Page 103 - CCB_Annual Report_2022

P. 103

102 Notes to the Financial Statements 103

20 Other assets and prepayments On initial designation of the hedge, the Bank

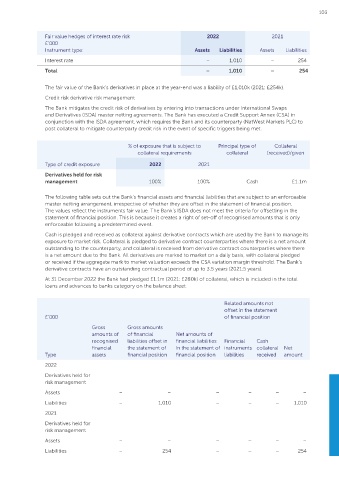

formally documents the relationship between Fair value hedges of interest rate risk 2022 2021

the hedging instruments and the hedged items, £’000

£’000 2022 2021

including the risk management objective, together Instrument type: Assets Liabilities Assets Liabilities

Other debtors 84 132 with the method that will be used to assess the Interest rate – 1,010 – 254

effectiveness of the hedging relationship. The Bank

Cash Ratio Deposit 1,415 1,205

makes an assessment, at inception of whether the Total – 1,010 – 254

Prepayments 1,074 754 hedging instruments are expected to be highly

effective in offsetting the changes in the fair value

Total 2,573 2,091 The fair value of the Bank’s derivatives in place at the year-end was a liability of £1,010k (2021: £254k).

or cash flows of the hedged items during the

period in which the hedge is designated. On a Credit risk derivative risk management

The Bank is required to hold a Cash Ratio Deposit monthly basis the Bank must be able to continue to The Bank mitigates the credit risk of derivatives by entering into transactions under International Swaps

by the Bank of England. This is calculated twice demonstrate that the critical terms of the derivative and Derivatives (ISDA) master netting agreements. The Bank has executed a Credit Support Annex (CSA) in

yearly at 0.18% of average eligible liabilities over the and the hedged item continue to be closely aligned conjunction with the ISDA agreement, which requires the Bank and its counterparty (NatWest Markets PLC) to

previous six months in excess of £600m. in order to conclude that the relationship remains post collateral to mitigate counterparty credit risk in the event of specific triggers being met.

highly effective.

21 Derivatives held for risk management

All the Bank’s hedging relationships are currently

Collateral

Derivatives held for risk management purposes fair value hedges. % of exposure that is subject to Principal type of (received)/given

collateral

collateral requirements

include all derivative assets and liabilities that are

not classified as trading assets or liabilities. The Bank • Fair value hedges Type of credit exposure 2022 2021

has designated its derivatives as fair value hedges in Where a derivative financial instrument is designated

order to reduce volatility in the income statement. as a hedge of the variability in fair value of a Derivatives held for risk

Where a derivative financial instrument meets recognised asset or liability, or an unrecognised management 100% 100% Cash £1.1m

the requirements of a fair value hedge, changes

firm commitment, all changes in the fair value of

in the fair value of the hedged item are taken to The following table sets out the Bank’s financial assets and financial liabilities that are subject to an enforceable

the derivative are recognised immediately in the

the income statement offsetting the effect of the master netting arrangement, irrespective of whether they are offset in the statement of financial position.

income statement. To the extent to which the

related movements in the fair value of the derivative. The values reflect the instruments fair value. The Bank’s ISDA does not meet the criteria for offsetting in the

hedge is effective, the carrying value of the hedged

As at 31 December 2022, the Bank had £9m statement of financial position. This is because it creates a right of set-off of recognised amounts that is only

item is adjusted by the change in fair value that is

nominal value of derivatives (2021: £21m), all related attributable to the risk being hedged (even if it is enforceable following a predetermined event.

to the hedging of fixed rate deposit balances.

normally carried at cost or amortised cost) and any Cash is pledged and received as collateral against derivative contracts which are used by the Bank to manage its

gains or losses on measurement are recognised exposure to market risk. Collateral is pledged to derivative contract counterparties where there is a net amount

Nominal value Fair value immediately in the income statement (even if outstanding to the counterparty, and collateral is received from derivative contract counterparties where there

those gains would normally be recognised directly is a net amount due to the Bank. All derivatives are marked to market on a daily basis, with collateral pledged

£’000 2022 2021 2022 2021

in reserves). or received if the aggregate mark to market valuation exceeds the CSA variation margin threshold. The Bank’s

Instrument On the discontinuance of a hedge, any adjustment derivative contracts have an outstanding contractual period of up to 3.5 years (2021:5 years).

type

made to the carrying amount of the hedged item as At 31 December 2022 the Bank had pledged £1.1m (2021: £280k) of collateral, which is included in the total

Interest rate 9,000 21,000 (1,010) (254) a consequence of the fair value hedge relationship, loans and advances to banks category on the balance sheet.

is recognised in the income statement over the

Designated remaining life of the hedged item.

in fair value Related amounts not

hedges The Bank uses interest rate swaps to minimise offset in the statement

interest rate risk exposure in specific periods by £’000 of financial position

Total hedging the interest rate risk associated with fixed

interest rate rate deposit balances. The terms of the hedged Gross Gross amounts

derivatives 9,000 21,000 (1,010) (254) amounts of of financial Net amounts of

items and hedging instrument are aligned to

minimise hedge ineffectiveness arising. Hedge recognised liabilities offset in financial liabilities Financial Cash

Under IFRS 9 the Bank is not required to undertake ineffectiveness, the difference between the hedging Type financial the statement of in the statement of instruments collateral Net

liabilities

financial position

financial position

assets

amount

received

a monthly retrospective test for hedge effectiveness gains or losses of the hedging instrument and the

as it can demonstrate the critical terms of the hedge hedged item recognised in the income statement 2022

instrument and the hedged item are matched. was £nil (2021: £2k charge).

Derivatives held for

risk management

Assets – – – – – –

Liabilities – 1,010 – – – 1,010

2021

Derivatives held for

risk management

Assets – – – – – –

Liabilities – 254 – – – 254