Page 92 - 86395_CCB - 2024 Annual Report (web)

P. 92

92

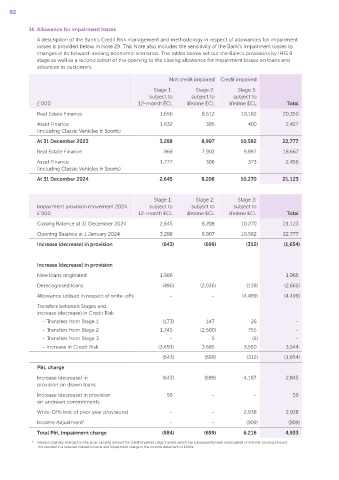

16 Allowance for impairment losses

A description of the Bank’s Credit Risk management and methodology in respect of allowances for impairment

losses is provided below in Note 29. This Note also includes the sensitivity of the Bank’s impairment losses to

changes in its forward‑looking economic scenarios. The tables below set out the Bank’s provisions by IFRS 9

stage as well as a reconciliation of the opening to the closing allowance for impairment losses on loans and

advances to customers.

Not credit impaired Credit impaired

Stage 1: Stage 2: Stage 3:

subject to subject to subject to

£’000 12‑month ECL lifetime ECL lifetime ECL Total

Real Estate Finance 1,656 8,512 10,182 20,350

Asset Finance 1,632 395 400 2,427

(including Classic Vehicles & Sports)

At 31 December 2023 3,288 8,907 10,582 22,777

Real Estate Finance 868 7,902 9,897 18,667

Asset Finance 1,777 306 373 2,456

(including Classic Vehicles & Sports)

At 31 December 2024 2,645 8,208 10,270 21,123

Stage 1: Stage 2: Stage 3:

Impairment provision movement 2024 subject to subject to subject to

£’000 12‑month ECL lifetime ECL lifetime ECL Total

Closing Balance at 31 December 2024 2,645 8,208 10,270 21,123

Opening Balance at 1 January 2024 3,288 8,907 10,582 22,777

Increase (decrease) in provision (643) (699) (312) (1,654)

Increase (decrease) in provision

New loans originated 1,966 1,966

Derecognised loans (490) (2,036) (139) (2,665)

Allowance utilised in respect of write‑offs – – (4,499) (4,499)

Transfers between Stages and

increase (decrease) in Credit Risk

– Transfers from Stage 1 (173) 147 26 –

– Transfers from Stage 2 1,745 (2,500) 755 –

– Transfers from Stage 3 – 5 (5) –

– Increase in Credit Risk (3,691) 3,685 3,550 3,544

(643) (699) (312) (1,654)

P&L charge

Increase (decrease) in (643) (699) 4,187 2,845

provision on drawn loans

Increase (decrease) in provision 59 – – 59

on undrawn commitments

Write‑Offs (net of prior year provisions) – – 2,938 2,938

Income Adjustment * – – (909) (909)

Total P&L impairment charge (584) (699) 6,216 4,933

* Interest originally charged on the gross carrying amount for credit impaired stage 3 assets which has subsequently been recalculated on the net carrying amount.

This resulted in a reduced interest income and impairment charge in the income statement of £909k.