Page 106 - CCB_Annual Report_2022

P. 106

106 Notes to the Financial Statements 107

27 Financial instruments and fair values – The Bank is prohibited under the terms of the Key considerations in the calculation of the

transfer contract from selling or pledging the disclosed fair values for those financial assets

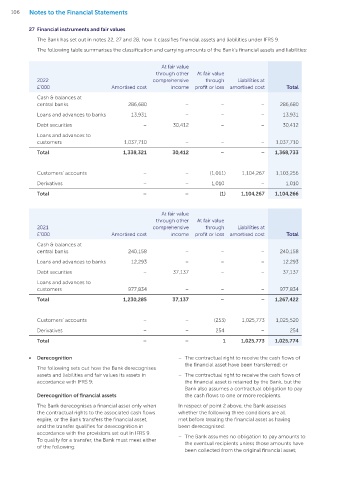

The Bank has set out in notes 22, 27 and 28, how it classifies financial assets and liabilities under IFRS 9.

original asset, other than as security to the carried at amortised cost include the following:

The following table summarises the classification and carrying amounts of the Bank’s financial assets and liabilities: recipients of the cash flows; and

– Cash and balances at central banks

– The Bank has an obligation to remit any cash These represent amounts with an initial maturity

At fair value flows it collects on behalf of the eventual

through other At fair value recipients without material delay. The Bank may of less than 3 months and their carrying value is

2022 comprehensive through Liabilities at also not reinvest any such cash flows received. considered to be the fair value.

£’000 Amortised cost income profit or loss amortised cost Total – Loans and advances to banks

Where the above criteria are met, and a transfer is

Cash & balances at deemed to have occurred, the Bank evaluates the These represent amounts with a maturity of less

central banks 286,680 – – – 286,680 extent to which it retains the risk and rewards of than 3 months, where adjustments to fair value

ownership of the financial asset. Where the Bank in respect of the credit rating of the counterparty

Loans and advances to banks 13,931 – – – 13,931

determines that the risk and reward of ownership are not considered necessary. The carrying value

Debt securities – 30,412 – – 30,412 of the assets has been transferred, the Bank of the asset is considered to be the fair value.

derecognises the asset. If the Bank determines that

Loans and advances to the risk and reward remains with them, the asset is – Loans and advances to customers

customers 1,037,710 – – – 1,037,710

not derecognised and remains on the statement of In both the Bank’s Real Estate and Asset Finance

Total 1,338,321 30,412 – – 1,368,733 financial position. portfolios, each loan is individually priced based

on the circumstances and credit quality of

On derecognition of the financial asset, the Bank the customer.

recognises the difference between the carrying

Customers’ accounts – – (1,011) 1,104,267 1,103,256

amount of the asset and the consideration received The fair value of loans and advances to

Derivatives – – 1,010 – 1,010 in the income statement. customers is assessed as the value of the

expected future cash flows, projected using

Total – – (1) 1,104,267 1,104,266

Derecognition of financial liabilities contractual interest payments, repayments and

the contractual maturity date. The estimated

The Bank derecognises a financial liability only when

At fair value the obligation, which is specified in the contract, future cash flows are discounted at current

through other At fair value has been discharged, is cancelled, or expires. market rates for all loan types. The contractual

2021 comprehensive through Liabilities at The Bank may also be required to derecognise a life of the majority of the Bank’s loan and

advances is 25 years.

£’000 Amortised cost income profit or loss amortised cost Total financial liability where there has been a substantial

modification. A modification is considered to be – Customers’ accounts

Cash & balances at substantial where the discounted present value of the

central banks 240,158 – – – 240,158 Customers’ accounts at variable rates are at

cash flows under the new terms, including any fees

Loans and advances to banks 12,293 – – – 12,293 paid net of any fees received and discounted using the current market rates and therefore the Bank

regards the fair value to be equal to the carrying

original effective interest rate, is at least 10 per cent

Debt securities – 37,137 – – 37,137 value. The fair value of fixed rate customers’

different from the discounted present value of the

Loans and advances to remaining cash flows of the original financial liability. accounts that have been designated as

hedged with interest rate derivatives have been

customers 977,834 – – – 977,834 determined by discounting estimated future

• Fair value

Total 1,230,285 37,137 – – 1,267,422 cash flows based on future market interest

For the purpose of calculating fair values, fair value rates. The fair value of fixed rate deposits has

is assessed as the price that would be received to been determined by discounting the estimated

Customers’ accounts – – (253) 1,025,773 1,025,520 sell an asset or paid to transfer a liability in an orderly future cash flows based on the existing product

transaction between market participants in the rate compared to current market rates for an

Derivatives – – 254 – 254

principal or, in its absence, the most advantageous equivalent deposit.

Total – – 1 1,025,773 1,025,774 market to which the Bank has access at that date. – Debt securities

Far value of financial assets and financial liabilities

are based on quoted market prices. If the market is Where securities are actively traded in a

• Derecognition – The contractual right to receive the cash flows of not active, the Bank establishes a fair value by using recognised market, with available and quoted

the financial asset have been transferred; or

The following sets out how the Bank derecognises appropriate valuation techniques. prices, these have been used to value these

assets and liabilities and fair values its assets in – The contractual right to receive the cash flows of The Bank measures fair values using the following fair instruments. These securities are therefore

accordance with IFRS 9: the financial asset is retained by the Bank, but the value hierarchy, which reflects the significance of the regarded as having level 1 fair values.

Bank also assumes a contractual obligation to pay inputs used in making the measurements: – Derivatives

Derecognition of financial assets the cash flows to one or more recipients.

– Level 1: quoted prices in active markets for The fair value of derivative assets and liabilities

The Bank derecognises a financial asset only when In respect of point 2 above, the Bank assesses identical assets or liabilities; are calculated based on the present value of

the contractual rights to the associated cash flows whether the following three conditions are all future interest cash flows, discounted at the

expire, or the Bank transfers the financial asset, met before treating the financial asset as having – Level 2: inputs other than quoted prices included market rate of interest at the balance sheet date.

and the transfer qualifies for derecognition in been derecognised: within level 1 that are observable either directly (e.g. The Bank has not been required to post any

accordance with the provisions set out in IFRS 9. prices) or indirectly (e.g. derived from prices); and

– The Bank assumes no obligation to pay amounts to collateral in respect of its derivatives. Derivative

To qualify for a transfer, the Bank must meet either

the eventual recipients unless those amounts have – Level 3: inputs for the asset or liability that are not financial assets and liabilities are classified at fair

of the following:

been collected from the original financial asset; based on observable market data. value through the income statement.