Page 106 - 86395_CCB - 2024 Annual Report (web)

P. 106

106

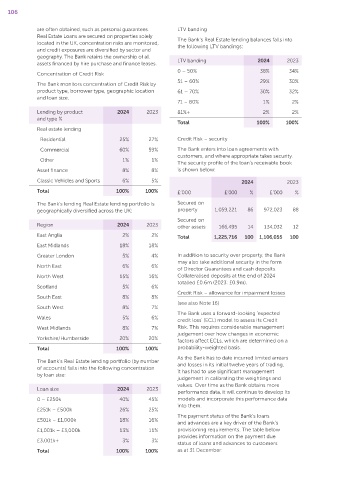

are often obtained, such as personal guarantees. LTV banding

Real Estate Loans are secured on properties solely The Bank’s Real Estate lending balances falls into

located in the UK, concentration risks are monitored, the following LTV bandings:

and credit exposures are diversified by sector and

geography. The Bank retains the ownership of all LTV banding 2024 2023

assets financed by hire purchase and finance leases.

0 – 50% 38% 34%

Concentration of Credit Risk

51 – 60% 29% 30%

The Bank monitors concentration of Credit Risk by

product type, borrower type, geographic location 61 – 70% 30% 32%

and loan size.

71 – 80% 1% 2%

Lending by product 2024 2023 81%+ 2% 2%

and type %

Total 100% 100%

Real estate lending

Residential 25% 27% Credit Risk – security

Commercial 60% 59% The Bank enters into loan agreements with

customers, and where appropriate takes security.

Other 1% 1%

The security profile of the loan’s receivable book

Asset finance 8% 8% is shown below:

Classic Vehicles and Sports 6% 5% 2024 2023

Total 100% 100% £’000 £’000 % £’000 %

The Bank’s lending Real Estate lending portfolio is Secured on

geographically diversified across the UK: property 1,059,221 86 972,023 88

Secured on

Region 2024 2023 other assets 166,495 14 134,032 12

East Anglia 2% 2% Total 1,225,716 100 1,106,055 100

East Midlands 18% 18%

Greater London 5% 4% In addition to security over property, the Bank

may also take additional security in the form

North East 6% 6%

of Director Guarantees and cash deposits.

North West 15% 16% Collateralised deposits at the end of 2024

totalled £0.6m (2023: £0.9m).

Scotland 5% 6%

Credit Risk – allowance for impairment losses

South East 8% 8%

(see also Note 16)

South West 8% 7%

The Bank uses a forward‑looking ‘expected

Wales 5% 6%

credit loss’ (ECL) model to assess its Credit

West Midlands 8% 7% Risk. This requires considerable management

judgement over how changes in economic

Yorkshire/Humberside 20% 20%

factors affect ECLs, which are determined on a

Total 100% 100% probability‑weighted basis.

As the Bank has to date incurred limited arrears

The Bank’s Real Estate lending portfolio (by number

and losses in its initial twelve years of trading,

of accounts) falls into the following concentration

it has had to use significant management

by loan size:

judgement in calibrating the weightings and

values. Over time as the Bank obtains more

Loan size 2024 2023

performance data, it will continue to develop its

0 – £250k 40% 45% models and incorporate this performance data

into them.

£251k – £500k 26% 25%

The payment status of the Bank’s loans

£501k – £1,000k 18% 16%

and advances are a key driver of the Bank’s

£1,001k – £3,000k 13% 11% provisioning requirements. The table below

provides information on the payment due

£3,001k+ 3% 3%

status of loans and advances to customers

Total 100% 100% as at 31 December: