Page 88 - 86395_CCB - 2024 Annual Report (web)

P. 88

88

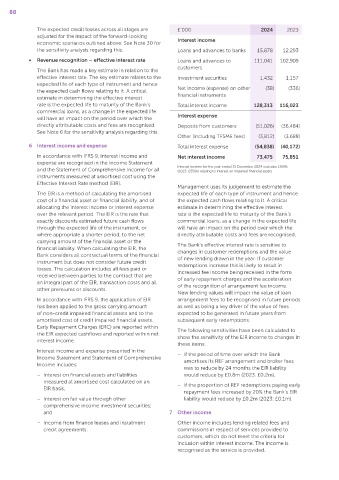

The expected credit losses across all stages are £’000 2024 2023

adjusted for the impact of the forward‑looking Interest income

economic scenarios outlined above. See Note 30 for

the sensitivity analysis regarding this. Loans and advances to banks 15,878 12,293

• Revenue recognition – effective interest rate Loans and advances to 111,041 102,909

customers

The Bank has made a key estimate in relation to the

effective interest rate. The key estimate relates to the Investment securities 1,432 1,157

expected life of each type of instrument and hence

the expected cash flows relating to it. A critical Net income (expense) on other (38) (336)

estimate in determining the effective interest financial instruments

rate is the expected life to maturity of the Bank’s Total interest income 128,313 116,023

commercial loans, as a change in the expected life

will have an impact on the period over which the Interest expense

directly attributable costs and fees are recognised. Deposits from customers (51,026) (36,484)

See Note 6 for the sensitivity analysis regarding this.

Other (including TFSME fees) (3,812) (3,688)

6 Interest income and expense Total interest expense (54,838) (40,172)

In accordance with IFRS 9, interest income and Net interest income 73,475 75,851

expense are recognised in the Income Statement

Interest income for the year ended 31 December 2024 excludes £909k

and the Statement of Comprehensive Income for all (2023: £550k) relating to interest on impaired financial assets

instruments measured at amortised cost using the

Effective Interest Rate method (EIR).

Management uses its judgement to estimate the

The EIR is a method of calculating the amortised expected life of each type of instrument and hence

cost of a financial asset or financial liability, and of the expected cash flows relating to it. A critical

allocating the interest income or interest expense estimate in determining the effective interest

over the relevant period. The EIR is the rate that rate is the expected life to maturity of the Bank’s

exactly discounts estimated future cash flows commercial loans, as a change in the expected life

through the expected life of the instrument, or will have an impact on the period over which the

where appropriate a shorter period, to the net directly attributable costs and fees are recognised.

carrying amount of the financial asset or the The Bank’s effective interest rate is sensitive to

financial liability. When calculating the EIR, the changes in customer redemptions and the value

Bank considers all contractual terms of the financial of new lending drawn in the year. If customer

instrument but does not consider future credit redemptions increase this is likely to result in

losses. The calculation includes all fees paid or increased fee income being received in the form

received between parties to the contract that are of early repayment charges and the acceleration

an integral part of the EIR, transaction costs and all of the recognition of arrangement fee income.

other premiums or discounts.

New lending values will impact the value of loan

In accordance with IFRS 9, the application of EIR arrangement fees to be recognised in future periods

has been applied to the gross carrying amount as well as being a key driver of the value of fees

of non‑credit impaired financial assets and to the expected to be generated in future years from

amortised cost of credit impaired financial assets. subsequent early redemptions.

Early Repayment Charges (ERC) are reported within The following sensitivities have been calculated to

the EIR expected cashflows and reported within net show the sensitivity of the EIR income to changes in

interest income.

these items:

Interest income and expense presented in the – If the period of time over which the Bank

Income Statement and Statement of Comprehensive amortises its REF arrangement and broker fees

Income includes:

was to reduce by 24 months the EIR liability

– Interest on financial assets and liabilities would reduce by £0.8m (2023: £0.2m);

measured at amortised cost calculated on an – If the proportion of REF redemptions paying early

EIR basis;

repayment fees increased by 20% the Bank’s EIR

– Interest on fair value through other liability would reduce by £0.2m (2023: £0.1m).

comprehensive income investment securities;

and 7 Other income

– Income from finance leases and instalment Other income includes lending related fees and

credit agreements. commissions in respect of services provided to

customers, which do not meet the criteria for

inclusion within interest income. The income is

recognised as the service is provided.