Page 24 - CCB_Full-Annual-Report-2021

P. 24

24 25

Strategic Report Contents

Contents

Loans and liquid assets

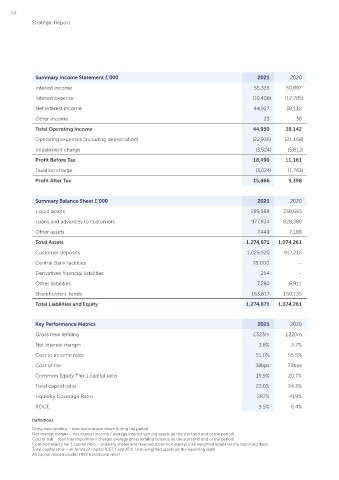

Summary Income Statement £’000 2021 2020

The Bank’s balance sheet reflects strong

Interest income 55,335 50,897 2021 Strategic Report

growth in each of its Real Estate Finance,

Interest expense (10,408) (12,785) Asset Finance and Classic Cars & Sports Impairment

vehicle loan portfolios in 2021. Gross

Net interest income 44,927 38,112 coverage ratio

Loan balances increased by £152m to

Other income 23 30 £993m (2020: £841m), an increase of 18% maintained at

as customers continued to invest in UK

Total Operating Income 44,950 38,142

property assets and finance their

Operating expenses (including depreciation) (22,936) (21,168) business aspirations. 1.5 %

Impairment charge (3,524) (5,813)

The Bank’s portfolio of £900m (2020:

Profit Before Tax 18,490 11,161 £771m) commercial loans is secured

on property, lending to experienced Corporate Governance Statement

Taxation charge (3,024) (1,763)

commercial and residential property

Profit After Tax 15,466 9,398 investors as well as to owner occupied

businesses to invest in their own

commercial premises.

Summary Balance Sheet £’000 2021 2020

The Bank ‘s Asset Finance business

Liquid assets 289,588 238,693

provides finance for businesses to acquire

Loans and advances to customers 977,834 828,380 essential assets such as equipment, plant,

machinery, or vehicles using hire purchase

Other assets 7,449 7,188 monitors liquidity daily to ensure it has

and finance lease facilities. The Bank’s sufficient funds available to meet maturing

Total Assets 1,274,871 1,074,261 customer exposures increased from liabilities and uses a range of metrics to

£42m to £54m during 2021. The Bank

Customer deposits 1,025,520 917,215 monitor this. The Bank’s liquidity position

also provides finance for the purchase of remains robust with a 287% liquidity Independent Auditor’s Report

Central Bank facilities 78,000 – classic cars and sports vehicles using hire coverage ratio (LCR) (2020: 419%). The LCR

purchase and finance lease products which

Derivatives financial liabilities 254 – reduced during the year as the Bank safely

increased from £27m to £36m in 2021.

reduced the deliberate liquidity headroom

Other liabilities 7,280 6,911 retained to mitigate Brexit, the pandemic,

All of the Bank’s Asset Finance and Classic

Shareholders’ funds 163,817 150,135 and recessionary risks at the end of 2020.

Car & Sports Vehicle loans are set at a fixed

Total Liabilities and Equity 1,274,871 1,074,261 rate with the majority of its Real Estate Sources of funding

loans linked to bank base rate.

The Bank’s lending is primarily funded by

Key Performance Metrics 2021 2020 The Bank’s liquidity portfolio comprises the acquisition of UK savings balances

high quality liquid assets, primarily through a range of deposit products

Gross new lending £323m £220m cash reserves at the Bank of England, available direct to business customers Financial Statements

Net interest margin 3.8% 3.7% International Bank Reconstruction and available to retail customers through

and Development Bank and European a network of Deposit Intermediaries.

Cost to income ratio 51.0% 55.5% Investment Bank bonds which are available Business customers include several broader

Cost of risk 38bps 72bps and accessible to meet potential cash organisations such as charities, clubs,

outflows. During the year the Bank repaid societies, and associations.

Common Equity Tier 1 capital ratio 19.9% 20.7% its £57m of Bank of England Funding

Total capital ratio 23.0% 24.3% for Lending Scheme (FLS) drawings and The Bank grew its deposit portfolio during

drew £78m of funding through the Term the year within the Board’s funding and

Liquidity Coverage Ratio 287% 419% Funding Scheme with additional incentives liquidity risk appetite from £917m to

ROCE 9.5% 6.4% for SMEs (TFSME). The Bank of England £1,026m, to support the lending activity.

TFSME drawings are due for repayment by

Definitions: September 2025. The cost of funds reduced during the year. Notes to the Financial Statements

In the unprecedented low interest rate

Gross new lending – new loans drawn down during the period

Net interest margin – net interest income / average interest earning assets (at the start and end of the period) A key regulatory measure of liquidity environment, the reduction was principally

Cost of risk – loan loss impairment charge/ average gross lending balance (at the start and end of the period) adequacy is the LCR, which is designed driven by maturing fixed rate bond deposits

Common equity tier 1 capital ratio – ordinary shares and reserves (common equity) /risk weighted assets (at the reporting date) to assess the short-term resilience of being replaced by lower priced new

Total capital ratio – all forms of capital (CET 1 and AT1) / risk weighted assets (at the reporting date)

All capital ratios include IFRS9 transitional relief the Bank’s liquidity risk profile. The Bank deposit inflows.