Page 29 - CCB_Full-Annual-Report-2021

P. 29

28 Strategic Report 29

Contents

Contents

original and 2020 new transitional relief Risk Management

2021 arrangements, this relief reduced in 2021

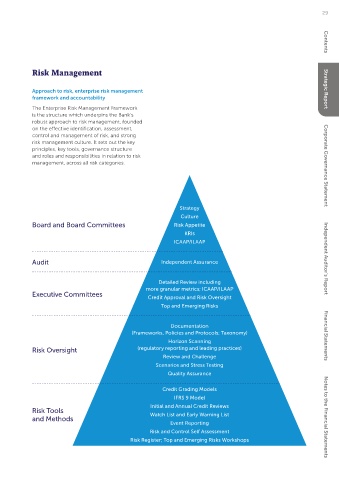

reflecting the scheduled reduction in Approach to risk, enterprise risk management Strategic Report

Common Equity the original transitional relief factor from framework and accountability

Tier 1 capital ratio 70% to 50%. The Enterprise Risk Management Framework

remains strong at The Bank continues to benefit from its is the structure which underpins the Bank’s

robust approach to risk management, founded

British Business Bank ‘Enable’ Guarantee

19.9 % facility. The guarantee provides the Bank on the effective identification, assessment,

control and management of risk, and strong

with a facility to support up to £50m

of commercial loans. The guarantee,

which for regulatory reporting purposes risk management culture. It sets out the key

principles, key tools, governance structure

is treated as a synthetic securitisation, and roles and responsibilities in relation to risk

2020

enables the Bank to risk weight the loans management, across all risk categories. Corporate Governance Statement

20.7 % within the guarantee at 0%. This benefit

is partially offset by the cost of the first

loss tranche which is reported as a

capital deduction of £1.7m.

The Bank’s capital ratios exceeded its

regulatory requirements throughout Strategy

the year. Culture

Board and Board Committees Risk Appetite

The Bank’s Common Equity Tier 1 KRIs

capital ratio (including the impact of ICAAP/ILAAP

the transitional arrangements) at the

31 December 2021 was 19.9%, (2020:

20.7%). The Bank’s total capital ratio Audit Independent Assurance Independent Auditor’s Report

(including the impact of the transitional

arrangements) at 31 December 2021

was 23.0% (2020: 24.3%). The Bank’s Detailed Review including

Common Equity Tier 1 capital ratio and more granular metrics; ICAAP/ILAAP

total capital excluding the transitional Executive Committees

arrangements were 19.2% and 22.4% at Credit Approval and Risk Oversight

31 December 2021 respectively. Top and Emerging Risks

Documentation

(Frameworks, Policies and Protocols; Taxonomy) Financial Statements

Horizon Scanning

Risk Oversight (regulatory reporting and leading practices)

Review and Challenge

Scenarios and Stress Testing

Quality Assurance

Credit Grading Models

IFRS 9 Model

Initial and Annual Credit Reviews

Risk Tools Watch List and Early Warning List

and Methods Notes to the Financial Statements

Event Reporting

Risk and Control Self Assessment

Risk Register; Top and Emerging Risks Workshops