Page 22 - 86395_CCB - 2024 Annual Report (web)

P. 22

22

Financial Performance to 243 during the year. The reduction in

income as a result of a reducing bank

base rate environment as well as the

Macroeconomics increased headcount and a provision

cost of £750k resulted in the cost income

The UK’s economic environment remained ratio increasing from 37% to 45% in 2024.

uncertain in 2024 with the Bank of England

base rate reducing to 4.75% as inflation The Board are pleased with the Bank’s

eased from 4% towards the Bank of performance delivering Profit after tax

England’s 2% target. The outlook for 2025 of £27.7m (2023: £31.3m) and ROCE of

is dependent on the success of the UK 12.2% (2023: 15.7%).

Government’s economic growth initiatives. The Bank continues to maintain strong

The Bank is supportive of the Government’s liquidity and capital positions. At the end

growth agenda and remains committed to of December 2024, the Bank held liquid

supporting and growing its own presence in assets of over £370m with an LCR of

the UK SME market.

521%, significantly above the regulatory

requirement of 100%. The Bank’s total

Prudential framework

capital ratio was 24.6% at the end of

The prudential framework has remained December with a CET1 ratio of 21.8%.

unchanged during 2024, with the next The Board are committed to continuing

significant change being the implementation to support our customers and the

of the Basel 3.1 and Capital SDDT regimes SME market. The Bank is planning for

in 2027.

continued growth in balance sheet assets

as well as ongoing investment in its

Financial review

people, products and systems.

The Bank has delivered a strong financial The Bank’s performance is presented on

performance in 2024 despite the a statutory basis and structured consistently

economic environment.

with the key elements of the business model

Net Interest income totalled £73.5m, explained on page 13. The 2024 Financial

£2.4m lower than in 2023 due to Statements have been prepared under UK‑

an increase in the cost of deposit adopted international financial reporting

balances. Interest receivable increased standards (IFRS). The Bank’s primary Financial

by 11% in line with customer loans and Statements are reported on pages 80 to 83,

advances. This was more than offset with a summary of these shown below.

by a 36% increase in interest payable. There have been no changes in the Bank’s

Pricing in both the lending and deposit accounting policies in 2024.

markets remains competitive. The Bank

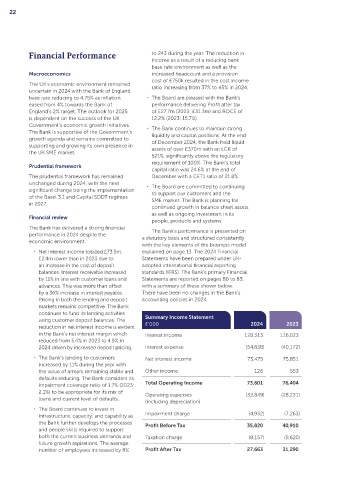

continues to fund its lending activities Summary Income Statement

using customer deposit balances. The

reduction in net interest income is evident £’000 2024 2023

in the Bank’s net interest margin which Interest income 128,313 116,023

reduced from 5.4% in 2023 to 4.9% in

2024 driven by increased deposit pricing. Interest expense (54,838) (40,172)

The Bank’s lending to customers Net interest income 73,475 75,851

increased by 11% during the year with

the value of arrears remaining stable and Other income 126 553

defaults reducing. The Bank considers its

impairment coverage ratio of 1.7% (2023: Total Operating Income 73,601 76,404

2.1%) to be appropriate for its mix of Operating expenses (32,849) (28,231)

loans and current level of defaults.

(including depreciation)

The Board continues to invest in

infrastructure, capacity, and capability as Impairment charge (4,932) (7,263)

the Bank further develops the processes Profit Before Tax 35,820 40,910

and people skills required to support

both the current business demands and Taxation charge (8,157) (9,620)

future growth aspirations. The average

number of employees increased by 8% Profit After Tax 27,663 31,290