Page 111 - 86395_CCB - 2024 Annual Report (web)

P. 111

111

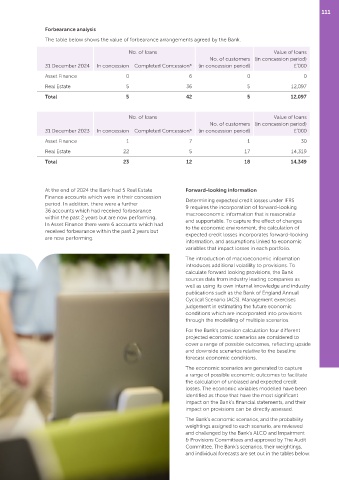

Forbearance analysis

The table below shows the value of forbearance arrangements agreed by the Bank.

No. of loans Value of loans

No. of customers (in concession period)

31 December 2024 In concession Completed Concession* (in concession period) £’000

Asset Finance 0 6 0 0

Real Estate 5 36 5 12,097

Total 5 42 5 12,097

No. of loans Value of loans

No. of customers (in concession period)

31 December 2023 In concession Completed Concession* (in concession period) £’000

Asset Finance 1 7 1 30

Real Estate 22 5 17 14,319

Total 23 12 18 14,349

At the end of 2024 the Bank had 5 Real Estate Forward-looking information

Finance accounts which were in their concession

Determining expected credit losses under IFRS

period. In addition, there were a further

9 requires the incorporation of forward‑looking

36 accounts which had received forbearance

macroeconomic information that is reasonable

within the past 2 years but are now performing.

and supportable. To capture the effect of changes

In Asset Finance there were 6 accounts which had

to the economic environment, the calculation of

received forbearance within the past 2 years but

expected credit losses incorporates forward‑looking

are now performing.

information, and assumptions linked to economic

variables that impact losses in each portfolio.

The introduction of macroeconomic information

introduces additional volatility to provisions. To

calculate forward looking provisions, the Bank

sources data from industry leading companies as

well as using its own internal knowledge and industry

publications such as the Bank of England Annual

Cyclical Scenario (ACS). Management exercises

judgement in estimating the future economic

conditions which are incorporated into provisions

through the modelling of multiple scenarios.

For the Bank’s provision calculation four different

projected economic scenarios are considered to

cover a range of possible outcomes, reflecting upside

and downside scenarios relative to the baseline

forecast economic conditions.

The economic scenarios are generated to capture

a range of possible economic outcomes to facilitate

the calculation of unbiased and expected credit

losses. The economic variables modelled have been

identified as those that have the most significant

impact on the Bank’s financial statements, and their

impact on provisions can be directly assessed.

The Bank’s economic scenarios, and the probability

weightings assigned to each scenario, are reviewed

and challenged by the Bank’s ALCO and Impairment

& Provisions Committees and approved by The Audit

Committee. The Bank’s scenarios, their weightings,

and individual forecasts are set out in the tables below: