Page 94 - 86395_CCB - 2024 Annual Report (web)

P. 94

94

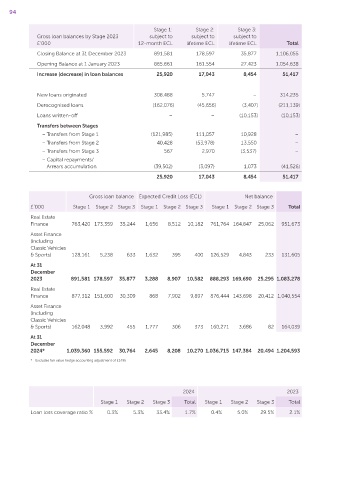

Stage 1: Stage 2: Stage 3:

Gross loan balances by Stage 2023 subject to subject to subject to

£’000 12‑month ECL lifetime ECL lifetime ECL Total

Closing Balance at 31 December 2023 891,581 178,597 35,877 1,106,055

Opening Balance at 1 January 2023 865,661 161,554 27,423 1,054,638

Increase (decrease) in loan balances 25,920 17,043 8,454 51,417

New loans originated 308,488 5,747 – 314,235

Derecognised loans (162,076) (45,656) (3,407) (211,139)

Loans written‑off – – (10,153) (10,153)

Transfers between Stages

– Transfers from Stage 1 (121,985) 111,057 10,928 –

– Transfers from Stage 2 40,428 (53,978) 13,550 –

– Transfers from Stage 3 567 2,970 (3,537) –

– Capital repayments/

Arrears accumulation (39,502) (3,097) 1,073 (41,526)

25,920 17,043 8,454 51,417

Gross loan balance Expected Credit Loss (ECL) Net balance

£’000 Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 Total

Real Estate

Finance 763,420 173,359 35,244 1,656 8,512 10,182 761,764 164,847 25,062 951,673

Asset Finance

(including

Classic Vehicles

& Sports) 128,161 5,238 633 1,632 395 400 126,529 4,843 233 131,605

At 31

December

2023 891,581 178,597 35,877 3,288 8,907 10,582 888,293 169,690 25,295 1,083,278

Real Estate

Finance 877,312 151,600 30,309 868 7,902 9,897 876,444 143,698 20,412 1,040,554

Asset Finance

(including

Classic Vehicles

& Sports) 162,048 3,992 455 1,777 306 373 160,271 3,686 82 164,039

At 31

December

2024* 1,039,360 155,592 30,764 2,645 8,208 10,270 1,036,715 147,384 20,494 1,204,593

* Excludes fair value hedge accounting adjustment of £149k

2024 2023

Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total

Loan loss coverage ratio % 0.3% 5.3% 33.4% 1.7% 0.4% 5.0% 29.5% 2.1%