Page 7 - CCB_Annual Report_2022

P. 7

6 Strategic Report 7

Cost to

Profit before tax income ratio

£ 28.5m 43.8 %

Strategic 2021: £18.5m 2021: 51.0%

Report Cost of risk

47

bps

2021: 38bps Impairment

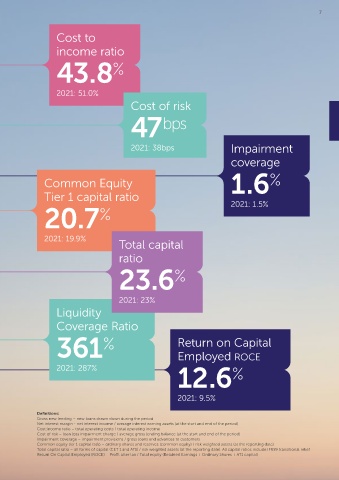

Summary of Key Performance Metrics coverage

Total Equity

£ 185m Common Equity 1.6 %

Tier 1 capital ratio

Gross lending 2021: £164m 20.7 % 2021: 1.5%

balances

£ 1,055m 2021: 19.9% Total capital

ratio

2021: £993m

Customer deposit 23.6 %

balances

£ 1,103m Liquidity 2021: 23%

2021: £1,026m Coverage Ratio

361 % Return on Capital

Gross new 2021: 287% Employed ROCE

%

Net interest lending 12.6

margin £ 310m 2021: 9.5%

4.5 % Definitions:

Gross new lending – new loans drawn down during the period

2021: £323m

Net interest margin - net interest income / average interest earning assets (at the start and end of the period)

Cost:income ratio – total operating costs / total operating income

2021: 3.8% Cost of risk – loan loss impairment charge / average gross lending balance (at the start and end of the period)

Impairment coverage – impairment provisions / gross loans and advances to customers

Common equity tier 1 capital ratio – ordinary shares and reserves (common equity) / risk weighted assets (at the reporting date)

Total capital ratio – all forms of capital (CET 1 and AT1) / risk weighted assets (at the reporting date). All capital ratios include IFRS9 transitional relief

Return On Capital Employed (ROCE) – Profit after tax / Total equity (Retained Earnings + Ordinary Shares + AT1 capital)