Page 109 - 86395_CCB - 2024 Annual Report (web)

P. 109

109

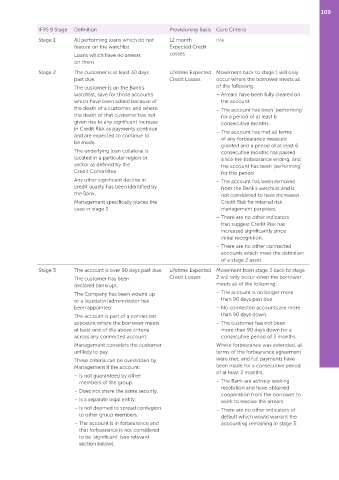

IFRS 9 Stage Definition Provisioning Basis Cure Criteria

Stage 1 All performing loans which do not 12 month n/a

feature on the watchlist Expected Credit

Loans which have no arrears Losses

on them.

Stage 2 The customer is at least 30 days Lifetime Expected Movement back to stage 1 will only

past due. Credit Losses occur where the borrower meets all

The customer is on the Bank’s of the following:

watchlist, save for those accounts – Arrears have been fully cleared on

which have been added because of the account.

the death of a customer, and where – The account has been ‘performing’

the death of that customer has not for a period of at least 6

given rise to any significant increase consecutive months.

in Credit Risk as payments continue – The account has met all terms

and are expected to continue to of any forbearance measure

be made.

granted and a period of at least 6

The underlying loan collateral is consecutive months has passed

located in a particular region or since the forbearance ending, and

sector as defined by the the account has been ‘performing’

Credit Committee. for this period.

Any other significant decline in – The account has been removed

credit quality has been identified by from the Bank’s watchlist and is

the Bank. not considered to have increased

Management specifically places the Credit Risk for internal risk

case in stage 2. management purposes.

– There are no other indicators

that suggest Credit Risk has

increased significantly since

initial recognition.

– There are no other connected

accounts which meet the definition

of a stage 2 asset.

Stage 3 The account is over 90 days past due. Lifetime Expected Movement from stage 3 back to stage

The customer has been Credit Losses 2 will only occur when the borrower

declared bankrupt. meets all of the following:

The Company has been wound up – The account is no longer more

or a liquidator/administrator has than 90 days past due.

been appointed. – No connected accounts are more

The account is part of a connected than 90 days down.

exposure where the borrower meets – The customer has not been

at least one of the above criteria more than 90 days down for a

across any connected account. consecutive period of 3 months.

Management considers the customer Where forbearance was extended, all

unlikely to pay. terms of the forbearance agreement

These criteria can be overridden by were met, and full payments have

Management if the account: been made for a consecutive period

of at least 3 months.

– Is not guaranteed by other

members of the group. – The Bank are actively seeking

resolution and have obtained

– Does not share the same security.

cooperation from the borrower to

– Is a separate legal entity. work to resolve the arrears.

– Is not deemed to spread contagion – There are no other indicators of

to other group members. default which would warrant the

– The account is in forbearance and accounting remaining in stage 3.

that forbearance is not considered

to be ‘significant’ (see relevant

section below).