Page 107 - 86395_CCB - 2024 Annual Report (web)

P. 107

107

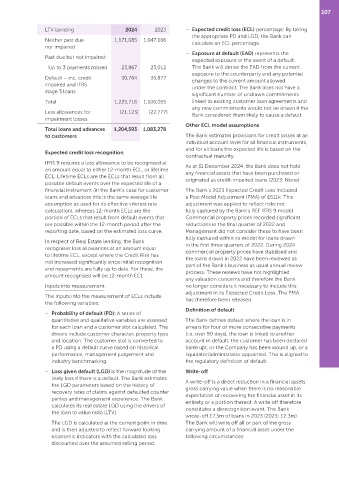

LTV banding 2024 2023 – Expected credit loss (ECL) percentage: By taking

the appropriate PD and LGD, the Bank can

Neither past due 1,171,085 1,047,166 calculate an ECL percentage.

nor impaired

– Exposure at default (EAD) represents the

Past due but not impaired:

expected exposure in the event of a default.

Up to 3 payments missed 23,867 23,012 The Bank will derive the EAD from the current

exposure to the counterparty and any potential

Default – inc. credit 30,764 35,877 changes to the current amount allowed

impaired and IFRS under the contract. The Bank does not have a

stage 3 loans

significant number of undrawn commitments

Total 1,225,716 1,106,055 linked to existing customer loan agreements and

any new commitments would not be drawn if the

Less allowances for (21,123) (22,777) Bank considered them likely to cause a default.

impairment losses

Other ECL model assumptions

Total loans and advances 1,204,593 1,083,278

to customers The Bank estimates provisions for credit losses at an

individual account level for all financial instruments,

and for all loans the expected life is based on the

Expected credit loss recognition

contractual maturity.

IFRS 9 requires a loss allowance to be recognised at As at 31 December 2024, the Bank does not hold

an amount equal to either 12‑month ECL, or lifetime any financial assets that have been purchased or

ECL. Lifetime ECLs are the ECLs that result from all originated as credit‑impaired loans (2023: None).

possible default events over the expected life of a

financial instrument (in the Bank’s case for customer The Bank’s 2023 Expected Credit Loss included

loans and advances this is the same average life a Post Model Adjustment (PMA) of £611k. This

assumption as used for its effective interest rate adjustment was applied to reflect risks not

calculation), whereas 12‑month ECLs are the fully captured by the Bank’s REF IFRS 9 model.

portion of ECLs that result from default events that Commercial property prices recorded significant

are possible within the 12‑month period after the reductions in the final quarter of 2022 and

reporting date, based on the estimated loss curve. Management did not consider these to have been

fully captured within its model for loans drawn

In respect of Real Estate lending, the Bank

in the first three quarters of 2022. During 2024

recognises loss allowances at an amount equal commercial property prices have stabilised and

to lifetime ECL, except where the Credit Risk has the loans drawn in 2022 have been reviewed as

not increased significantly since initial recognition part of the Bank’s business as usual annual review

and repayments are fully up to date. For these, the process. These reviews have not highlighted

amount recognised will be 12‑month ECL.

any valuation concerns and therefore the Bank

Inputs into measurement no longer considers it necessary to include this

adjustment in its Expected Credit Loss. The PMA

The inputs into the measurement of ECLs include has therefore been released.

the following variables:

Definition of default

– Probability of default (PD): A series of

quantitative and qualitative variables are assessed The Bank defines default where the loan is in

for each loan and a customer slot calculated. The arrears for four or more consecutive payments

drivers include customer character, property type (i.e. over 90 days), the loan is linked to another

and location. The customer slot is converted to account in default, the customer has been declared

a PD using a default curve based on historical bankrupt, or the Company has been wound up, or a

performance, management judgement and liquidator/administrator appointed. This is aligned to

industry benchmarking. the regulatory definition of default.

– Loss given default (LGD) is the magnitude of the Write-off

likely loss if there is a default. The Bank estimates A write‑off is a direct reduction in a financial assets

the LGD parameters based on the history of gross carrying value when there is no reasonable

recovery rates of claims against defaulted counter expectation of recovering the financial asset in its

parties and management experience. The Bank entirety or a portion thereof. A write off therefore

calculates its real estate LGD using the drivers of constitutes a derecognition event. The Bank

the loan to value ratio (LTV).

wrote‑off £7.3m of loans in 2023 (2023: £2.3m).

The LGD is calculated at the current point in time The Bank will write off all or part of the gross

and is then adjusted to reflect forward looking carrying amount of a financial asset under the

economic indicators with the calculated loss following circumstances:

discounted over the assumed selling period.