778

finance lease facilities. The Bank’s Asset

Total Liabilities and Equity 1,581,735 1,450,722 Finance customer exposures increased

by 14% from £83m to £95m during

2024. The Bank also provides finance for

Key Performance Metrics 2024 2023 the purchase of classic cars and sports

vehicles using hire purchase and finance

Gross new lending £376m £328m lease products which increased from £51m

Net interest margin 4.9% 5.4% to £72m.

The majority of the Bank’s Real Estate

Cost : income ratio 45% 37% loans continue to be base rate linked

although the Bank has continued to record

Cost of risk 42bps 67bps a growing proportion of 3 and 5 year fixed

rate loans. All the Bank’s Asset Finance and

Common Equity Tier 1 capital ratio 21.8% 22.7%

Classic Car & Sports Vehicle loans are set

Total capital ratio 24.6% 26.0% at a fixed rate.

The Bank holds a portfolio of highly

Liquidity Coverage Ratio 521% 718% liquid assets which are available and

accessible to meet cash outflows. The

Return On Capital Employed (ROCE) 12.2% 15.7% Bank’s liquid assets are held as cash

reserves at the Bank of England and

Definitions: bonds issued by supra‑national bodies

Gross new lending – new loans drawn down during such as the European Investment Bank

the period

Net interest margin – net interest income/average interest and the Asian Development Bank and

earning assets (at the start and end of the period) other well‑known European and UK

Cost : income ratio – total operating costs/total based banks.

operating income

Cost of risk – loan loss impairment charge/average gross The Bank monitors its liquidity daily

lending balance (at the start and end of the period) using a broad range of performance

Impairment coverage – impairment provisions/gross loans metrics. A key regulatory measure of

and advances to customers

Common equity tier 1 capital ratio – ordinary shares and liquidity adequacy is the LCR (Liquidity

reserves (common equity)/risk weighted assets (at the Coverage Ratio), which is designed to

reporting date)

Total capital ratio – all forms of capital (CET 1 and AT1)/ assess the short‑term resilience of the

risk weighted assets (at the reporting date) Bank’s liquidity risk profile. The Bank’s LCR

All capital ratios include IFRS9 transitional relief was 521% (2023: 718%) significantly higher

Liquidity Coverage Ratio – calculated by dividing a bank's

high‑quality liquid assets by its total net cash flows, over a than the regulatory requirement of 100%.

30‑day stress period. The LCR reduced during the year reflecting

Return On Capital Employed (ROCE) – Profit after tax/

average Total equity (Retained Earnings+ Fair value through an increasing proportion of the Bank’s

other comprehensive income reserve (FVOCI) +Ordinary HQLA being invested in Level 2 assets as

Shares+AT1 capital) (at the start and end of the period).

2023 previously reported 15.6% excluding FVOCI reserve. the Bank seeks to optimise its HQLA yield.