Page 108 - 86395_CCB - 2024 Annual Report (web)

P. 108

108

– Where the underlying collateral of a loan

has been sold, with the proceeds having

been received by the Bank, and there is no

reasonable expectation of recovering the

remainder of the outstanding balance due;

– The write off has been approved in line with

the Bank’s policy; and

– The Bank have explored reasonable avenues

of recovering the outstanding loan amount.

The release of provisions and the write‑off

of any bad debt is subject to appropriate

delegated authorities.

Credit risk grades

The Bank allocates each exposure a credit risk

grade (slot) using its Credit Grading Model.

Each exposure has been allocated a credit risk

grade on initial recognition. Credit grades are

formally reviewed as a minimum on an annual

basis. The grades are reassessed earlier if the

customer falls into arrears or contacts the Bank

with information that impacts its credit quality.

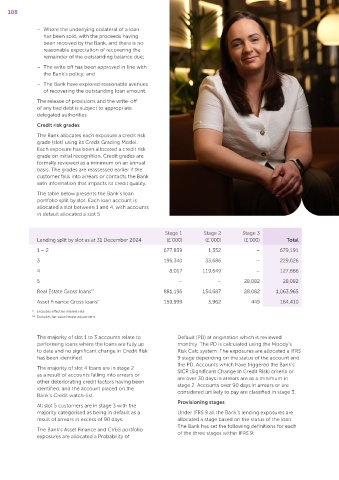

The table below presents the Bank’s loan

portfolio split by slot. Each loan account is

allocated a slot between 1 and 4, with accounts

in default allocated a slot 5

Stage 1 Stage 2 Stage 3

Lending split by slot as at 31 December 2024 (£’000) (£’000) (£’000) Total

1 – 2 677,839 1,352 – 679,191

3 195,340 33,686 – 229,026

4 8,017 119,649 – 127,666

5 – – 28,082 28,082

Real Estate Gross loans ** 881,196 154,687 28,082 1,063,965

Asset Finance Gross loans * 159,999 3,962 449 164,410

* Excludes effective interest rate

** Excludes fair value hedge adjustment

The majority of slot 1 to 3 accounts relate to Default (PD) at origination which is reviewed

performing loans where the loans are fully up monthly. The PD is calculated using the Moody’s

to date and no significant change in Credit Risk Risk Calc system. The exposures are allocated a IFRS

has been identified. 9 stage depending on the status of the account and

the PD. Accounts which have triggered the Bank’s

The majority of slot 4 loans are in stage 2 SICR (Significant Change In Credit Risk) criteria or

as a result of accounts falling into arrears or are over 30 days in arrears are as a minimum in

other deteriorating credit factors having been

stage 2. Accounts over 90 days in arrears or are

identified, and the account placed on the

Bank’s Credit watch‑list. considered unlikely to pay are classified in stage 3.

Provisioning stages

All slot 5 customers are in stage 3 with the

majority categorised as being in default as a Under IFRS 9 all the Bank’s lending exposures are

result of arrears in excess of 90 days. allocated a stage based on the status of the loan.

The Bank has set the following definitions for each

The Bank’s Asset Finance and CV&S portfolio

exposures are allocated a Probability of of the three stages within IFRS 9: