Page 105 - CCB_Annual Report_2022

P. 105

104 Notes to the Financial Statements 105

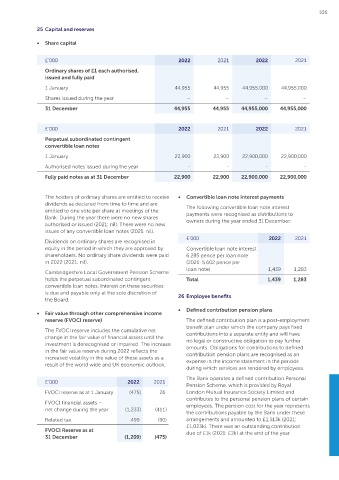

22 Deposits from customers 25 Capital and reserves

£’000 2022 2021

IFRS 9 stipulates that all financial liabilities be • Share capital

classified at amortised cost, except for those Variable rate

recognised at fair value through profit or loss deposit balances 643,438 658,229

(including derivative contracts). This includes: £’000 2022 2021 2022 2021

Fixed rate deposit balances 460,829 367,544

– Financial liabilities which have been designated Total 1,104,267 1,025,773 Ordinary shares of £1 each authorised,

as FVTPL on the basis that this provides more issued and fully paid

relevant financial information; Fair value adjustment 1 January 44,955 44,955 44,955,000 44,955,000

for hedged risk (1,011) (253)

– Financial liabilities which arise when a transfer of Shares issued during the year – – – –

a financial asset do not qualify for derecognition Total deposits

(or when the continuing involvement from customers 1,103,256 1,025,520 31 December 44,955 44,955 44,955,000 44,955,000

approach applies);

– Financial guarantee contracts; 23 Central Bank Facilities

£’000 2022 2021 2022 2021

– Commitments to provide a loan at a below The Bank has drawings of £78m under the Bank of Perpetual subordinated contingent

market rate of interest; or England Term Funding Scheme for SMEs (‘TFSME’). convertible loan notes

These funds drawn in September 2021 have a

– Contingent consideration recognised by an maturity of four years and bear interest at bank base 1 January 22,900 22,900 22,900,000 22,900,000

acquirer in a business combination to which rate. The remaining maturity of the Bank’s drawings

IFRS 3 applies. Authorised notes issued during the year - - - -

is 33 months.

The Bank has assessed all financial liabilities to The Bank has pre-positioned loan assets with the Fully paid notes as at 31 December 22,900 22,900 22,900,000 22,900,000

classify and measure them appropriately. As with

Bank of England for future use in Sterling Monetary

financial assets, financial liabilities are initially

Schemes. More details are set out in Note 28.

measured at their fair value, plus or minus any The holders of ordinary shares are entitled to receive • Convertible loan note interest payments

transaction costs which are directly attributable to dividends as declared from time to time and are The following convertible loan note interest

the financial liability. £’000 2022 2021 entitled to one vote per share at meetings of the payments were recognised as distributions to

Bank. During the year there were no new shares

In respect of Customer Deposits, the Bank TFSME 78,000 78,000 authorised or issued (2021: nil). There were no new owners during the year ended 31 December:

classifies its customer deposits as being held at Total 78,000 78,000 issues of any convertible loan notes (2021: nil).

amortised cost, which is consistent with the criteria £’000 2022 2021

outlined above. Dividends on ordinary shares are recognised in

24 Other liabilities and accruals equity in the period in which they are approved by Convertible loan note interest

The Bank pays commission to certain brokers in shareholders. No ordinary share dividends were paid 6.285 pence per loan note

respect of its deposit accounts. The commission is £’000 2022 2021 in 2022 (2021: nil). (2021: 5.602 pence per

charged as a percentage of the customer balance loan note) 1,439 1,283

and is recognised within interest payable. Accruals 6,041 4,284 Cambridgeshire Local Government Pension Scheme

holds the perpetual subordinated contingent Total 1,439 1,283

Deposits are the Bank’s primary source of debt Lease liability 1,995 2,056 convertible loan notes. Interest on these securities

funding. The Bank hedges interest rate risk Corporation tax 326 – is due and payable only at the sole discretion of

arising from its fixed rate deposit balances. As at 26 Employee benefits

31 December 2022 £9m (2021: £21m) of the Bank’s Other creditors 1,071 940 the Board.

fixed rate deposits are hedged using interest rate • Fair value through other comprehensive income • Defined contribution pension plans

derivatives. These deposits are held at amortised Total 9,433 7,280 reserve (FVOCI reserve)

cost but a fair value adjustment is applied in respect The defined contribution plan is a post-employment

of the hedged risk. See Note 30 for more details on the lease liability. The FVOCI reserve includes the cumulative net benefit plan under which the company pays fixed

change in the fair value of financial assets until the contributions into a separate entity and will have

no legal or constructive obligation to pay further

investment is derecognised or impaired. The increase

£’000 2022 2021 amounts. Obligations for contributions to defined

in the fair value reserve during 2022 reflects the

Instant access 65,441 77,309 increased volatility in the value of these assets as a contribution pension plans are recognised as an

expense in the income statement in the periods

result of the world wide and UK economic outlook.

Term and notice accounts during which services are rendered by employees.

Payable within 1 year 882,998 801,011 The Bank operates a defined contribution Personal

£’000 2022 2021

Payable after one year 155,828 147,453 Pension Scheme, which is provided by Royal

FVOCI reserve as at 1 January (475) 26 London Mutual Insurance Society Limited and

Total 1,104,267 1,025,773 contributes to the personal pension plans of certain

FVOCI financial assets – employees. The pension cost for the year represents

Fair value adjustment net change during the year (1,233) (411)

the contributions payable by the Bank under these

for hedged risk (1,011) (253)

Related tax 499 (90) arrangements and amounted to £1,513k (2021:

Total deposits FVOCI Reserve as at £1,023k). There was an outstanding contribution

from customers 1,103,256 1,025,520 due of £1k (2021: £2k) at the end of the year.

31 December (1,209) (475)