Page 89 - 86395_CCB - 2024 Annual Report (web)

P. 89

89

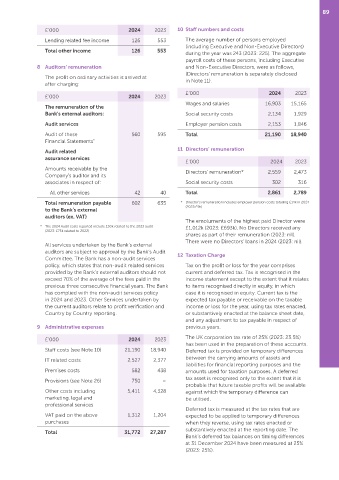

£’000 2024 2023 10 Staff numbers and costs

Lending related fee income 126 553 The average number of persons employed

(including Executive and Non‑Executive Directors)

Total other income 126 553

during the year was 243 (2023: 225). The aggregate

payroll costs of these persons, including Executive

8 Auditors’ remuneration and Non‑Executive Directors, were as follows,

(Directors’ remuneration is separately disclosed

The profit on ordinary activities is arrived at in Note 11).

after charging:

£’000 2024 2023

£’000 2024 2023

Wages and salaries 16,903 15,165

The remuneration of the

Bank’s external auditors: Social security costs 2,134 1,929

Audit services Employer pension costs 2,153 1,846

Audit of these 560 595 Total 21,190 18,940

Financial Statements *

11 Directors’ remuneration

Audit related

assurance services

£’000 2024 2023

Amounts receivable by the Directors’ remuneration* 2,559 2,473

Company's auditor and its

associates in respect of: Social security costs 302 316

All other services 42 40 Total 2,861 2,789

Total remuneration payable 602 635 * Director’s remuneration includes employer pension costs totalling £14k in 2024

to the Bank’s external (2023:£9k)

auditors (ex. VAT)

The emoluments of the highest paid Director were

* The 2024 Audit costs reported include £30k related to the 2023 audit £1,012k (2023: £693k). No Directors received any

(2023: £75k related to 2022)

shares as part of their remuneration (2023: nil).

There were no Directors’ loans in 2024 (2023: nil).

All services undertaken by the Bank’s external

auditors are subject to approval by the Bank’s Audit 12 Taxation Charge

Committee. The Bank has a non‑audit services

policy, which states that non‑audit related services Tax on the profit or loss for the year comprises

provided by the Bank’s external auditors should not current and deferred tax. Tax is recognised in the

exceed 70% of the average of the fees paid in the income statement except to the extent that it relates

previous three consecutive financial years. The Bank to items recognised directly in equity, in which

has complied with the non‑audit services policy case it is recognised in equity. Current tax is the

in 2024 and 2023. Other Services undertaken by expected tax payable or receivable on the taxable

the current auditors relate to profit verification and income or loss for the year, using tax rates enacted,

Country by Country reporting. or substantively enacted at the balance sheet date,

and any adjustment to tax payable in respect of

9 Administrative expenses previous years.

£’000 2024 2023 The UK corporation tax rate of 25% (2023: 23.5%)

has been used in the preparation of these accounts.

Staff costs (see Note 10) 21,190 18,940 Deferred tax is provided on temporary differences

between the carrying amounts of assets and

IT related costs 2,527 2,377

liabilities for financial reporting purposes and the

Premises costs 582 438 amounts used for taxation purposes. A deferred

tax asset is recognised only to the extent that it is

Provisions (see Note 26) 750 –

probable that future taxable profits will be available

Other costs including 5,411 4,328 against which the temporary difference can

marketing, legal and be utilised.

professional services

Deferred tax is measured at the tax rates that are

VAT paid on the above 1,312 1,204 expected to be applied to temporary differences

purchases when they reverse, using tax rates enacted or

substantively enacted at the reporting date. The

Total 31,772 27,287

Bank’s deferred tax balances on timing differences

at 31 December 2024 have been measured at 25%

(2023: 25%).