Page 103 - 86395_CCB - 2024 Annual Report (web)

P. 103

103

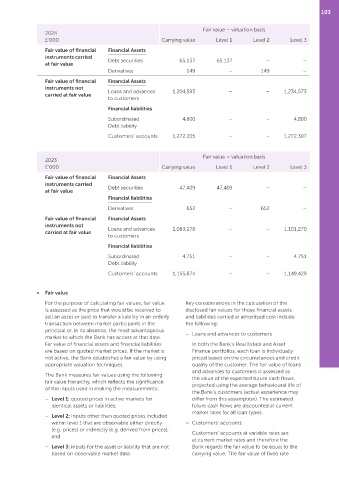

Fair value – valuation basis

2024

£’000 Carrying value Level 1 Level 2 Level 3

Fair value of financial Financial Assets

instruments carried Debt securities 65,137 65,137 – –

at fair value

Derivatives 149 – 149 –

Fair value of financial Financial Assets

instruments not

carried at fair value Loans and advances 1,204,593 – – 1,234,573

to customers

Financial liabilities

Subordinated 4,800 – – 4,800

Debt liability

Customers’ accounts 1,272,205 – – 1,272,307

Fair value – valuation basis

2023

£’000 Carrying value Level 1 Level 2 Level 3

Fair value of financial Financial Assets

instruments carried Debt securities 47,409 47,409 – –

at fair value

Financial liabilities

Derivatives 652 – 652 –

Fair value of financial Financial Assets

instruments not

carried at fair value Loans and advances 1,083,278 – – 1,101,270

to customers

Financial liabilities

Subordinated 4,751 – – 4,751

Debt liability

Customers’ accounts 1,155,874 – – 1,149,429

• Fair value

For the purpose of calculating fair values, fair value Key considerations in the calculation of the

is assessed as the price that would be received to disclosed fair values for those financial assets

sell an asset or paid to transfer a liability in an orderly and liabilities carried at amortised cost include

transaction between market participants in the the following:

principal or, in its absence, the most advantageous – Loans and advances to customers

market to which the Bank has access at that date.

Far value of financial assets and financial liabilities In both the Bank’s Real Estate and Asset

are based on quoted market prices. If the market is Finance portfolios, each loan is individually

not active, the Bank establishes a fair value by using priced based on the circumstances and credit

appropriate valuation techniques. quality of the customer. The fair value of loans

and advances to customers is assessed as

The Bank measures fair values using the following

the value of the expected future cash flows,

fair value hierarchy, which reflects the significance

projected using the average behavioural life of

of the inputs used in making the measurements:

the Bank’s customers (actual experience may

– Level 1: quoted prices in active markets for differ from this assumption). The estimated

identical assets or liabilities; future cash flows are discounted at current

market rates for all loan types.

– Level 2: inputs other than quoted prices included

within level 1 that are observable either directly – Customers’ accounts

(e.g. prices) or indirectly (e.g. derived from prices); Customers’ accounts at variable rates are

and

at current market rates and therefore the

– Level 3: inputs for the asset or liability that are not Bank regards the fair value to be equal to the

based on observable market data. carrying value. The fair value of fixed rate