Page 91 - 86395_CCB - 2024 Annual Report (web)

P. 91

91

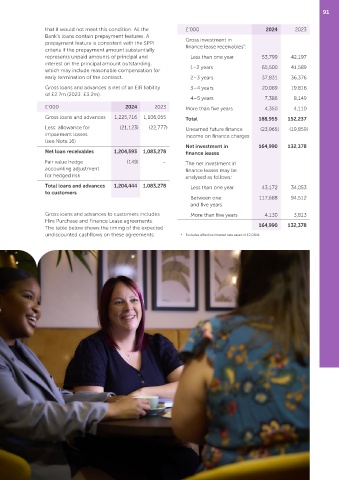

that it would not meet this condition. All the £’000 2024 2023

Bank’s loans contain prepayment features. A Gross investment in

prepayment feature is consistent with the SPPI finance lease receivables :

*

criteria if the prepayment amount substantially

represents unpaid amounts of principal and Less than one year 53,799 42,197

interest on the principal amount outstanding, 1 – 2 years 65,500 41,589

which may include reasonable compensation for

early termination of the contract. 2 –3 years 37,831 36,376

Gross loans and advances is net of an EIR liability 3 –4 years 20,089 19,816

of £2.7m (2023: £3.2m).

4 –5 years 7,386 8,149

£’000 2024 2023 More than five years 4,350 4,110

Gross loans and advances 1,225,716 1,106,055 Total 188,955 152,237

Less: allowance for (21,123) (22,777) Unearned future finance (23,965) (19,859)

impairment losses income on finance charges

(see Note 16)

Net investment in 164,990 132,378

Net loan receivables 1,204,593 1,083,278 finance leases

Fair value hedge (149) – The net investment in

accounting adjustment finance leases may be

for hedged risk analysed as follows:

Total loans and advances 1,204,444 1,083,278 Less than one year 43,172 34,053

to customers

Between one 117,688 94,512

and five years

Gross loans and advances to customers includes More than five years 4,130 3,813

Hire Purchase and Finance Lease agreements.

The table below shows the timing of the expected 164,990 132,378

undiscounted cashflows on these agreements. * Excludes effective interest rate asset of £2,084k