Page 114 - 86395_CCB - 2024 Annual Report (web)

P. 114

114

Asset Finance

Current

weighted 100%

Scenario weighting

Scenario ECL £000 ECL £000

Base Case 2,159

Downside 2,812

2,455

Severe Downside 3,091

Upside 1,916

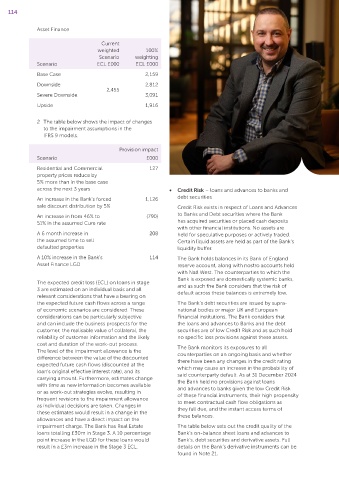

2 The table below shows the impact of changes

to the impairment assumptions in the

IFRS 9 models.

Provision impact

Scenario £000

Residential and Commercial 127

property prices reduce by

5% more than in the base case

across the next 3 years • Credit Risk – loans and advances to banks and

An increase in the Bank’s forced 1,126 debt securities

sale discount distribution by 5% Credit Risk exists in respect of Loans and Advances

An increase in from 46% to (790) to Banks and Debt securities where the Bank

51% in the assumed Cure rate has acquired securities or placed cash deposits

with other financial institutions. No assets are

A 6 month increase in 208 held for speculative purposes or actively traded.

the assumed time to sell Certain liquid assets are held as part of the Bank’s

defaulted properties liquidity buffer.

A 10% increase in the Bank’s 114 The Bank holds balances in its Bank of England

Asset Finance LGD reserve account, along with nostro accounts held

with Natl West. The counterparties to which the

Bank is exposed are domestically systemic banks,

The expected credit loss (ECL) on loans in stage and as such the Bank considers that the risk of

3 are estimated on an individual basis and all default across these balances is extremely low.

relevant considerations that have a bearing on

the expected future cash flows across a range The Bank’s debt securities are issued by supra‑

of economic scenarios are considered. These national bodies or major UK and European

considerations can be particularly subjective Financial institutions. The Bank considers that

and can include the business prospects for the the loans and advances to Banks and the debt

customer, the realisable value of collateral, the securities are of low Credit Risk and as such hold

reliability of customer information and the likely no specific loss provisions against these assets.

cost and duration of the work‑out process.

The Bank monitors its exposures to all

The level of the impairment allowance is the

counterparties on an ongoing basis and whether

difference between the value of the discounted

there have been any changes in the credit rating

expected future cash flows (discounted at the

which may cause an increase in the probability of

loan’s original effective interest rate), and its said counterparty default. As at 31 December 2024

carrying amount. Furthermore, estimates change the Bank held no provisions against loans

with time as new information becomes available and advances to banks given the low Credit Risk

or as work‑out strategies evolve, resulting in of these financial instruments, their high propensity

frequent revisions to the impairment allowance to meet contractual cash flow obligations as

as individual decisions are taken. Changes in they fall due, and the instant access terms of

these estimates would result in a change in the these balances.

allowances and have a direct impact on the

impairment charge. The Bank has Real Estate The table below sets out the credit quality of the

loans totalling £30m in Stage 3. A 10 percentage Bank’s on‑balance sheet loans and advances to

point increase in the LGD for these loans would Bank’s, debt securities and derivative assets. Full

result in a £3m increase in the Stage 3 ECL. details on the Bank’s derivative instruments can be

found in Note 21.